The Pacific Ocean covers a massive 63.8 million square miles.

The Atlantic Ocean makes up another 41.1 million square miles.

That’s a lot of ocean to cover.

Today, the most efficient way to transport goods across our vast oceans is by ship:

In 2020, the market size of global shipping containers was $6.4 billion.

Grand View Research projects the size of that market topping $15.9 billion by 2028 — a 148.4% jump in just eight years.

And today’s Power Stock is set to benefit from that growth.

Eagle Bulk Shipping Inc. (Nasdaq: EGLE) transports important commodities such as coal, iron ore and grain around the world.

Connecticut-based EGLE owns a fleet of Ultramax and Supramax container ships used to transport dry goods across the Atlantic and Pacific oceans.

Fun fact: Ultramax and Supramax ships are considered medium-sized and can carry between 48,000 deadweight tons and 60,000 deadweight tons of cargo.

EGLE stock scores a “Strong Bullish” 98 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

EGLE Stock: Top-Tier Fundamentals + Strong Momentum

Eagle Bulk Shipping turned in a strong third quarter, leading to an outstanding year.

Highlights include:

- Revenue for 2022 is $568.5 million — 7% higher than the revenue generated in all of 2021!

- Its one-year annual sales growth rate is 116.1% and its earnings-per-share growth rate is 446.6%.

As you can see from those numbers, EGLE is a terrific growth stock, scoring an 83 on that factor in our Stock Power Ratings system.

It really excels on value — where it scores a 99.

EGLE’s price-to-earnings ratio is almost three times lower than its industry average.

Its price-to-cash flow is 2.2 while the cargo transportation industry average is 5.3.

This tells us EGLE is undervalued as a stock compared to its shipping competition.

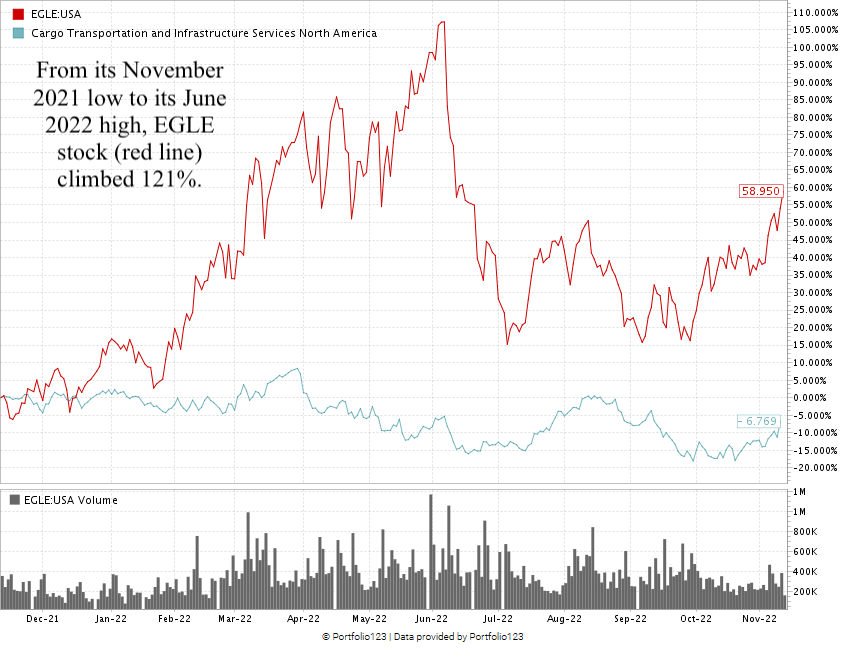

Over the last 12 months, EGLE is up 58.9%.

You can see EGLE’s 121% spike from its November 2021 low to its June 2022 high.

Broader market headwinds pared those gains back, but the stock has climbed 36.7% since September.

Eagle Bulk Shipping Inc. stock scores a 98 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Shipping dry goods across the ocean is best done with ships.

Eagle Bulk has the right fleet of ships for the job.

I’m confident that EGLE is a strong contender for your portfolio.

Bonus: EGLE’s 13.3% forward dividend yield pays shareholders an impressive $7.20 per share per year to own the stock.

Stay Tuned: ”Strong Bullish” Furniture Co. Boasts Strong Online Sales

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a furniture company that is capitalizing on e-commerce growth.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets