Retail stocks are still in focus in this week’s Earnings Edge, but more specifically, the mall trade. This may be dated, but the early 2000s were red hot for both of the stocks I’m watching — Abercrombie & Fitch Co. (NYSE: ANF) and American Eagle Outfitters (NYSE: AEO).

Teens loved the new looks they offered, and their stores were packed.

Back then, though, the mall was a central hangout.

Times have changed.

As that generation from the 2000s grows older, the new generation of kids has largely shopped elsewhere, forcing Abercrombie and American Eagle to struggle to keep growing sales.

Now, after years of turmoil and volatility, their stocks are revived again with digital sales during the pandemic.

This week will be key to see if that momentum keeps going. Let’s dive in to see what we can expect from these two retail stocks…

Stock No. 1: Abercrombie & Fitch Co.

Earnings Announcement Date: Wednesday, before the open.

Expectations: Earnings at a loss of $0.40 per share. Revenue at $685 million.

Average Analyst Rating: Outperform.

We can tell analysts love Abercrombie with the stock rated an outperform.

Meanwhile, its share price has climbed more than 400% coming out of the darkest days during the pandemic-related selloff.

Online sales helped boost its results. It managed to boost its digital sales to more than 50% of its revenues for all of 2020. Impressive, considering that would have been a tiny fraction before.

In the fourth quarter, digital sales growth jumped 34%.

So it’s been able to reduce its operating expenses with stores closed and minimal staff while generating sales throughout the pandemic.

Even with that, you’ll notice Abercrombie is expected to report a loss per share this quarter with stores ramping back up and employees coming back.

The first quarter is a historically weak quarter for Abercrombie, as sales fall off a cliff after the fourth quarter holiday rush. But this year felt different. Consumers received stimulus checks, tax checks, plenty of cash to go spend. And with stores opening back up, a sudden rush to venture back out may deliver some surprising results.

We’ve seen that concern in the stock. While shares are still climbing, it’s only up about 10% since March. It was up 50% the two months before that.

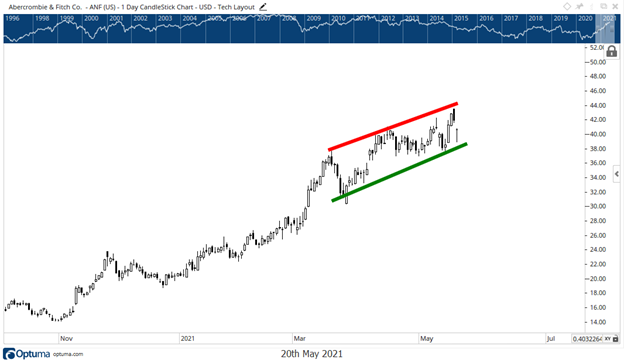

ANF’s Rally Has Slowed

The red resistance line and green support are creating a clear rising price channel, one the stock is bouncing around in at this point.

Earnings are a likely tipping point to break this trend but keep in mind, the stock doesn’t have to make a big move.

With a rising support line, if the stock simply trends sideways, that could break the uptrend and provide weakness in the stock in a few weeks.

That’s not what options traders are betting on, though. The options market is pricing in a 7% move. That’s significant on earnings. A great report, or a horrible one, may move the stock 10% to 15%. To pay 7% just to bet on a slightly larger move isn’t worth the risk to me.

I prefer to trade stocks after the earnings announcement. That’s when a phenomenon known as an earnings “drift” takes place and can lead to rapid gains, with much more predictability.

You can learn all about it by watching this special presentation.

Stock No. 2: American Eagle Outfitters

Earnings Announcement Date: Wednesday, after the close.

Expectations: Earnings at $0.47 per share. Revenue at $1.02 billion.

Average Analyst Rating: Outperform.

For everything Abercrombie has done to revitalize sales, American Eagle is doing even better.

American Eagle, too, saw digital sales jump 35% last quarter. But its Aerie brand, essentially its version of Victoria’s Secret, has brought a resurgence to the entire franchise.

It was segmented out into its own brand back in 2018 and now makes up more than 25% of American Eagle’s revenues.

The Aerie division is also driving digital sales, seeing the segment jump 75%.

That’s why AEOs similar 450% price rise since the low point of the pandemic isn’t the big news here.

This stock hit a new all-time high on April 21.

Higher than the dot-com bubble. Higher than the 2007 top before the financial crisis. And that was the prime time for the company.

American Eagle has been able to pull a 180 amidst the most challenging year on record for retailers. Dealing with a global shutdown causing people to buy fewer clothes, it is coming out in the best shape of its 25-year stint as a public company.

Now that’s impressive. But based on its price chart, investors are getting a little nervous now.

AEO Might Have Topped Out

The red resistance line shows a clear horizontal point of tension. But the support line in green is trending lower.

I think of supports and resistance lines as the point where buyers and sellers overpower each other.

The support line is a level where sellers fade away, and more buyers step in.

The resistance line is a level where buyers fade away, and more sellers step in.

That means a declining support line tells me the buyers are not that aggressive at the new all-time highs for the stock. Earnings this week could make or break those key levels I’m watching.

According to the options market, traders are only looking for a 5% move. I say only because on its price chart, that likely doesn’t get us to breakout of either key level. It could jump or dump by 5% and still be within those ranges.

This is one I’d stay away from for the moment.

Chad Shoop is a Chartered Market Technician and options expert for Banyan Hill Publishing. He is the editor of three leading newsletters: Quick Hit Profits, Automatic Profits Alert and Pure Income. His content is frequently published on Investopedia and Seeking Alpha. Check out his YouTube Channel to see his latest market insights.

Click here to join his free newsletter, Weekly Options Corner.