Before I get into the one stock that passed our earnings screen this week, I want to talk about earnings beats and misses.

I’m referring to how a company’s actual earnings compare to analysts’ expectations.

A beat occurs when a company reports earnings that are above analysts’ expectations, whereas an earnings miss is the opposite.

These earnings surprises can have either a major impact on stock prices.

What to Make of Earnings Surprises

While researching earnings this week, I came across some fascinating data related to the S&P 500 from Standard & Poor’s:

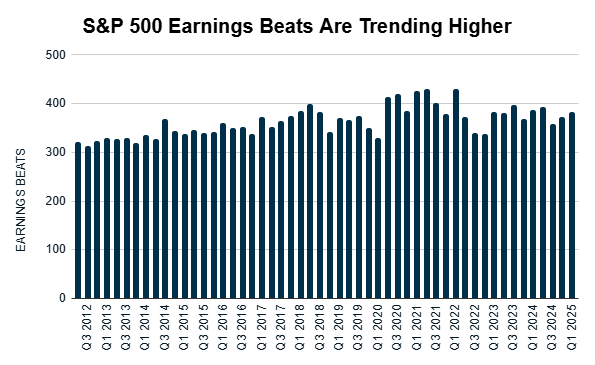

In the first quarter this year, 383 companies listed on the S&P 500 reported earnings beats.

Since the second quarter of 2013, the average number of companies beating earnings is 363, so not only did the number of earnings beats rise, but it was also better than average.

Here’s the second part of that data:

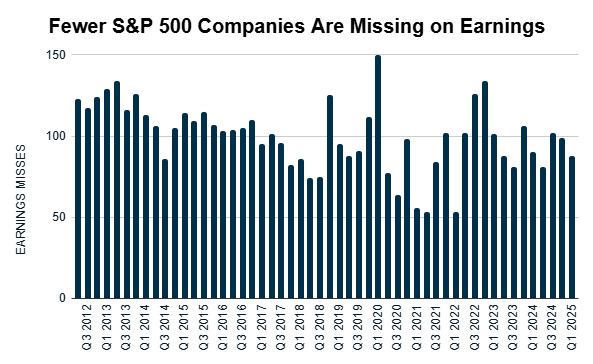

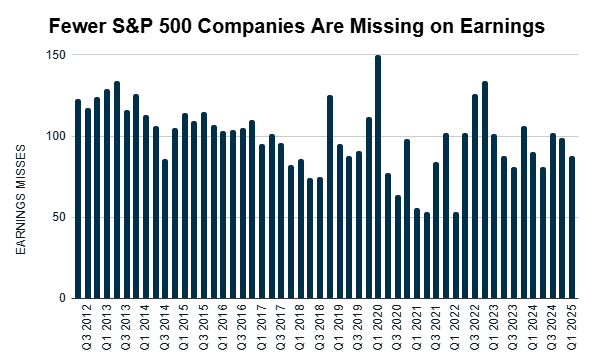

Of the companies on the S&P 500 index reporting, only 88 missed on earnings.

This is significantly below the average of 100, and lower than the last two quarters by a significant margin.

All told, 77% of companies in the S&P 500 reported earnings beats, while just 17.7% reported misses. The other 5.2% met expectations on the nose.

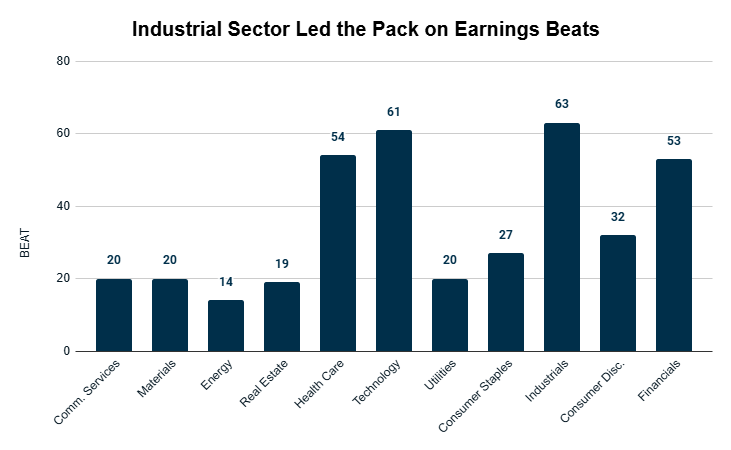

Now, I took those first quarter 2025 numbers and broke things down by sector:

On the surface, the industrial sector led with 63 companies beating expectations.

However, while that was 82% of all industrials on the index, it was the health care sector that had the largest percentage of stocks with earnings surprises to the positive side (90%).

Only four sectors — materials, industrials, health care and technology — had a higher percentage of companies beat earnings expectations than the S&P 500 average.

Although 16 companies in the financial sector missed earnings, that doesn’t mean it was the worst-performing sector.

That title would go to consumer discretionary.

While 22.5% of S&P 500 financial companies missed earnings expectations, 29.4% of energy companies missed.

Six of the 11 S&P 500 sectors had higher percentages of companies miss earnings in the first quarter of 2025 than the broader index.

While it appears the broader S&P 500 is doing well on the earnings front, it’s obvious that some sectors aren’t keeping up.

Now, let’s get into bullish and bearish earnings for next week…

“Bullish” Earnings to Watch

Let’s analyze companies expected to beat their previous quarter’s earnings and, thus, potentially trade higher if those expectations are met … or even exceeded.

For this screen, stocks must meet four criteria:

- The stock is covered by 10 or more analysts.

- The average analyst recommendation is a “Buy.”

- It BEAT analysts’ EPS estimates for the previous quarter.

- The average analyst estimate for the current quarter’s EPS is greater than the previous one.

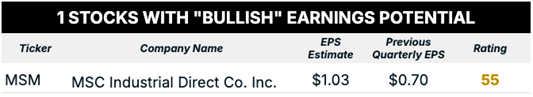

Here is the one company that made the list for next week:

MSC Industrial Direct Co. Inc. (MSM) sells metalworking products and services, like cutting tools, measuring instruments and raw materials.

Last quarter, MSC reported its lowest earnings per share ($0.70) of any quarter since the third quarter of 2021.

However, if the company beats analysts’ expectations and reaches $1.03 or more, it will be the highest EPS the company has earned in the last four quarters.

If it does beat, I will be curious to see how it impacts the stock’s “Neutral” rating on Adam’s Green Zone Power Rating system and its stock performance.

Over the last 12 months, MSM has been mostly range-bound between $75 and $85 per share.

It’s currently showing signs of breaking out above $85, and an earnings beat could be the propellant needed to push the stock higher.

The next step in our analysis would be to look at stocks with “bearish” earnings potential, but our screen did not turn up any stocks meeting our criteria.

The likely explanation is that none of the stocks reporting earnings next week have enough analyst coverage, or none of those companies have an estimate lower than the previous quarter. With the vast majority of companies having already reported, the group of stocks we’re looking at is also much smaller. That should change when the next earnings season kicks off in mid-July.

That’s all from me today. I hope everyone has a great weekend!

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets