[UPDATE] — We have a much better idea now of what 2021 will look like than we did when I first wrote the article below, on August 22, 2020.

In August, I advised: “A Joe Biden win would likely mean higher taxes for tech companies, particularly if the Democrats also take the Senate.”

Well, two Senate seats in Georgia are awaiting a runoff election on January 5 — and control of the Senate comes down to those two races.

But I don’t want to spend too much time focusing on red or blue. As I’ve said, the color we should be most concerned about is green — and how we can best position our portfolios ahead of the change in administration in January.

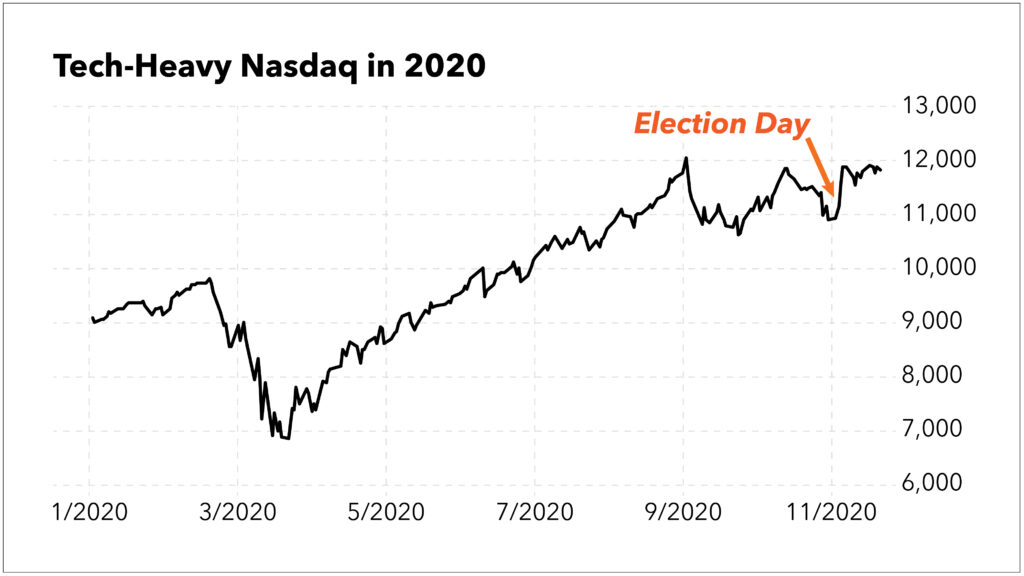

Stocks in the tech-heavy Nasdaq index dipped a bit in the week after the election. But as you can see in the chart below, tech is nowhere near its March lows:

So, should you take your gains and sell all of your FAANG stocks before Biden’s inauguration?

Not quite.

Tech has had a fantastic run, and many of these names will probably go much higher before all is said and done.

However, given the risk of regulation that I outlined below, it might make sense to trim back your positions. Consider rebalancing your portfolio, particularly if it’s especially tech-heavy after this year’s run.

Have a great Thanksgiving!

—Charles Sizemore

[Originally posted on August 22, 2020:]

I mentioned earlier this week that, if history were any guide, the man in the White House come Inauguration Day won’t matter nearly as much for the stock market as you might think.

Going back to 1926, the S&P 500’s returns have been identical under Republican dominance and Democratic dominance.

Results were a little mixed under a split government. But in all scenarios, stocks had positive returns over time no matter who controlled what branch.

Let’s dig a little deeper and look at what would happen within the tech sector.

Tech matters because 27% of the S&P 500 is weighted to tech stocks. And that doesn’t include “techy” retailers like Amazon (NYSE: AMZN), which is classified as a consumer discretionary.

Tech stocks have dominated since 2009. And they’ve been insulated from the effects of the COVID-19 pandemic, making them even more potent in 2020.

So, which candidate is better for the tech sector?

Tax Policy Impact on the Tech Sector

President Donald Trump’s corporate tax reforms were a windfall for American tech companies. The Tax Cut and Jobs Act of 2017 lowered the corporate tax rate from 35% to 21%.

But the far bigger deal was tax amnesty. It allowed American companies to pay a modest 15.5% tax rate on massive piles of untaxed cash overseas as they brought it back home.

A second Trump term would mean more of the same. The tax cuts won’t expire until 2025.

A Joe Biden win would likely mean higher taxes for tech companies, particularly if the Democrats also take the Senate.

Biden has also proposed eliminating loopholes that allow U.S. companies to stash cash from foreign profits offshore.

So, with respect to tax policy, a Trump win would be a boon for Big Tech.

Tech Sector Regulation: Look at California

Joe Biden and his running mate Kamala Harris are by no means anti-tech crusaders.

But Massachusetts Senator Elizabeth Warren — who has been floated as a potential cabinet secretary — certainly is.

Warren’s belief is firm: She believes that the largest tech and social media companies are effective monopolies that should be broken up or heavily regulated.

Now, I don’t want to get political here.

I don’t know how successful a government antitrust action against Facebook or Google would be. The last major antitrust action was against Microsoft. It ended up being a lot of sound and fury without action.

But if one party will be more aggressive in attempting to regulate Big Tech, it’s the Democrats.

Developments in California are a case in point.

The Golden State has required Uber and Lyft to classify its drivers as employees rather than independent contractors (something the ride-hailing firms are fighting in court).

California is also trying to blow a hole in Facebook’s model with a new consumer privacy law that could hurt Facebook’s advertising business.

There haven’t been major calls for similar moves at the national level … yet. But this is a real risk for Big Tech.

President Trump likes to bash tech companies — on tech company Twitter’s platform, nonetheless. But he’s shown no inclination to take action against them.

So, a Trump win would likely push any disruptive regulation at least another four years into the future. That’s a win for tech.

The Outrage Factor

Big Tech and President Trump have something of a love-hate relationship. While they publicly clash, it seems they need each other.

Trump uses Twitter and Facebook to communicate with his base. And the controversy around his tweets keeps both friend and foe engaged and clicking.

In the social media business model, eyeballs are everything. Advertisers are only willing to pay when there are engaged viewers.

This may end up being neutral. Even if he loses the election, President Trump will likely still be active on Twitter, keeping eyeballs glued to screens.

But a Trump win would be at least marginally better for social media engagement.

The Stock Market as a Whole

Looking at the stock market as a whole, it seems a Trump win would be beneficial for the tech sector.

A Biden win could spark the sector rotation away from tech that value investors expect.

Now, the market’s overall health depends on moves made by the Federal Reserve Chairman, not the man in the White House.

But November’s winner may help to determine which sectors take the lead.

Money & Markets contributor Charles Sizemore specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore.