Last week’s news confirmed what many consumers already knew. The pace of economic recovery slowed in the fourth quarter.

CNBC reported that “gross domestic product, or the sum of all goods and services produced, increased at a 4% pace in the fourth quarter, slightly below the 4.3% expectation from economists surveyed by Dow Jones.”

At first glance, the quarter represented a level of normalcy after the economy contracted at a record 31.4% in the second quarter, then rebounded to a 33.4% gain in the following three months.

However, combined with news from this week, it looks like the economy is returning to the “normal” that concerned so many investors a year ago.

It can be difficult to remember now, but the economy was in trouble before the pandemic shutdowns occurred.

Data confirms the reasons behind that trouble haven’t been resolved.

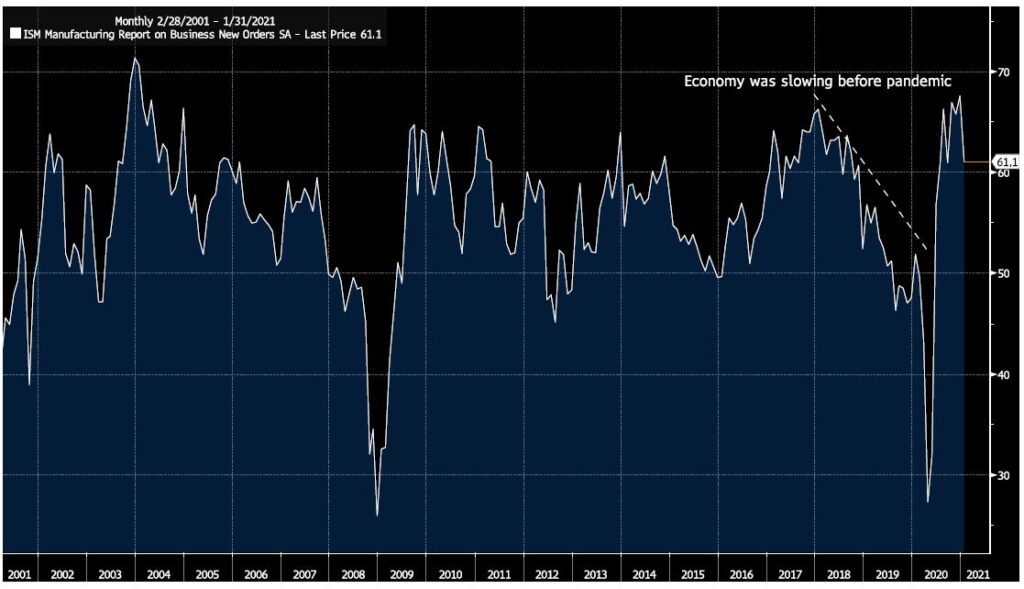

The ISM manufacturing index provided the first insight into the level of economic activity in 2021. The report indicated momentum in the factory sector is slowing.

The chart below shows the new orders index, a forward-looking component of the manufacturing index. The index fell 9.5% from December.

New Manufacturing Orders Are Slowing

Source: Bloomberg.

The Economy Is Weaker Than Investors Think

New orders are the first step in the manufacturing process. When orders rise, manufacturers increase inventories. Large and sustained increases in orders lead to expansions of factories and new jobs. Declines in new orders carry negative implications for the economy.

The dashed line in the chart shows the two-year downtrend in new orders that was in place before the economy shut down early last year.

The rebound that accompanied reopening is likely over. The trend is now down, and new orders are likely to fall to levels seen in early 2020.

This is especially likely since the ISM report showed significant problems exist in the economy.

Manufacturers in several industries cited labor shortages as a problem. Combined with high unemployment, this means there is a mismatch between what the economy needs (skilled workers) and the unemployed workers (unskilled workers).

Overall, the economy looks weaker than what investors are pricing into the stock market.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.