In order to put my education to good use, I started teaching college classes online seven years ago.

Teaching was never part of my career path. But I’ve found that I really enjoy it.

Since I started, my classroom has grown from about 12 students to more than 28 each term.

That growth really took off during the COVID pandemic. Traditional college campuses closed, pushing students toward online classes to further their education.

Now, online education is well-integrated into all levels of learning — from grade school all the way to graduate school.

Data firm Statista forecasts the size of the online education market will hit $238.4 billion by 2027. That’s a 109% jump from where it was in 2020!

Today’s Power Stock develops online education tools used by classrooms around the world: Stride Inc. (NYSE: LRN).

Stride is a $1.8 billion company that develops curriculum and career services software for high school and middle school students.

The company also produces platforms used for training, recruitment and job placement services for adults.

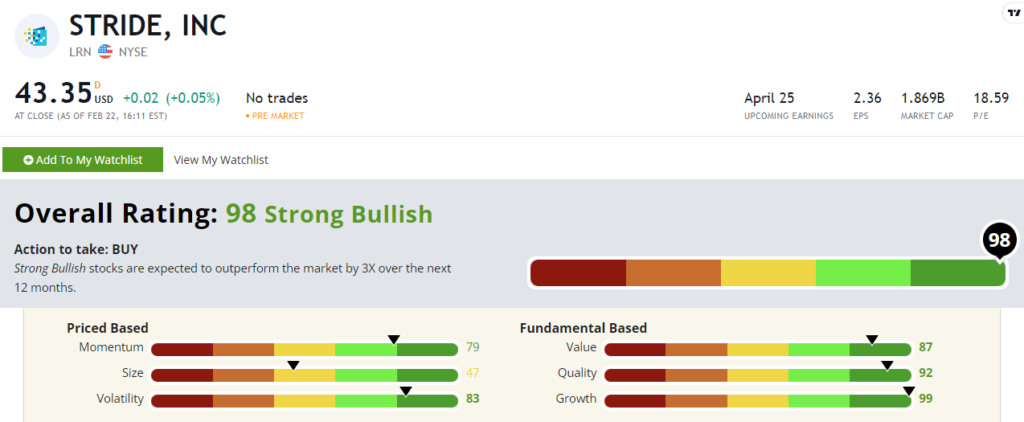

LRN stock scores a “Strong Bullish” 98 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

Stride Stock: Outstanding Growth and Quality

LRN had an outstanding second quarter of fiscal 2023 and is lining up for another solid year:

- Quarterly operating income was $76.3 million — a 25.7% jump from the same quarter a year ago.

- Revenue from its middle and high school career learning division rose 104.2% from last year!

While that shows fantastic growth (it scores a 99 on that factor), LRN is also a solid quality stock.

Its returns on assets, equity and investment are all positive while its peers are averaging in the red.

This tells us Stride’s management does an effective job at turning (and growing) profits.

It earns a 92 on our quality factor.

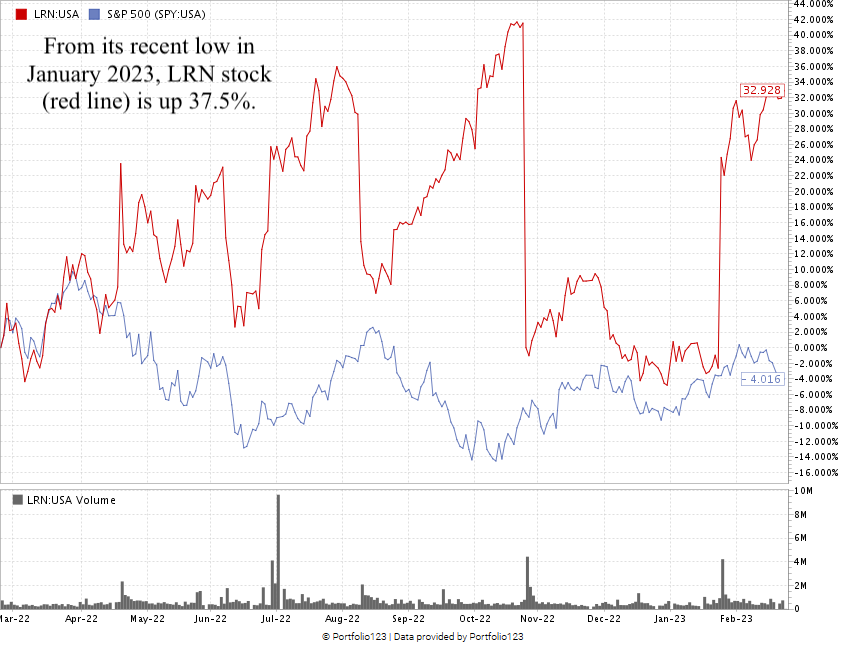

Over the last 12 months, LRN has risen 32.9%. The S&P 500 is down 4% over the same time.

Stride stock’s recent performance is what stands out to me. Check out the chart below:

Created in February 2023.

From its recent low in January 2023 to its recent high in February 2023, the stock has increased 37.5%.

That’s fantastic short-term momentum, and with a factor score of 79, I expect LRN to climb higher from here.

Stride stock scores a 98 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least 3X in the next 12 months.

The COVID pandemic showed us the benefits of online learning.

It’s a growing trend that is expanding into all levels of education.

You can certainly see why LRN is a strong stock for your portfolio.

Stay Tuned: A Smart Home Powerhouse

Stay tuned for the next issue, where I’ll share all the details on a stock that is in a strong position to profit as we make our homes smarter using innovative technology.

Stay tuned.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets