Do you want to know what Earnings Edge is all about? Just look at the stocks I talked about last week.

I called it a make-or-break week for ABM Industries Inc. (NYSE: ABM) and Trip.com (Nasdaq: TRIP). It turned out to be just that.

With both stocks falling 5% or more after reporting quarterly earnings, we got a clear break out move to the downside of their chart patterns.

If you missed out on this initial drop, don’t worry. That’s not what we look to chase.

Instead, you can bank on these stocks heading lower for weeks ahead now that they’ve broken below key price support levels.

Today, I highlight two more stocks that are at a pivotal point this holiday trading week.

Earnings Edge Stock No. 1: Rite Aid Corp. (NYSE: RAD)

Earnings Announcement Date: Tuesday, before the open.

Expectations: Earnings at a loss of $0.18 per share. Revenue at $6.2 billion.

Average Analyst Rating: Underperform.

I just want to point out, Rite Aid is the first stock we’ve featured in Earnings Edge with an underperform rating, according to analyst coverage on the S&P Capital IQ platform. It’s not a flat-out sell, but it rates a 4 on a scale of 1 to 5, with 5 being the flat-out sell rating.

There’s only three analysts covering RAD now, according to Capital IQ, which tells you how far it has fallen. Peer Walgreens has 19 analysts covering its stock.

But man, this chart screams volatility.

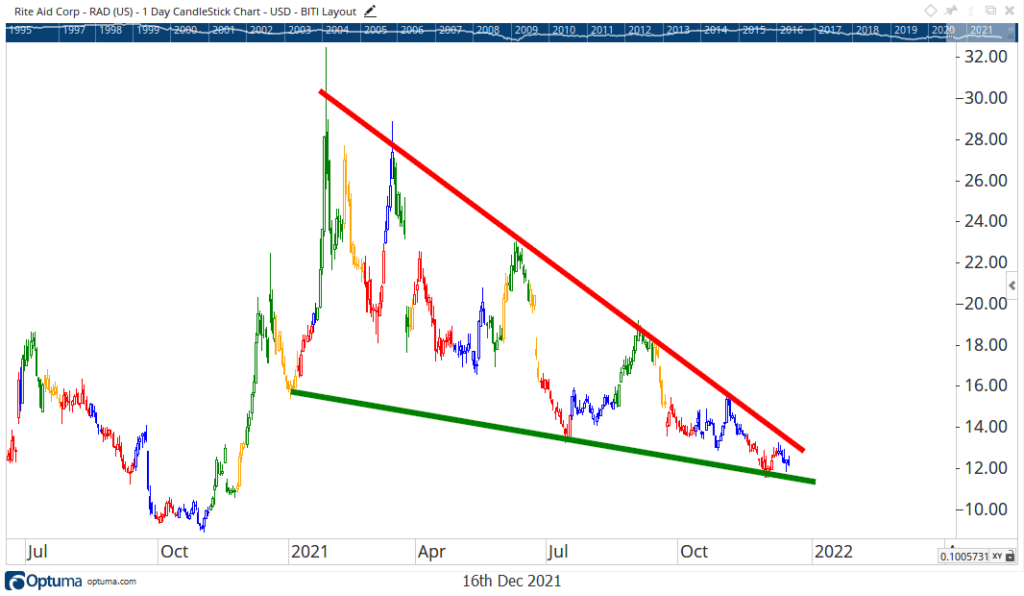

RAD’s Volatile Consolidation

A falling wedge pattern that starts at $30 a share and is down to $12 a share is calling for a major move.

Yet the options market is only pricing in a 6% price change after Rite Aid reports earnings this week.

I’m willing to bet we see at least a double-digit move. I can’t confirm the direction, but you can bet on a big move with a straddle trade. Buying the same strike call and put options will have you in a position to make money as long as one leg of the straddle makes more than the cost of the other.

It’s a conservative play on earnings, but one that may be worth a look in a stock that isn’t expecting a lot of volatility this week.

Earnings Edge Stock No. 2: Paychex Inc. (Nasdaq: PAYX)

Earnings Announcement Date: Wednesday, before the open.

Expectations: Earnings at $0.80 per share. Revenue at $1.06 billion.

Average Analyst Rating: Hold.

The payroll processing giant Paychex is steadily climbing higher.

It‘s not a surprise. The labor market is as tight as it has ever been with record hiring taking place.

But all eyes are on earnings. How is the growth in the economy translating into more earnings for Paychex? That’s what we want to see this week, and that’s why this is a pivotal quarter for the stock.

PAYX Eyes a Big Move

PAYX shares won’t stay in a tight trend channel like this forever. It’s already been trending higher along these two same trend lines for more than a year.

And the eventual breakout will likely come on earnings, possibly as soon as this week.

It’s a hot stock to watch in the coming days.

With PAYX trending along the top of the resistance, it won’t take much to trigger a breakout to the upside. But, shares could fall as much as 8% and still be stuck in this trend channel.

If investors dump more than that on earnings, then we could break that green support. And if that happens, look out below. Shares will head lower for a lot longer than just a few weeks.

We’ve seen plenty of volatility this year.

That’s why I research trading systems like my Profit Radar. I aim to produce market-beating returns in a fraction of the time it would take by just buying and holding. And with this recent innovation, I’m all but certain I’ve cracked the code to doing it consistently.

If this sounds like something you’d like to trade with, you’ll want to watch my presentation.

There’s no one I want to benefit from my newest strategy more than loyal readers. So, I urge you to watch this video while you still can.

Regards,

Chad Shoop

Editor, Quick Hit Profits

Click here to join True Options Masters.