Markets are closed today in observance of the Juneteenth holiday, commemorating the day that slavery ended in America 160 years ago.

Of course, I didn’t want to leave you hanging because my Green Zone Power Rating system doesn’t take a day off. And we’ve got a fresh batch of “New Bulls” to peruse.

Today’s note is brief, but you’ll find the full list below…

Energy Sector Tops the Stock Market’s “New Bulls”

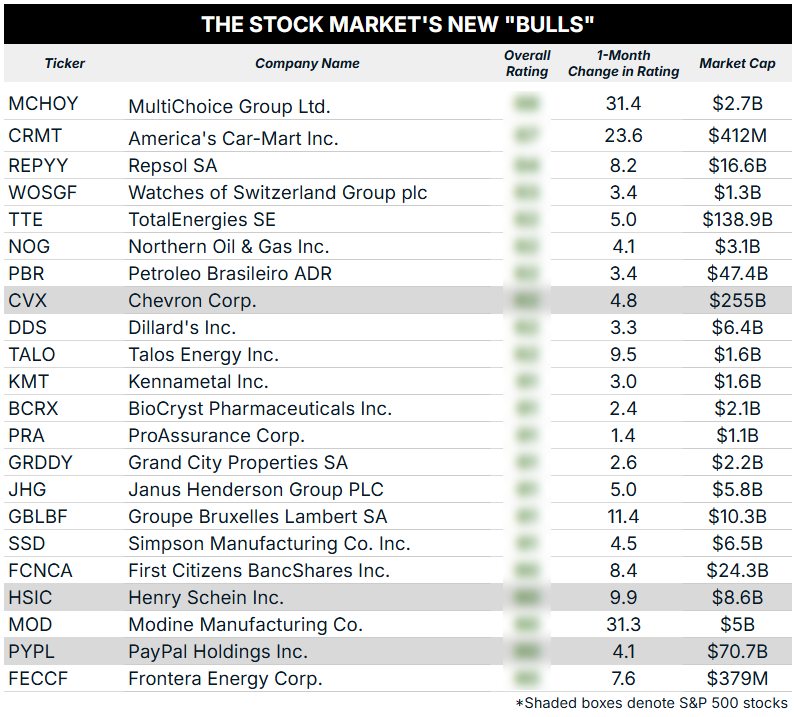

I’ve combined our screen of S&P 500 and non-S&P stocks for you this week.

As always, these “New Bulls” all meet two criteria:

- The stock must currently rate 60 or higher (that is, “Bullish” or “Strong Bullish”) in my Green Zone Power Rating system.

- The stock must have been rated less than 60 for each of the last four weeks.

In short, these stocks were rated “Neutral” or worse … but now are rated “Bullish” or better:

Not quite as long as last week’s list, but 22 stocks is nothing to balk at! (Note: If you want to view the full ratings for any of the stocks above, click here to see how you can gain full access to my system. It’s one of the perks of my flagship Green Zone Fortunes investing service.)

With the energy sector leading the pack in gains last week, it makes sense that a lot of our new bulls are from that sector in particular. By my count, 7 of the 22 stocks come from that sector.

We also have three stocks on the list (MCHOY, CRMT and MOD) which have gained at least 20 overall ratings points in my system over the last month. This is a massive achievement!

Lastly, I’ll note that once again we have 19 (!) stocks outside the S&P 500 that gained “Bullish” status in my Green Zone Power Rating system and only three stocks from the large-cap index.

There’s nothing wrong with just riding the index to higher highs, but in this example alone, we’re seeing six “bullish” stocks outside the S&P 500 for every one that’s included. Wouldn’t you rather swim in a larger pond while hunting for new stocks to invest in?

That’s a wrap for today’s brief. My right-hand man and chief research analyst, Matt Clark, will be back tomorrow with his latest earnings analysis based on Green Zone Power Ratings.

Enjoy the rest of the day off!

To good profits,

Editor, What My System Says Today