A good earnings report can provide a needed boost to a company’s share price.

At least that is what logic tells us. But it’s not always the case.

A company can report positive earnings but fail to meet analysts’ expectations — like reporting $1.50 in earnings per share (EPS) when analysts expected $2.

In those cases, a stock price may fall because it looks like the company isn’t living up to expectations.

Another instance where good earnings won’t translate to positive stock movement is if the company lowers its guidance for revenue or earnings in future quarters.

So what’s going on in this quarter?

Today, I’ll break down the S&P 500 and show you an anomaly between stock prices and the latest round of company earnings. Then I’ll tell you why it pays to dig deeper into earnings reports before trading.

It’s Been a Good Quarter Overall

More than 84% of companies listed in the S&P 500 have reported quarterly earnings for the second quarter.

Data firm FactSet has found that 79% of them have beaten EPS estimates. That’s above the 5-year average of 77% and the 10-year average of 73%.

All told, earnings have beaten expectations by 7.2% — which is higher than the 10-year average of 6.4%.

It means that more companies are beating earnings expectations by a wider margin than just a decade ago.

Logic would tell us that share prices for those companies reporting a beat should go up, right?

In this quarter, that isn’t the case.

Positive Earnings Leads to … Price Declines?

You read that right.

Despite more companies reporting higher quarterly earnings in the second quarter of 2023, stock prices have not correlated… They’ve actually gone down by a good margin.

The five-year average price change for companies reporting positive earnings is 1%. However, this quarter, prices have declined by 0.5%.

It’s the largest negative price action for companies with higher earnings since 2011.

Since 2018, this anomaly has only occurred three times — this quarter included. In the previous instances, the average stock price decline was just 0.2%. This quarter is more than double that.

In most instances, stock prices rose after companies reported higher EPS — the highest was a 2.4% average up move in the third quarter of last year.

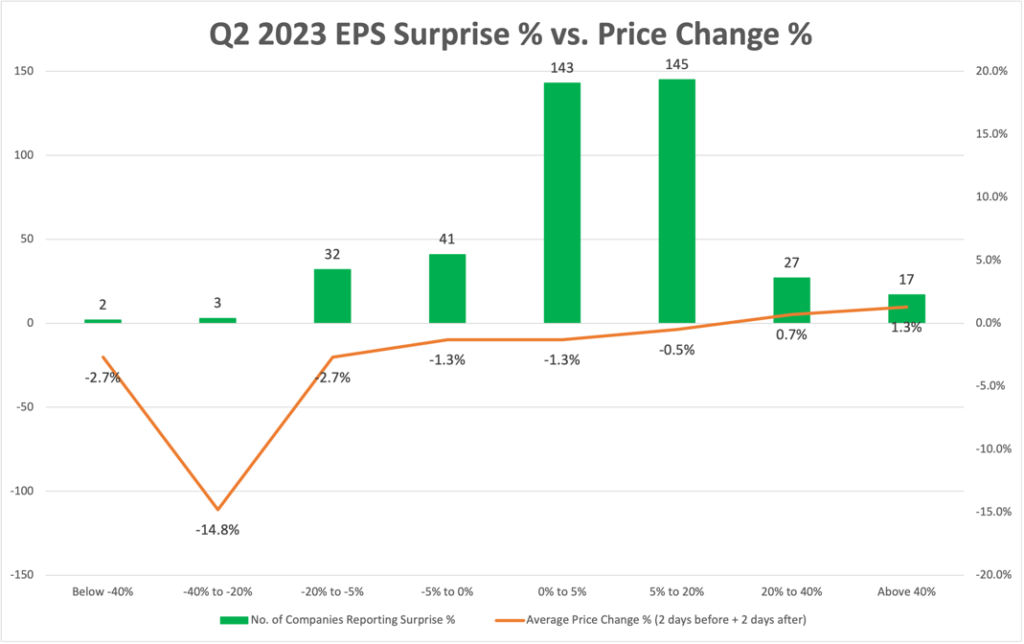

Drilling down into this quarter shows us where the negative price action is coming from:

Source: FactSet

It’s not unexpected that share prices will drop after companies report a negative earnings surprise.

However, the 288 companies reporting up to a 20% positive surprise in earnings have lost an average of 0.9% in their stock price in the days before and after they report.

Tesla Inc. (Nasdaq: TSLA) is an example of this. The company reported EPS of $0.91 this quarter. That was above the mean estimate of $0.81. But from July 17 to July 21 — two days before to two days after the company reported — the stock fell 10.5%.

One big reason Wall Street is punishing these stocks is because of guidance.

Of the 79 companies that have issued earnings guidance, 49 of them have issued negative guidance — meaning they expect the next quarter to be worse than the previous.

It tells institutional investors that these companies are expecting turbulence ahead.

Wall Street doesn’t like that kind of news.

Bottom line: The point I’m trying to make here is that it’s common to want to trade stocks on earnings.

It’s logical to think that if a company knocks it out of the park in its quarterly call, that’s cause to buy in and capture gains.

But this quarter proves that’s not always the case.

It pays to dig a little deeper into these quarterly reports for hints on what to expect for the future.

Stay Tuned: Is Max Verstappen Killing F1 Stock Hype?

Tomorrow, Chad is going to do a deep dive on a sports stock that’s banking on massive growth.

But one driver, and poor Green Zone Power Ratings, are hurting its fate.

Until then…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets