I wouldn’t call every company boasting big gains sexy.

They don’t all tap into artificial intelligence or find the cures for diseases.

Some are just run-of-the-mill companies that have perfected their businesses over the years.

And the stock I have for you today fits that bill.

Using Chief Investment Strategist Adam O’Dell’s proprietary six-factor Stock Power Ratings system, I found a “Strong Bullish” company that manufactures business supplies like labels and envelopes:

- It pays its shareholders a 4.58% dividend yield.

- The stock jumped up 32% since the middle of June.

- It’s in the top 2% of all the stocks we rate.

Here’s why the business supply stock I share with you today will continue its strong performance in 2022 and beyond.

The Great Migration Back to the Office

During the pandemic, many businesses allowed their staff to work from home.

Now as the world returns to something that resembles pre-pandemic life, employers are bringing people back to the office.

That means increased demand for office supplies:

The chart above shows the revenue generated from manufacturing office supplies in the U.S.

In 2013, the industry recorded $2.7 billion in revenue. Statista expects that to grow 37% by 2024 to $3.7 billion.

Bottom line: After COVID lockdowns pushed us out of the office, Americans are returning to their desks … meaning offices are returning to the norm.

High-Quality, Low-Volatility EBF Stock

More Americans are returning to the office. That means more demand for office supplies.

Ennis Inc. (NYSE: EBF) has been meeting that demand for American companies since 1909.

It provides businesses with a wide array of products including tags, labels and envelopes.

COVID-19 lockdowns put a crimp in Ennis’ bottom line, but the company has roared back:

COVID lockdowns lopped 19.2% off Ennis’ total annual revenue in 2021.

The company expects to gain 13% of its revenue back this year and reach $420 million by 2024.

Now, let’s look at how this business supply stock has performed.

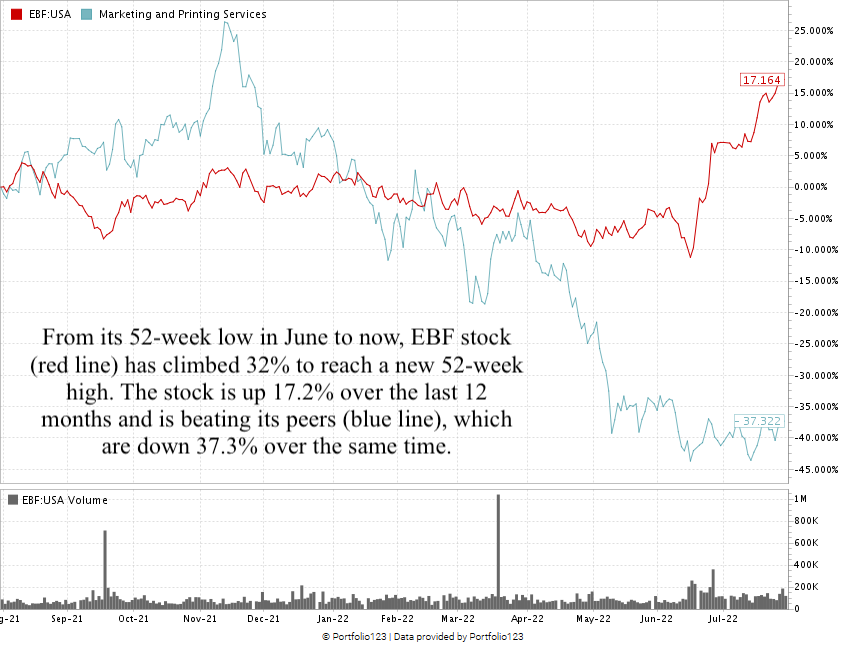

EBF Hits 52-Week High

Ennis stock hit a 52-week low in June. Since then, the stock has had a massive run-up of 32% to reach a new 52-week high.

EBF (up 17% over the last 12 months) continues to outperform its marketing and printing services industry peers — which are down 37.3% over the same 12 months.

Ennis Inc. Stock Rating

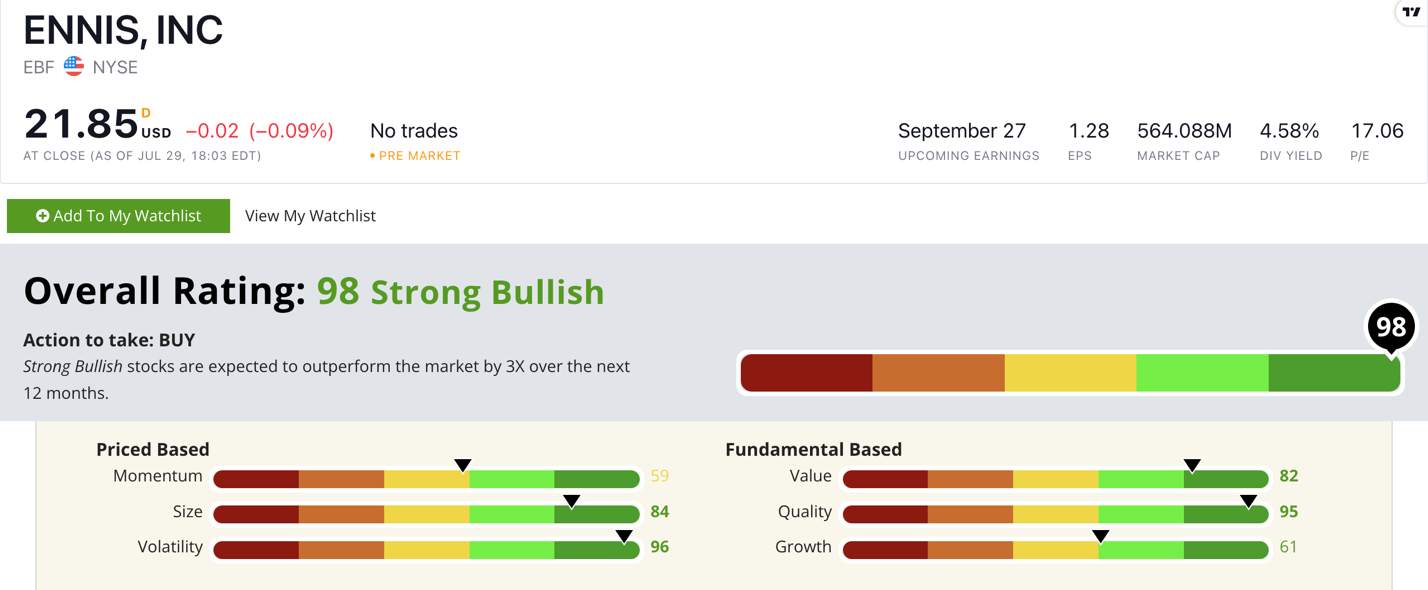

Using Adam’s six-factor Stock Power Ratings system, Ennis Inc. stock scores a 98 overall.

That means we’re “Strong Bullish” on the stock and expect it to beat the broader market by at least three times over the next 12 months.

EBF rates in the green on five of our six factors:

- Volatility — EBF’s recent climb has met little resistance. It scores a 96 on volatility.

- Quality — Returns on assets, equity and investment are all negative in the marketing and printing services industry, but Ennis boasts positive gains on all three metrics. EBF scores a 95 on quality.

- Size — With a market cap of $564.1 million, EBF is the perfect size to produce even stronger gains. It scores an 84 on size.

- Value — Ennis’ price-to ratios (sales, cash flow and book value) are all either in line or slightly below the industry average. EBF scores an 82 on value.

- Growth — EBF scores a 61 on growth, with a one-year earnings-per-share growth rate of 19.8% and 11.1% growth in sales from its last quarter.

EBF earns a “Neutral” 59 on value, but the stock has run up 32% since the middle of June … showing the “maximum momentum” we love to see in stocks. That has pushed its value rating down a bit.

Bottom line: More Americans are returning to the office after working from home throughout the pandemic…

And the demand for business supplies will grow as this trend continues.

This is why EBF stock is a must-have for your portfolio.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Stock Power Podcast, as well as the Marijuana Market Update. He’s also a certified Capital Markets and Securities Analyst through the Corporate Finance Institute. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.