Investors have spent most of the last two years fretting over the health of the economy…

But apparently, American consumers aren’t worried.

Because they just spent a record $9.8 billion on last weekend’s holiday shopping deals.

That makes this the most successful Black Friday in history, even bigger than pre-pandemic shopping bonanzas.

It’s a remarkable contrast, where the people buying stocks are convinced a recession is inevitable, and those buying retail goods are spending more than ever before.

That’s enough to make you wonder whether investors might be missing out on one of the most reliable seasonal trends in retail…

Seasonal Strategies for Holiday Gains?

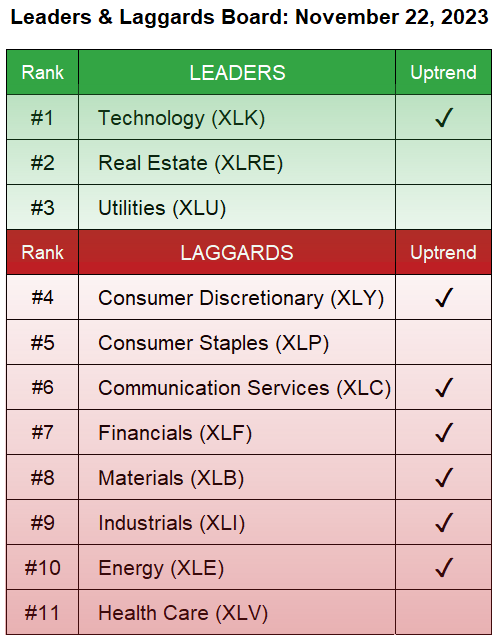

In Green Zone Fortunes I maintain a “Leaders & Laggards” board, showing which sectors of the market are currently outperforming (and which ones you should avoid). It looks like this:

Consumer discretionary stocks have steadily shown up as “Leaders” or in an uptrend over the last few updates.

That’s not surprising, given their strong seasonal tailwinds around the holiday season.

But just how strong are the seasonal forces driving retail?

You might already be familiar with one of the market’s strongest seasonal trends, known to investors as “Sell in May and go away.”

The phrase is shorthand for how the market consistently underperforms during the six months from May to October.

But is there also data-supported seasonality around “Black Friday” investing?

What if we buy in November, the week before Thanksgiving, then sell in February after the holiday retail season is truly over…

Well, if you’d done that over the last 15 years with the benchmark SPDR S&P 500 ETF (NYSE: SPY), you’d see gains 71% of the time, with an average return of 3.3% per year.

Execute that same “Sell in February” strategy with the Consumer Discretionary Select Sector SPDR (NYSE: XLY) and you’d see gains 78% of the time, with an average return of 4%.

We see similar returns executing the same strategy with Technology Select Sector SPDR (NYSE: XLK), where the average return nudges up to 4.3% per year (which likely accounts for all those high-tech holiday gifts).

Just to recap that:

- SPY (benchmark): up 71.4% of years, +3.3% average return.

- XLY (Consumer Discretionary): up 78.6% of years, +4%.

- XLK (Tech): up 71.4% of years, +4.3%.

So there were larger gains in both the tech and consumer discretionary exchange-traded funds through the holiday season more frequently than the S&P 500 benchmark.

But what about the sector’s top performers?

I drilled down even further — evaluating XLY’s top-performing holdings using the same criteria — and I found the following:

- Tesla (Nasdaq: TSLA): up 54% of years, +14.7% average return (over all 15 years).

- PulteGroup Inc. (NYSE: PHM): 86%, +11.1%.

- Wynn Resorts (Nasdaq: WYNN): 71.4%, +10.6%.

- MGM Resorts International (NYSE: MGM): 71.4%, +10.5%.

- Domino’s Pizza (NYSE: DPZ): 71.4%, +10.5%.

You might be surprised to see Tesla at the top of the list here.

Most investors would think of Tesla as a tech company.

Yet combined with Amazon.com Inc. (Nasdaq: AMZN), TSLA accounts for roughly 50% of the risk of the Consumer Discretionary ETF XLY.

And that’s good for the index because enthusiasm for Tesla’s stock has been especially strong during the holidays.

