DraftKings Inc. (Nasdaq: DKNG) is a leading operator of online sports betting and gaming platforms in the United States. How does DraftKings stock rate?

The company was founded in 2012 by Jason Robins, Matt Kalish and Paul Liberman and is headquartered in Boston, Massachusetts.

DraftKings has around 1.6 million monthly users, according to its most recent earnings report.

The company offers its users a variety of online gaming experiences including daily fantasy sports, online sports betting and casino games.

DraftKings has acquired a number of companies since its inception, most notably DraftStreet in 2014 and SBTech in 2019.

In 2020, DraftKings went public via a reverse merger with Diamond Eagle Acquisition Corp. This made DraftKings the first publicly traded U.S.-based online gambling company.

DraftKings has been a major force in the growth of legal sports betting in the U.S. and is currently operational in 19 states. The company plans to expand its operations to more states as laws regarding sports betting continue to change across the country.

The DraftKings Business Model

DraftKings’ main source of revenue is through entry fees charged to users who enter contests.

Draftkings also generates revenue through advertisement, sponsorship and affiliate marketing agreements.

It has partnered with major media companies such as ESPN and NBC to create exclusive content and broadcast deals.

As a result, DraftKings has quickly become one of the most popular daily fantasy sports companies.

DraftKings Stock Earnings

The company’s revenues have grown rapidly in recent years, driven by the popularity of daily fantasy sports and the expansion of legal sports betting.

DraftKings has also attracted new customers with its mobile app and wide range of betting options.

While the company is still not making money, it is expected to achieve profitability within the next few years.

Risks With Investing in DKNG

DraftKings is a publicly-traded company, and as such, comes with all the risks associated with investing in stocks.

The value of DraftKings stock can go up or down based on a variety of factors, including the company’s financial performance, changes in the regulatory environment and broader market trends.

DraftKings also faces competition from other daily fantasy sports providers, as well as traditional sports betting businesses.

As a result, there is always the risk that DraftKings could lose market share and see its stock price decline. Before investing in DraftKings stock, check out our Stock Power Ratings system:

DraftKings Stock Power Ratings

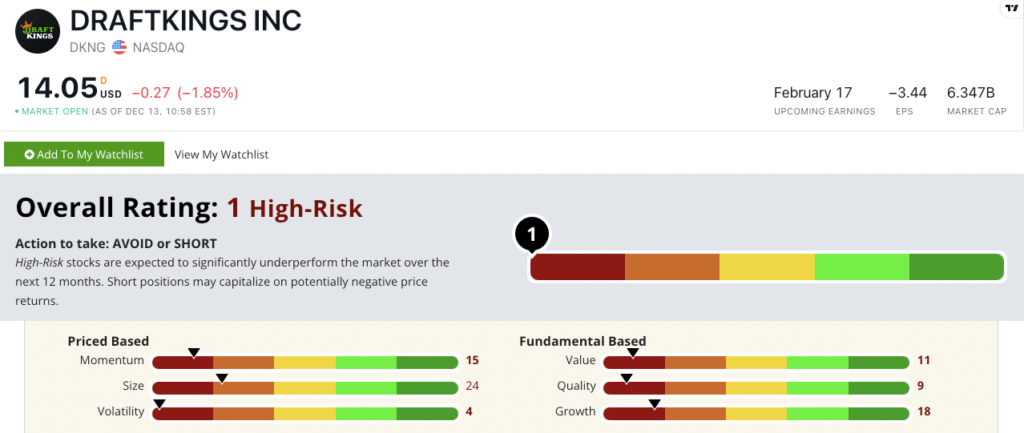

DraftKings’ stock scores a “High-Risk” 1 out of 100 on our Stock Power Ratings system.

That means it’s expected to underperform the broader market over the next 12 months.

In its most recent quarterly report, the company reported a net loss of $450.5 million. Over the first nine months of 2022, the net loss was $1.13 billion.

That shows why DKNG scores an 18 on our growth factor.

It also scores in the red on our other five factors.

DKNG has negative price-to-earnings, meaning it’s not making any profit. It scores an 11 on value.

The company has a horrible return on equity of negative 89.6% … and a return on investment of negative 49.4%, earning it a 9 on quality.

It means the stock is overvalued, and the company isn’t turning a profit — all bad news for investors.

The bottom line: Since its inception in 2012, DraftKings has quickly become one of the most popular fantasy sports providers in the industry.

The company is expected to generate nearly $3 billion in revenue by 2022 and is projected to be profitable by 2025.

What do you think? Is DraftKings stock a buy or sell at current prices? Let me know your thoughts in the comments below.