During the 2008 Republican National Convention, a relative unknown in the political realm coined one of the most popular phrases used to describe domestic energy production.

It was during that convention that former Maryland Lt. Gov. Michael Steele used the phrase “Drill, baby, drill” during a primetime speech to promote domestic energy production and reduce reliance on foreign oil.

Former Alaska Gov. Sarah Palin — then the GOP’s VP nominee — then took the phrase and ran with it during the campaign… one ultimately lost by the Republicans.

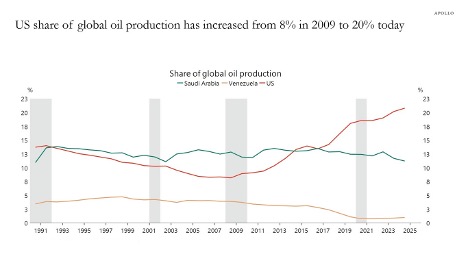

Despite that, the United States has quietly become the world’s largest oil producer:

When Steele first uttered the phrase, there was reason behind it. The U.S. accounted for only about 8% of global oil production at that time.

Today, however, production in Saudi Arabia has fallen from about 15% to 11%, while oil production in the U.S. now accounts for 20% of global output.

The first obvious question is: why is the U.S. increasing its production?

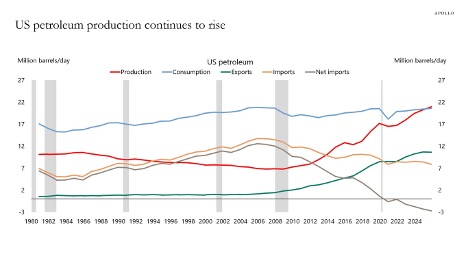

It’s a little more complicated to answer, but this might help:

While the U.S. has ramped up oil production since 2009, imports have declined, but consumption and exports have steadily increased.

It should be a boon for U.S. oil and gas companies’ stock that production has increased so much, so fast.

However, that hasn’t necessarily been the case…

Oil And Gas Underperforms the Benchmark

While the U.S. is pumping, exporting and using more oil, that hasn’t translated into big gains for oil and gas stocks.

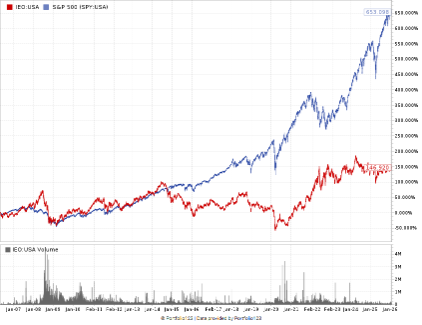

Oil & Gas ETF Up… But Not As Much As S&P 500

The red line in the chart above represents the iShares Oil & Gas Exploration & Production ETF (IEO), while the blue line represents the S&P 500.

As you can see, IEO has gained 147% since January 2007. However, the benchmark index has jumped more than 653% during the same time.

The leading reason oil and gas stocks haven’t benefited from this increase in production is that those companies rely heavily on the price of the commodity they pump.

If output is high but demand increases only slightly, there is a market glut, lowering oil prices.

When oil prices are lower, producers’ profits are also lower… diminishing the appetite for those stocks.

Let’s look and see where oil and gas stocks stand using Adam’s Green Zone Power Ratings system…

Ranking Oil & Gas Production Stocks

To get a comprehensive view of oil and gas production and exploration stocks, I used an X-ray.

This means I took all the holdings in IEO and ran them through Adam’s Green Zone Power Ratings system to get an overall view of the ETF.

The results were interesting, to say the least…

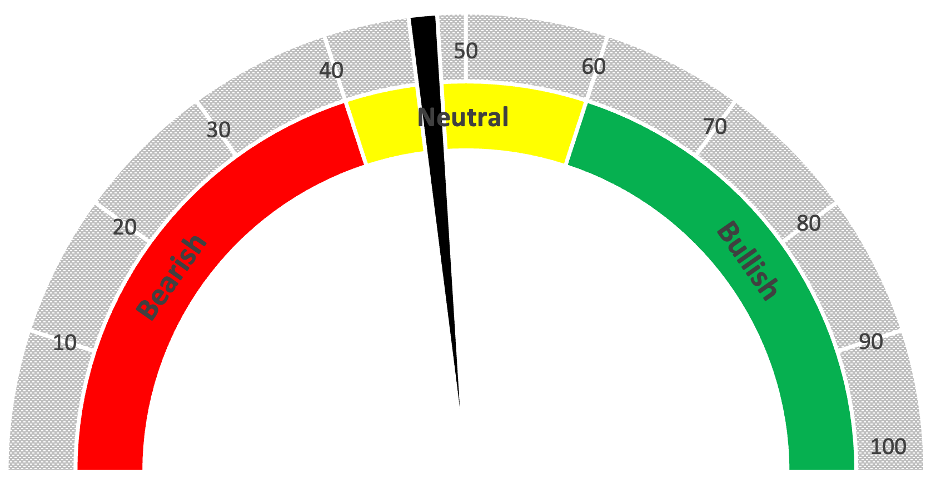

Oil & Gas ETF Earns “Neutral” Rating

Of the 51 stocks listed in IEO, only seven earn a rating of 70 or higher on Adam’s system.

On the other hand, 17 have a rating of 30 or lower, with the rest somewhere in between.

This is why the ETF’s rating is a “Neutral” of 46 out of 100.

The ETF earns high marks on Value (77 out of 100); however, it does not score higher than 58 on any other factor and scores below 40 on both Size and Momentum.

All of this suggests that while oil and gas companies are pulling more out of the ground, the investment potential in those stocks is still very much “wait and see.”

That is all for me today.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets