Traders eagerly await earnings announcements because stock prices can make significant moves after the quarterly calls.

If the company beats earnings estimates, the stock usually goes up. Missing estimates can send a stock sharply lower.

About half of the companies in the S&P 500 have reported earnings for the fourth quarter of 2022. Results are disappointing. It looks like earnings for the index will be under $200 per share.

Earnings per share for the index are based on the same weights that are used to calculate the price index. Apple makes up 5.9% of the earnings and value of the index. Microsoft accounts for 5.6%. The other 498 companies carry lesser weights.

Earnings Estimates Are Off the Mark

Standard & Poor’s estimates earnings will reach $224 this year. That’s optimistic when consumers are cutting back due to inflation. That will pressure the first step toward earnings: company revenue.

Accountants call the next step toward earnings the “cost of goods sold” (COGS). This is the amount a company spends on inventory and raw materials.

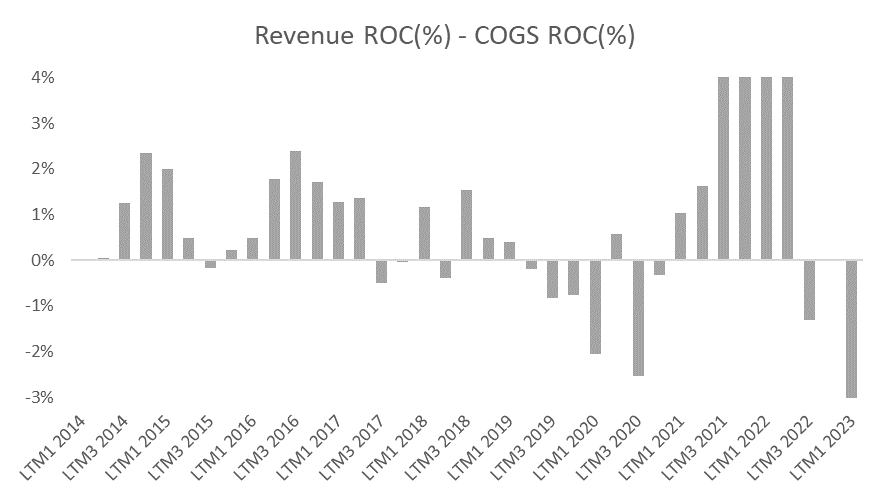

In the past three quarters, COGS grew faster than revenue. This is shown in the chart below which subtracts the year-over-year rate of change in COGS from the return on capital (ROC) in revenue.

The last time this value was negative for three straight quarters was in the run-up to the 2020 recession.

It’s easy to forget that the economy was headed toward recession when the pandemic shut the world down in 2020. Even without COVID-19, a recession appeared inevitable.

This chart shows that companies can’t raise prices now. Consumers just aren’t willing to pay, most likely because they are unable to. The ROC of COGS captures that.

The fact that costs are rising faster than revenue shows that earnings will be under pressure.

Bottom line: Instead of earnings rising 10% in 2023, it seems likely they will fall. If that happens, the overvalued stock market will follow.

Michael Carr, CMT, CFTe is the editor of two investment trading services — One Trade and Precision Profits — and a contributing editor to The Banyan Edge. He teaches Technical Analysis and Quantitative Technical Analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.