There are stocks to buy.

There are stocks to sell.

And then there are stocks you should run away from — screaming.

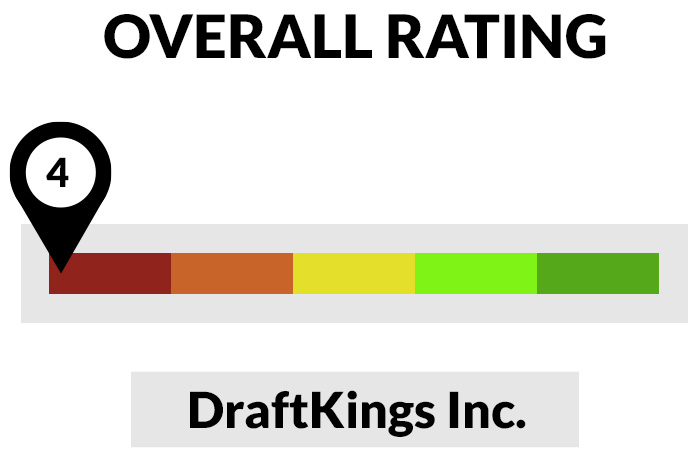

I’d place DraftKings Inc. (Nasdaq: DKNG) into that latter category. In fact, Adam O’Dell’s Green Zone Ratings system revealed just how much of a dog DraftKings stock rating is.

But more on that in a bit.

DraftKings is a popular online fantasy sports and betting site. At first glance, it looks like a solid investment. With live sports returning, fantasy sports and gambling won’t be far behind.

But looking closer tells a different story.

DraftKings generated revenues of $70.9 million in the quarter ending June 30, up from $57.4 million in the same quarter last year.

But a lot of that growth is due to a series of mergers.

An apple-to-apples comparison is more bleak. Sales actually fell about 10% last quarter when looking at the combined entities.

Furthermore, DraftKing’s sales haven’t translated into profits. Operations losses ballooned from $28 million to $160 million last quarter. DraftKings is getting less profitable as it grows.

COVID-19 is a big part of this story. It’s commendable that DraftKings kept its revenues as high as it did given the only sports on TV were NASCAR, golf, UFC and some European soccer.

Still, the profit outlook is murky.

Of the nine Wall Street analysts covering the stock, none forecast profitability in 2020 or 2021. The average estimate is a loss of $0.63 per share in 2021.

Furthermore, while sports betting rules are gradually being relaxed, it’s worth noting that DraftKing’s business is still effectively illegal across large swaths of the country.

Let’s take a closer look at DraftKings’ stock rating.

DraftKings Stock Rating Breakdown

Using Adam’s Green Zone Ratings system, DraftKings’ stock rates near the bottom of the heap, scoring only a 4. That means that fully 96% of the stocks in our universe rate higher.

Digging into the details doesn’t paint a better picture.

- Size — DraftKings rates middle-of-the-pack in size, scoring a 52. Historically, smaller stocks tend to outperform larger ones. But with a market cap of $12 billion, DraftKings isn’t small.

- Growth — The stock scores poorly on growth as well, at 25. We might need to give DraftKings the benefit of the doubt here, given that live sports have been shut down for most of this year. But based on the numbers we have to work with, DraftKings is in the bottom quarter of stocks based on growth.

- Momentum — The numbers don’t get better. DraftKings rates at 20 on momentum. Rising prices beget rising prices as they attract trend followers. But the trend is not high at the moment for DraftKings,.

- Quality — DraftKings stock rates low on quality at 16. The biggest weight pulling the company down here is its low margins, which rate a 3. And remember, COVID isn’t the only issue. The company isn’t expected to generate a profit in 2021 either.

- Value — There is a price at which just about any stock would be worth buying. Unfortunately, we’re nowhere near that price for DraftKings. Based on value, the stock rates a 16, meaning it’s more expensive than 84% of the stocks in our universe. Its price-to-sales ratio is a real dog, rating just a 4.

- Volatility —As a general rule, slow and steady wins the race in investing. Low-volatility stocks outperform over time. But DraftKings rates a 1 here. It’s one of the most volatile stocks in our universe.

If you like sports betting, then knock yourself out using DraftKings’ services. But don’t bet your retirement on the stock.

Money & Markets contributor Charles Sizemore specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore.