Welcome to our Earnings Friday edition of What My System Says Today.

I’ll break down our “bullish” and “bearish” earnings screens in a second, but first, I want to discuss something I mentioned last week.

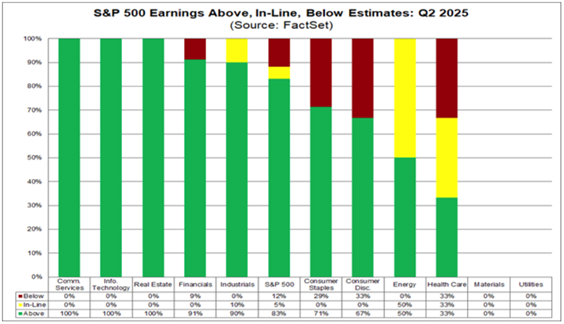

We’ve kicked off the quarterly earnings season in strong fashion.

A majority of the S&P 500 companies reporting have posted numbers estimates for both revenue and earnings per share (EPS):

According to the data firm FactSet, 83% of the small number of companies that have reported earnings thus far have exceeded expectations.

The same percentage — 83% — has also beaten revenue estimates.

Keep in mind that we’re still in the early days of earnings season, but if the start is any indication of the finish, this could be an excellent quarter for benchmark index companies.

Now let’s review one sector that came up last Friday…

Defense Sector Pays Well For NOC

One of the companies appearing on our “bullish” earnings screener last week was Northrop Grumman Corp. (NOC).

I mentioned that this large defense contractor should continue to benefit from defense spending in the U.S. and abroad.

While the economic benefits to specific companies have yet to be realized, NOC’s future is strong after the passage of President Trump’s “One Big Beautiful Bill,” which will inject billions into defense spending.

To back that point up, the company reported a 9% increase in sales and EPS of $8.15 for the previous quarter.

Those earnings blew away expectations ($6.84) and doubled the previous quarter.

Additionally, the company raised its 2025 guidance for operating income, EPS and free cash flow.

Things seem to be picking up for NOC, even before spending from Trump’s bill begins.

Let’s stay on the “bullish” storyline and check out companies expected to report stronger earnings next week…

“Bullish” Stocks to Watch

Stocks on this list are expected to beat their previous quarter’s EPS, thus could potentially trade higher if those expectations are met… or exceeded.

For this screen, stocks must meet four criteria:

- 10 or more analysts cover the stock.

- The average analyst recommendation is a “Buy.”

- It BEAT analysts’ EPS estimates for the previous quarter.

- The average analyst estimate for the current quarter’s EPS is greater than the previous one.

Here are the top 10 companies that made the list:

The first thing that stands out here is Booking Holdings Inc.’s (BKNG) projected 5X EPS increase.

Booking Holdings’ subsidiaries, such as Priceline.com and Booking.com, specialize in online travel and related services.

These websites can be used to secure hotel reservations, flights, and just about anything else related to travel.

If you’ve looked up BKNG stock before, you know that it costs more than $5,000 per share.

In addition, the projection of a 5X increase in earnings is hefty, considering the mix of trends in the travel and tourism industry.

Domestic travel in the U.S. is up; however, international travel to and from the U.S. is down.

In May, the U.S. Travel Association reported that overall travel spending was only up 3% year-over-year; however, consumer sentiment on travel and tourism ticked up.

I see an earnings and revenue beat here, but I’m interested to see how they do that exactly.

More importantly, I want to see what that kind of earnings beat does to BKNG’s “neutral” rating on our Green Zone Power Rating system.

Let’s switch things up a bit and look at the “bearish” side of earnings for next week…

“Bearish” Stocks to Watch

For our “bearish” earnings screen, we’re only looking for two things:

- 10 or more analysts must cover the stock.

- The average analyst estimate for the current quarter’s EPS is less than the previous quarter’s.

We want companies that are covered by a sufficiently large group of Wall Street analysts who collectively expect the company to report a quarter-over-quarter decline in earnings.

Here are the top 10 companies that passed this screen:

Two things stand out here:

- Could things get any worse for The Boeing Co. (BA)?

- Is Meta Platforms Inc. (META) slowing down?

It’s been a tough few years for The Boeing Co. (BA) … aircraft malfunctions, sales declines, you name it.

Expectations are for the aircraft manufacturer to report its 11th consecutive quarter of negative EPS.

If earnings shake out as expected, it wouldn’t be the lowest EPS the company has reported, but negative earnings are never good, no matter how you slice it.

For Meta Platforms Inc. (META), the tech giant had four straight quarters of EPS growth. That streak came to a halt last quarter when the company’s earnings declined from $8.02 per share to $6.43.

This would be the first time since 2022 that the company has reported a back-to-back drop in earnings.

It could have an adverse effect on META’s rating on the Green Zone Power Ratings system.

As for Boeing, there isn’t a lot of room left for its rating to get much worse.

That’s all from me today.

I hope you all have a great weekend!

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets