Eight out of 10 adults in the U.S. are in debt.

The average debt, excluding mortgages, was $38,000 in 2021.

As the chart above shows, Americans used an average of 10% of our disposable income to pay off debt from 2012 to 2020.

That dropped to 8% in the first quarter of 2021.

Now the downward trend is reversing.

By the end of 2021, Americans used 9.34% of our disposable income to pay debt … and I think that will grow in 2022 with soaring inflation and rising interest rates.

Today’s Power Stock is Encore Capital Group Inc. (Nasdaq: ECPG).

Encore Capital purchases defaulted debt from businesses at deep discounts and manages it by working with folks to repay those obligations.

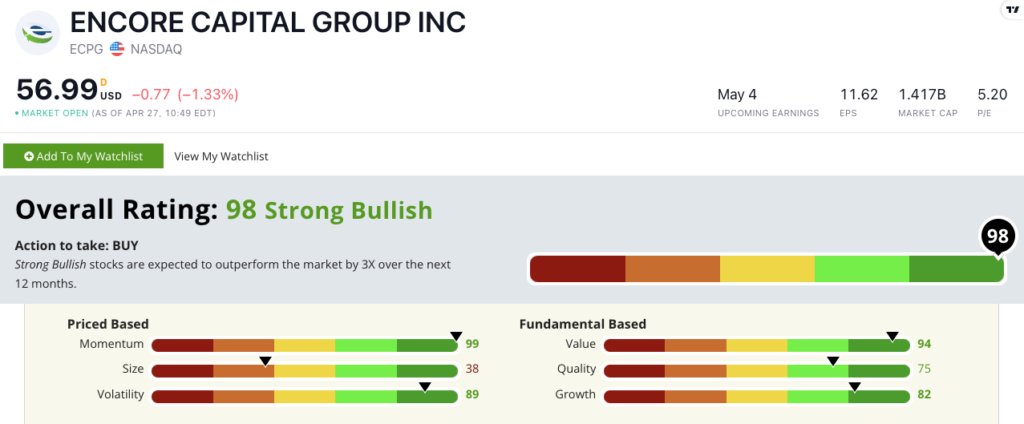

ECPG scores a “Strong Bullish” 98 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

ECPG Stock: Terrific Value, Strong Momentum & Low Volatility

Two items stood out to me about ECPG in my research:

- In 2021, the company reported an increase in its net income of 66% to $351 million and grew its earnings-per-share by 69% to $11.26.

- The company has been in business for 25 years and operates in nine countries.

ECPG is in the top 6% of all stocks we rate on our value metric — scoring a 94!

It trades at a desirable price-to-earnings ratio of 5.14, compared to the specialty finance sector average of 13.1.

The company’s price-to-book value ratio is a reasonable 1.46. Its industry peer average is 2.2, which tells us that ECPG is a better value than its cousins.

Its increase in net income and earnings-per-share in 2021 demonstrate that ECPG is an excellent growth stock.

In terms of quality, ECPG’s gross margin is 74.25% — better than the industry average of 62.8%.

The company’s double-digit returns on equity and investment earn it a 75 on our quality metric.

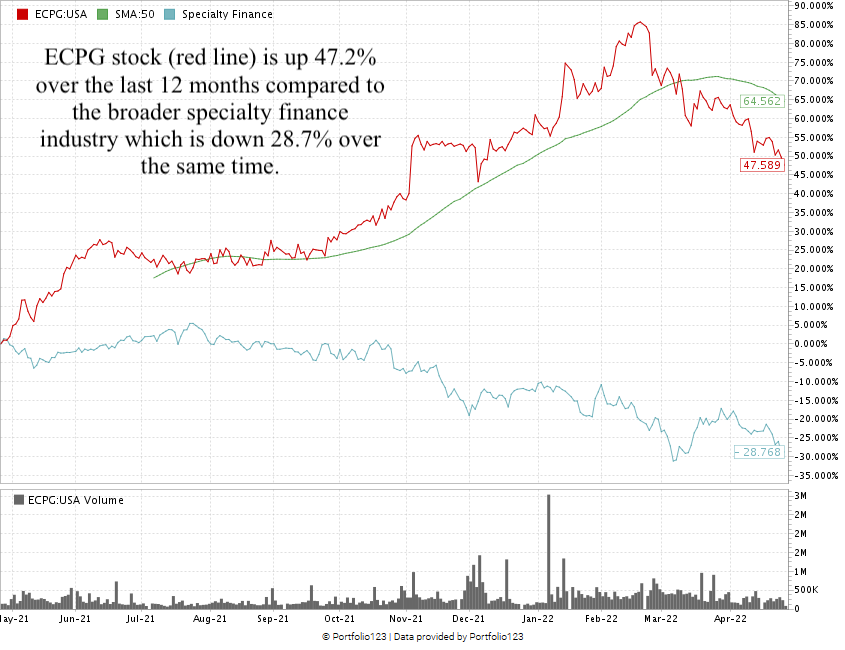

ECPG showed strong momentum into March 2022. You can see in the chart above that it blasted up 85% from this time last year.

Despite headwinds against the broader market, the stock is up 47.2% over the last 12 months and crushes the specialty finance sector, which is down 28.7%.

Encore Capital Group stock scores a 98 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Rating in the green on five of our Stock Power Ratings system’s six metrics, ECPG is an awesome value and growth stock for your portfolio.

Stay tuned: No. 1 Consulting Firm

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a top firm that consults on energy, the environment and engineering.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got questions or a request for my team and me? You can reach us anytime at Feedback@MoneyandMarkets.com!