On Friday, we got a reminder of how markets so often react to geopolitical conflict.

While most sectors sold off as Israel launched a missile strike against Iran, the energy sector surged as oil prices spiked higher.

It wasn’t long before Iran responded with its own missile attack, which in turn instilled fears of a more prolonged conflict.

All told, it was otherwise a fairly uneventful week … until it wasn’t.

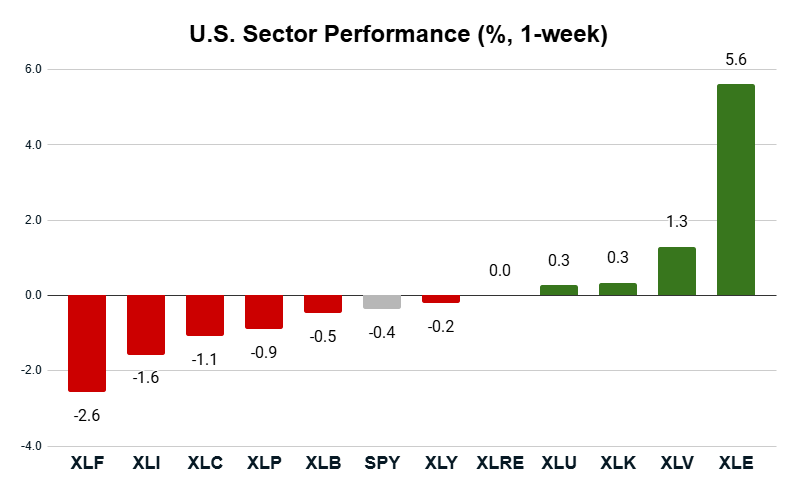

You can see below how, by Friday’s close, the energy sector was the only sector with meaningful gains – a full six percentage points better than the S&P 500’s marginal loss of 0.4%:

Key Insights:

- The S&P 500 (SPY) closed the week -0.4% lower.

- 4 of 11 sectors showed a positive gain for the week.

- Five sectors underperformed the broader S&P 500.

- The energy sector (XLE) led the market with a 5.6% gain.

- Financials (XLF) lagged the rest with a 2.6% loss.

Despite the fearful close to last week, stocks are up nearly across the board this morning.

This can be interpreted as investors expecting the conflict to be fairly “contained,” though Friday’s sell-off was a reminder that this is a very reactionary market — now, not just to tariff announcements but also to moves of aggression in the Middle East.

That’s why a tool like my Green Zone Power Rating system can help you cut through the noise to see which stocks are best poised to benefit when volatility ramps up, and which are more likely to be damaged by it.

Now, let’s see how notable stocks within last week’s best- and worst-performing sectors are looking…

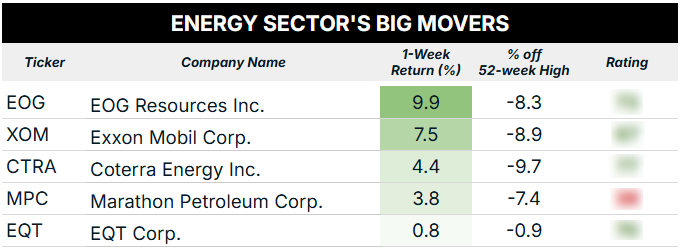

Energy Sector Top Performers

After screening for all S&P 500 energy sector stocks that closed last week within 10% of their 52-week highs, you can see the top performers from last week in the table below:

I’ll first point out that this list includes two oil giants: Exxon Mobil Corp. (XOM) and Marathon Petroleum Corp. (MPC).

While both stocks posted solid gains for the week, XOM is “Bullish” according to Green Zone Power Ratings and MPC is currently “Bearish.”

It all comes down to fundamentals…

XOM has incredible fundamental factor ratings (Value, Quality and Growth) right now. MPC’s ratings on these factors aren’t bad, but XOM has a clear edge, especially on value.

To look up the full ratings of these stocks for yourself — as well as the various energy sector stocks in my Green Zone Fortunes model portfolio — click here for more information.

A pat on our backs: My Green Zone Fortunes portfolio holds nine energy-sector stocks; all of them were up last week, and five beat the broader sector’s 5.4% return.

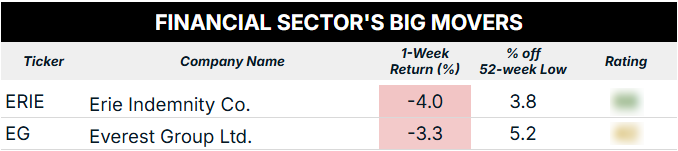

Financial Sector Fallout

The financial sector lagged the rest of the market last week. Here’s what my screen of the weakest financial sector stocks revealed:

We’ve got a really short list this week, and that’s in part because the vast majority of S&P 500 stocks in the financial sector are not trading within 10% of their 52-week lows. Basically, we have a lot of financial stocks treading water right now.

Looking at Erie Indemnity Co. (ERIE), I can note a market-moving event that might’ve sent a wave of selling through this otherwise “Bullish” stock in Green Zone Power Ratings.

The company just announced an “information security event” that caused a prolonged network outage on June 7. The outage continued into last week, and Erie is now working with its cybersecurity team and local law enforcement to investigate the issue.

While this is a significant issue, it seems like the company is on top of resolving the issue. With “Bullish” standing in Green Zone Power Ratings, last week’s sell-off may present a buying opportunity for investors looking to add a financial stock to their portfolio.

ERIE, in particular, boasts strong ratings on Quality and Growth. That’s generally a good sign for a stock’s future.

To good profits,

Editor, What My System Says Today