Good morning!

We’re back in action after the long holiday weekend, so let’s take a closer look at last week’s sector performance to see how things stacked up. As always:

- I’ll show you which sectors led the market higher…

- Offer a “Top 10” list of strong stocks in the top-performing sector, with a simple momentum screen, and…

- Offer a list of 10 “worst” stocks in a lagging sector, which we recommend you avoid.

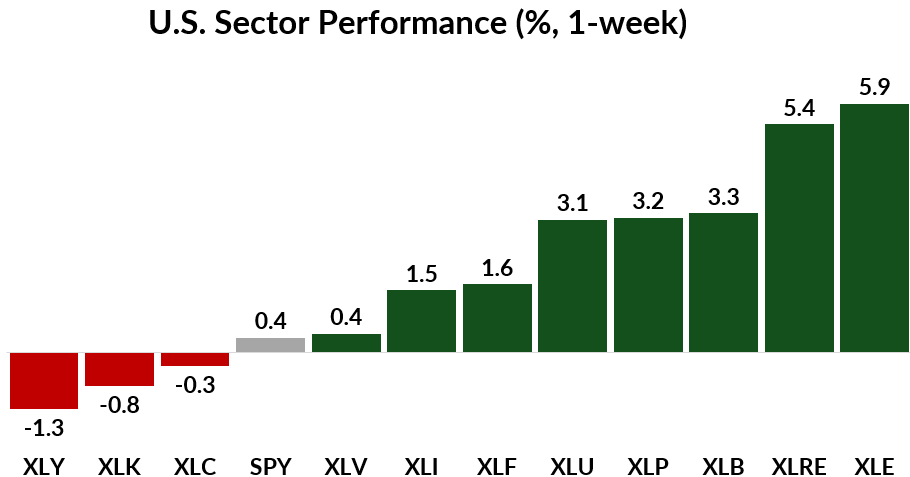

Here’s how the major U.S. stock sectors fared during last week’s holiday-shortened trading week:

Key Insights:

- The S&P 500 (SPY) closed the week 0.4% higher.

- 8 out of 11 sectors showed a positive gain for the week.

- Only three sectors underperformed the broader S&P 500.

- The energy sector (XLE) rallied the strongest, with a 5.9% gain.

- Consumer discretionary (XLY) lagged the market by the greatest margin (-1.3%).

Now, let’s take a closer look at the energy sector’s top-performing stocks through the lens of a simple momentum screen…

The Energy Sector Beat the Rest

The energy sector just beat out real estate for the best performance last week. It closed the week 5.9% higher, crushing the broader S&P 500, which closed the week more or less flat.

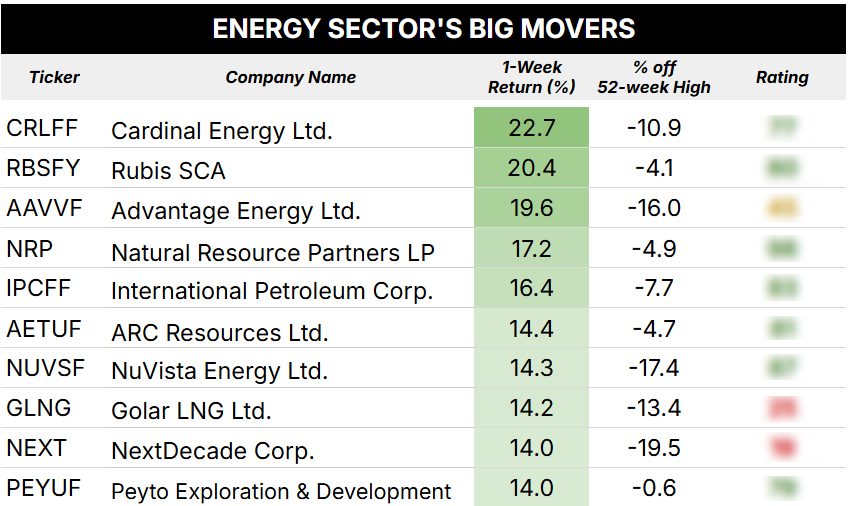

Here’s a list of (mostly small-cap) stocks that even crushed the energy sector’s impressive return:

After screening for all energy sector stocks that closed last week within 20% of their 52-week highs, you can see the top performers from last week in the table above.

All 10 stocks above managed a double-digit gain! My Green Zone Power Rating system confirms that most of these stocks were in the perfect position for outperformance, as seven of them rate as “Bullish” or better.

It’s encouraging to see this sector perk up because it had gotten walloped following President Trump’s “Liberation Day” tariff announcement on April 2. The sector crashed more than 18% in less than a week.

It seems like investors did some bargain hunting last week!

If you’re interested in finding the cheapest energy stocks, I highly encourage you to join me in Green Zone Fortunes. You’ll gain full access to my system so you can see how all of these energy stocks (or one of thousands of other tickers) stack up in the current market. You’ll also see how we’re playing the sector in the Green Zone Fortunes portfolio. Click here to see how you can join.

Now let’s see which stocks pulled the consumer discretionary sector lower last week…

Last Week’s Laggard: Consumer Discretionary

Consumers are in focus right now as everyone tries to assess the state of the economy amid hints of higher inflation and looming tariffs that threaten to stall consumer spending.

The consumer discretionary sector’s 1.3% drop last week is mild compared to the sharper sell-offs we’ve seen recently.

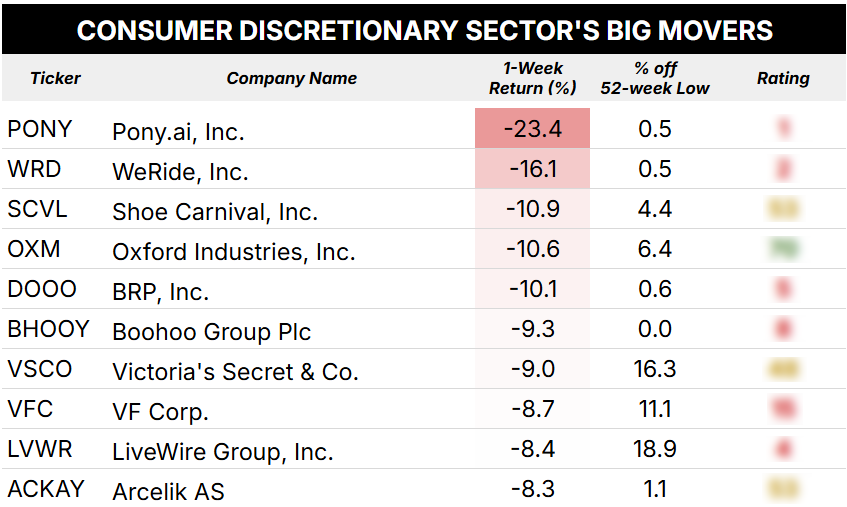

Nonetheless, my “biggest losers” momentum screen confirms that investors were dumping some of the sector’s worst stocks. Have a look:

To construct this table, we ran a screen of all consumer discretionary stocks that closed last week within 20% of their 52-week lows. Of those stocks, you’re seeing the worst performers from last week.

I’ll note that six of the 10 stocks above rate “High-Risk” in my Green Zone Power Rating system. The stocks in this category are expected to vastly underperform the broader market over the next 12 months.

Or, even worse, are putting investors at risk of substantial losses.

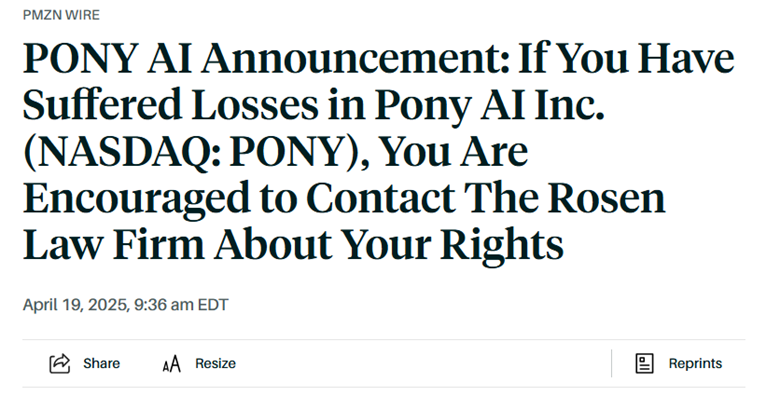

Consider Pony.ai (PONY)…

Pony.ai specializes in autonomous vehicle technology, or at least that’s what it claims to do. Over the weekend, The Rosen Law Firm solicited shareholders who may have been exposed to the company’s potentially illegal actions:

According to the press release: “Rosen Law Firm, a global investor rights law firm, continues to investigate potential securities claims on behalf of shareholders of Pony AI Inc. (NASDAQ: PONY) resulting from allegations that Pony AI may have issued materially misleading business information to the investing public.”

With any new technology, there are going to be companies coming out of the woodwork trying to slice off their piece of the pie. Artificial intelligence (AI) is, of course, no different.

These allegations are NOT a good sign for PONY stock ahead, and we’re seeing that play out as the stock hits new lows seemingly every day. What’s more, its 1 out of 100 overall Green Zone Power Ratings makes it one of the worst-rated stocks in my system today!

Otherwise, we’re also seeing weakness in more traditional discretionary stocks, like Shoe Carnival (SCVL) and Victoria’s Secret & Co. (VSCO).

Lastly, we learned last week that the widely followed University of Michigan’s consumer confidence survey dipped 11% to 50.8, the second-lowest reading on record since 1952.

All told, it’s clear that uncertainty over the trade war’s impact on consumer spending, which makes up roughly 70% of the U.S. economy, is driving bearishness in consumer discretionary stocks.

We advise caution in the names above since they’re all in a lagging sector and trading within 20% of “new lows” territory.

Have a great week!

To good profits,

Editor, What My System Says Today