I went to Europe for the first time this past spring.

To be more specific, I went all over France. Many warned me that I would need to learn a bit of French to make my way around.

Little did they know I had a secret weapon: I was staying with a friend who was born and raised there.

But a lot of people don’t share this luxury.

Some rely on a little green owl to help them learn a new language and feel less like a stranger in a foreign country.

Duolingo makes learning a new language fun and easy.

But the company’s mascot has grown quite the infamous reputation (more on that below).

According to our system, the company’s stock also has a bad rap.

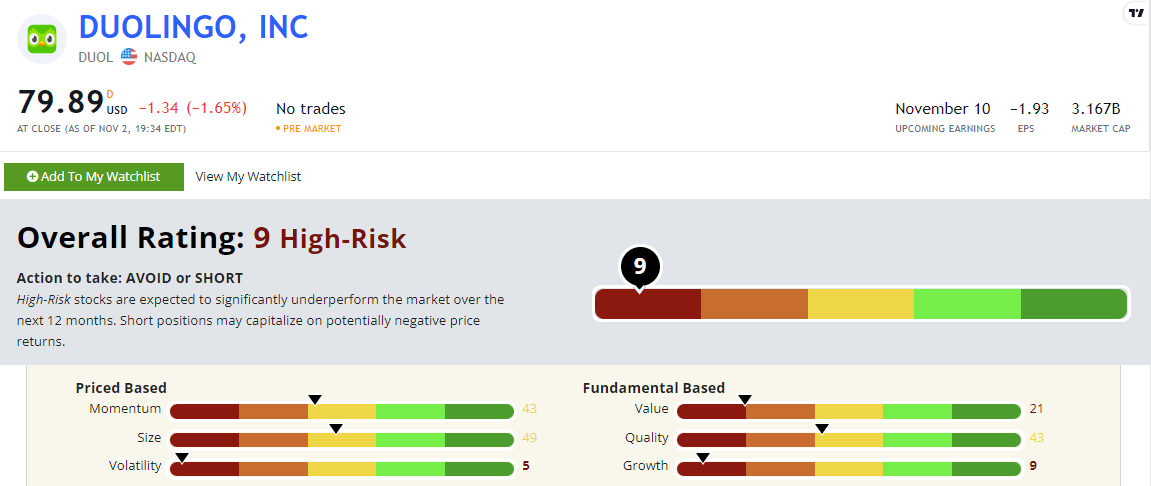

Duolingo Inc. (Nasdaq: DUOL) rates a “High-Risk” 9 out of 100 on our proprietary Stock Power Ratings system.

Let’s get into this little owl’s popularity before digging into its Stock Power Ratings.

Duolingo’s Manic Mascot

Duolingo is an educational app that makes learning a new language fun and accessible.

And it has a cute little green owl mascot named Duo that reminds you every day when it’s time to study.

Duo has garnered quite an unhinged reputation for his social media presence, getting involved in viral trends and memes (think inside jokes on the internet).

One infamous meme shows Duo taking matters into his own hands when his notifications were ignored for too long, as seen in the image below.

Source: Buzzfeed.

Duo has helped the company grow its audience to over 5 million followers on TikTok. And he’s verified on Twitter.

This modern advertisement scheme is a way to hit younger audiences, as many companies try to gain more traction — and revenue.

Zaria Parvez, the company’s social media coordinator, told Teen Vogue: “A lot of brands are just figuring out TikTok, ourselves included. This is part of our origin story right now. A lot of it is testing, seeing if something works or [doesn’t] work.”

Though this marketing ploy is entertaining for audiences, it isn’t bringing in the revenue Duolingo’s stock needs.

We can see this by looking at its Stock Power Ratings.

Duolingo’s Stock Power Ratings & Terrible Growth

Duolingo’s revenue is way down, but I highlight that when I get to growth in just a second.

This is clear if we take a quick look at its overall rating of a “High-Risk” 9.

DUOL’s Stock Power Ratings in November 2022.

Duolingo doesn’t rate in the green on any of our six factors.

The highest score is on its size factor (49). That means the company is still small enough to outperform a larger company that carries similar ratings on other factors.

But if we zoom in on growth, we can see where the trouble lies for Duolingo’s stock.

In the last 12 months, DUOL’s earnings per share have fallen 159.5%.

Despite earning $88.3 million in total revenue last quarter, Duolingo’s net margin is negative 24.1%.

All these numbers tell us that Duolingo isn’t turning a profit.

And to earn a high rating in our system, we need to see sales growth trend over short- and long-term time frames.

Because we are not seeing this from Duolingo, the company earns a 9 on our growth factor.

The Bottom Line

Duolingo scores a “High-Risk” 9 out of 100 on our Stock Power Ratings system.

But there are plenty of stocks out there that boast much stronger scores.

To get one highly rated stock you should consider investing in or some more to avoid — check out Matt Clark’s Stock Power Daily.

Monday through Friday, he gives you one stock to buy or avoid on our system and tells you why.

All for free!