This week I highlight two hot stocks from my Winning 75 list.

These are stocks that have a clear Profit Trigger to watch and that I trade around in the Quick Hit Profits research service.

Every earnings season there’s a whirlwind of news for the market to adapt to. But the most important information gets priced in right away. That helps us decide how to trade the company over the next few weeks.

Since I use options, these stocks don’t even have to move much after the earnings report to deliver generous profits.

Options are our leverage and are a great tool when used the right way.

If you are new to options — or even if you are a seasoned trader — check out True Options Masters. I write over there several times a week, and all the content is framed with you in mind. We want you to get the most out of options trading in your own account.

We’ll look at Electronic Arts Inc. (Nasdaq: EA) and Teradata Corp. (NYSE: TDC) today, and I break down what you can expect, including my Profit Trigger to watch for potential trades.

Let’s get started…

Earnings Edge Stock No. 1: Electronic Arts Inc. (Nasdaq: EA)

Earnings Announcement Date: Wednesday, after the close.

Expectations: Earnings at $0.63 per share. Revenue at $1.27 billion.

Average Analyst Rating: Outperform.

One thing that continues to slow video game sales is the lack of new gaming platforms for sale. I still can’t find the new PlayStation 5 for my son, though, admittedly, I stopped looking every day.

Once he gets the new system, he will want some new games and he’ll want to upgrade some older games to use on the new console.

So there will be some pent-up demand, but that isn’t happening yet.

In the meantime, Electronic Arts continues to rely on consumers spending on fewer games and titles for older consoles. That has to be slow, right?

We just had a pandemic where almost all kids (and even a lot of adults) did was play video games. Now that they are back outdoors, we could see the company miss expectations this week, at least on the outlook.

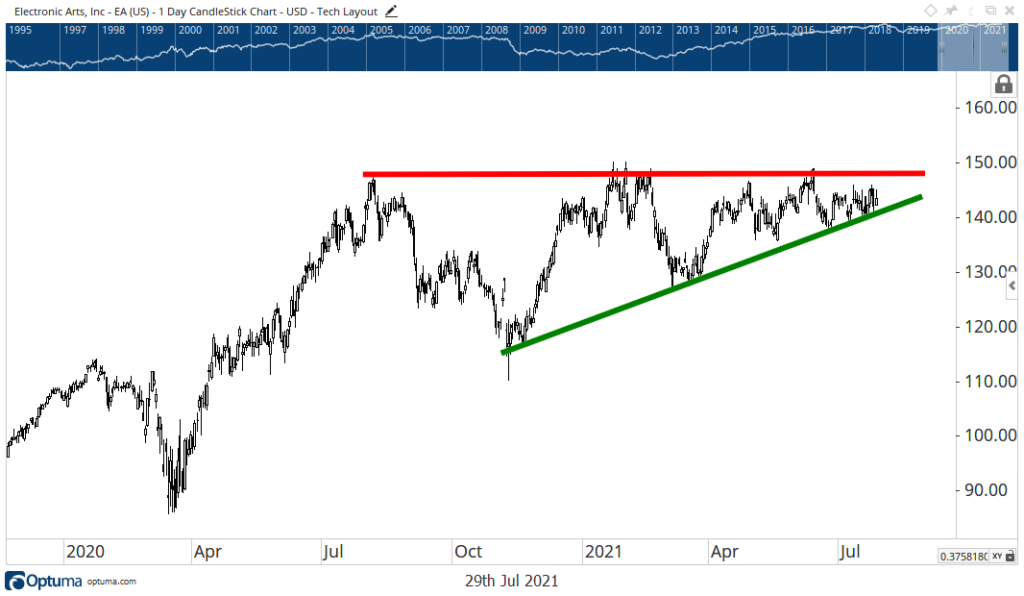

When you take a look at the stock, an ascending triangle pattern is alluding to an upcoming breakout.

EA Is Trading in a Tight Range

All the stock needs is a 5% move, up or down, and we’ll get a breakout.

Options traders are looking for a 2.7% move this week. That’s a decent jump. Look for some fireworks from EA at the open on Thursday.

When it comes to my Profit Trigger, Electronic Arts offers a rare bearish signal. If the stock misses expectations by 5% or more and the stock falls 5% or more, then we grab puts and expect the stock to continue falling for the next two months.

Stock No. 2: Teradata Corp. (NYSE: TDC)

Earnings Announcement Date: Thursday, after the close.

Expectations: Earnings at $0.46 per share. Revenue at $474 million.

Average Analyst Rating: Outperform.

Teradata is a cloud analytics company. It was a big winner as workspaces went virtual last year, and investors will look for that growth to continue for now.

Most companies are not bringing back employees until the fall, which is right around the corner. So for now, I’m not expecting a big disappointment in earnings. But ignoring downside risks can set up a disappointing report.

The bigger debate is if this is a one-off event or if it jumpstarted an inevitable trend?

I’d be willing to bet corporations are seeing the benefits from cloud platforms they implemented to help measure analytics and access data around the world.

TDC will remain volatile, but as we look ahead six months to a few years, Teradata’s platforms are going to be in even more demand.

Take a look at some of the volatility the stock has experienced over the last 12 months…

Teradata’s Wild Ride

Shares more than doubled at the start of 2021. The stock pulled back hard, and now it’s trading in a wide wedge pattern with a falling resistance in red and rising support in green.

I expect more big moves ahead for TDC, and that’s exactly what traders are betting on. Right now, the options market is pricing in a 6% move over the next few weeks based on the August 20 expiration.

Even though those options don’t expire this week, the premiums are loaded due to earnings.

After earnings, these premiums are going to drop, especially for the option on the wrong side of the trade.

For TDC, my Profit Trigger looks for the company to beat expectations by more than 5% and then pop by more than 5%. If it does that, I know to expect the rally to continue for another month.

And I’ll jump in even in extreme times.

The last time was right in the middle of this chart, when the stock surged more than 40% in a single day from earnings. We didn’t hesitate.

And we saw our gains climb over the next couple of days as the stock surged another 40%.

It’s a rare move, but you can see this is a volatile stock.

And if we get a 5% pop on earnings, chances are we’re on the verge of an upwards breakout. It’s something to pay attention to.

Chad Shoop is a Chartered Market Technician and options expert for Banyan Hill Publishing. He is the editor of three leading newsletters: Quick Hit Profits, Automatic Profits Alert and Pure Income. His content is frequently published on Investopedia and Seeking Alpha. Check out his YouTube Channel to see his latest market insights.

Click here to join True Options Masters.