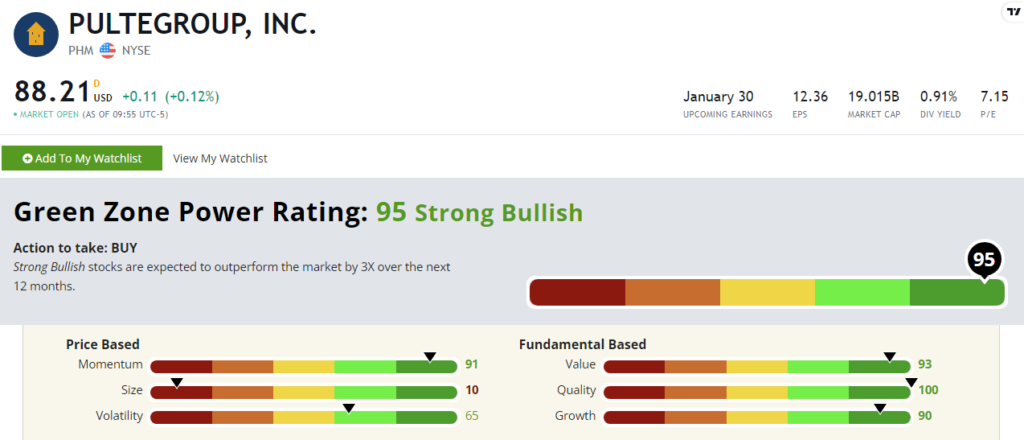

PHM is another surprise, since it’s a home construction company with outstanding Green Zone Power Ratings of 95 out of 100:

With mortgage rates now starting to decline, home construction companies like PHM make a much more compelling investment than other consumer discretionary stocks.

Otherwise, there’s just not much to write home about in this sector, at least if you follow my Green Zone Power Ratings system, and want to stick with stocks that rate 81 or above (“Strong Bullish”).

Among XLY’s historical top performers from November to February, the next highest rating belonged to DPZ — with a barely “Bullish” 68 out of 100.

Two others, MGM and Wynn, rated 19 and 6 respectively.

Not quite my idea of a great Black Friday deal for investors.

In fact, some consumer discretionary stocks are disasters waiting to happen…

Dump 7 Consumer Discretionary Stocks

There’s a dangerous “Buyer Beware” aspect to investing in consumer discretionary stocks.

After all, we’re taught to invest in what we know.

And once you’ve spent a lifetime of watching television commercials or seeing magazine ads, it’s easy to feel like you know a brand.

But a great public image can often disguise decades of bad management or a mountain of debt.

Which is exactly what I found when I evaluated the Green Zone Power Ratings for each of XLY’s holdings.

I was genuinely surprised to see so many household names at the bottom of the barrel — with the lowest scores of any stock in the index.

So if you own any of the following seven stocks, you might want to think about selling them ASAP:

As you know, the Green Zone Power Ratings system determines the strength of a company and its stock based on six factors proven to drive market-beating returns — three “technical” ones (momentum, size, volatility) and three “fundamental” ones (value, quality, growth).

And multiple household brands, including Whirlpool, Hasbro, Wynn and Norwegian scored in the single digits.

With ratings this low, it’s difficult to really differentiate the issues. They all rate low for size, volatility and value, with no positive momentum to speak of.

Based on our Green Zone Power Ratings criteria, these stocks are set to significantly underperform the market over the next 12 months. I suggest you avoid them at all costs.

So instead of adding some retail stocking stuffers to your portfolio for the holidays, it might make sense to cut out a few underperformers and redeploy that cash into more promising opportunities.

Keep the Holidays Happy

Black Friday might be a great time for retail deals.

But it’s not necessarily a great time to invest in any and all consumer discretionary stocks, either willy-nilly or based on the brands you “know” or see rampant ads for on TV and social media.

There are just too many great opportunities elsewhere, and even a tidal wave of reliable seasonal demand isn’t going to change their long-term prospects.

Nevertheless, it’s still going to be important to see strong retail results this holiday season.

The U.S. just printed an impressive +4.9% gross domestic product growth for the quarter, and American shoppers are starting to spend again.

We’re bound to see a few missteps along the way, but the trend is headed upward.

And that’s phenomenal news for stocks across the board.

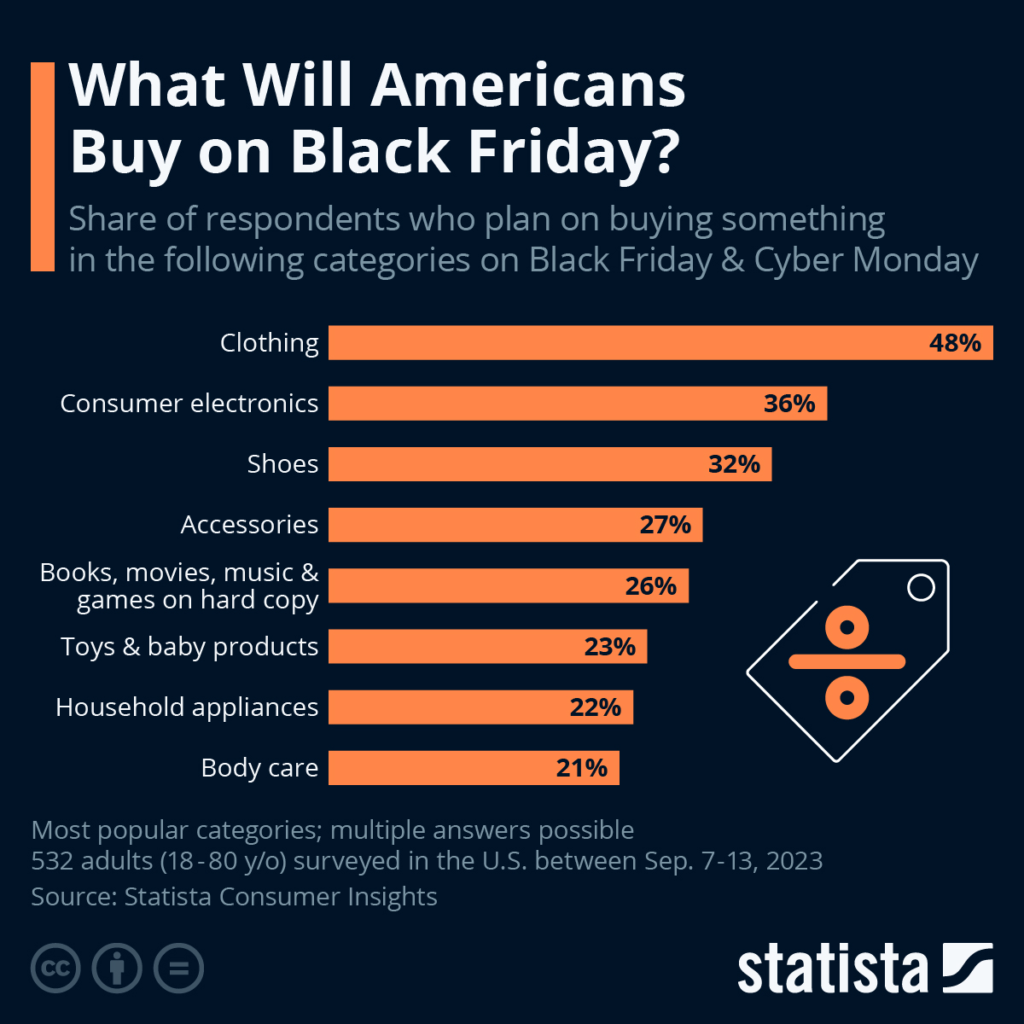

Based on a recent Statista survey, this year’s Black Friday shoppers are aiming to take advantage of deep discounts on things like clothing, shoes and personal electronics:

In other words — they’re finally refreshing the items they’ve held off buying for over a year now.

Even vehicle sales are starting to surge, despite short supply and auto loan rates reaching nearly 8%.

So the American consumer seems rather strong, and we’ll see if a strong holiday spending confirms that trend as we head into 2024.

As for which stocks you should be buying right now? Find that out HERE…

To good profits,

Adam O’Dell

Chief Investment Strategist