Another earnings season is kicking off again…

With hundreds of companies reporting quarterly numbers over the next few weeks, we’ll have plenty to cover.

Part of our weekly earnings analysis is derived from the average analyst coverage of a stock and their expectations for a company’s earnings per share for the previous quarter. We want to focus on companies with many analysts because this provides a more accurate picture of a company’s financial health and future.

I bring this up because I ran across some interesting data just before the start of this next earnings season…

Analysts’ Lower Estimates for Next Quarter

For the last two earnings seasons, companies have mentioned inflation and tariffs a lot more than usual.

Pro tip: I examined the number of S&P 500 companies talking about inflation in quarterly reports here.

Well, these concerns haven’t gone away, and analysts are taking note.

Bottom-up estimates — the aggregation of median analysts’ EPS estimates for all companies in the S&P 500 — have declined at a faster rate than the five-year average.

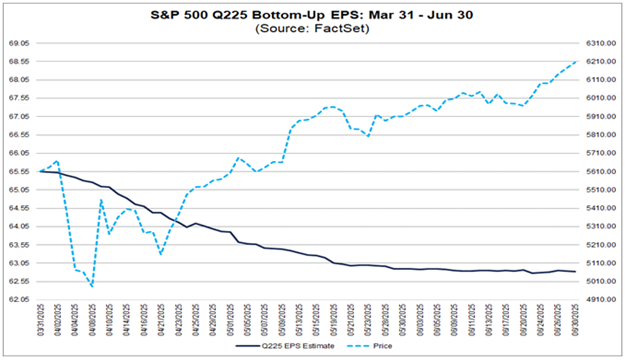

This chart shows the S&P 500’s price action (blue dotted line) and the index’s bottom-up EPS estimates (black line).

The aggregate median was $65.55 at the end of March. By the end of June, it had fallen 4.2% to $62.83.

To put it in perspective, the average decline in bottom-up EPS estimates for the last five years was just 3%. Over the last decade, that decline average was 3.1%.

Analysts have also lowered EPS estimates for the rest of the year by 3.6%.

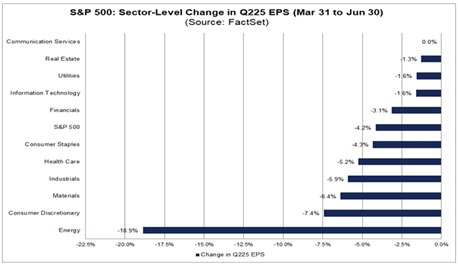

On a sector level, energy is estimated to have the most significant decline (-18.9%), while communication services estimates are flat.

The average decline for the entire S&P 500 is -4.2%.

It will be interesting to see how many companies meet these lowered earnings expectations, and how many beat them.

Which leads me to my earnings analysis this week…

“Bullish” Earnings to Watch

Let’s start with companies expected to beat their previous quarter’s earnings and, thus, potentially trade higher if those expectations are met … or even exceeded.

For this screen, stocks must meet four criteria:

- 10 or more analysts cover the stock.

- The average analyst recommendation is a “Buy.”

- It BEAT analysts’ EPS estimates for the previous quarter.

- The average analyst estimate for the current quarter’s EPS is greater than the previous one.

Here are the seven companies that made the list:

Last quarter, Netflix Inc. (NFLX) blew the doors off its earnings report.

The company reported revenues of $10.5 billion, up from $10.2 billion in the previous quarter, and earnings per share of $6.76, up from $4.37.

In addition, 2025 has been a decent year for NFLX, as the stock has climbed nearly 41%, while its industry peers are only averaging a 17.4% increase.

The stock reached a 52-week high at the end of June before paring back some of those gains.

If Netflix beats earnings estimates, it will mark the highest quarterly EPS in the last five years.

Next week, I’ll see if another earnings beat moves NFLX higher on Adam’s Green Zone Power Rating system — but it’s already “Bullish,” pointing to more outperformance ahead.

The last step in our weekly earnings analysis looks at which companies could face a bearish earnings swing next week…

“Bearish” Stocks to Watch

For our “bearish” earnings screen, we’re only looking for two things:

- 10 or more analysts must cover the stock.

- The average analyst estimate for the current quarter’s EPS is less than the previous quarter’s.

We want companies that are covered by a sufficiently large group of Wall Street analysts who collectively expect the company to report a quarter-over-quarter decline in earnings.

As Adam has mentioned before, our reports are primarily focused on members of the S&P 500 to capture the largest publicly traded stocks.

Our screen brought back eight companies:

What interests me here is Morgan Stanley (MS).

The company has increased its quarterly earnings per share in each of the last four quarters … despite its stock price bouncing around a bit.

The increase in earnings is due to elevated activity in its sales and trading division, which trades various products, from equities to foreign exchange.

Higher lending costs due to elevated benchmark rates set by the Federal Reserve have hit banks harder than some other industries.

Although rates have come down a bit, banks aren’t lending out nearly as much as they were five years ago, meaning their interest income takes a hit.

Action at their trading desks has bailed them out and generated more profits. The more people trade, the greater the percentage banks make.

Missing on earnings could drop MS below its current “Neutral” rating on the Green Zone Power Rating system.

That’s all from me today. I hope you all have a great weekend!

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets