Tobacco stocks were always an anomaly. Even while smoking rates plummeted across the globe, and governments trying their hardest to tax and regulate cigarettes out of existence, Big Tobacco stocks managed to thrive over the past several decades. And they paid out monster dividends along the way.

Pariah stocks aren’t always bad. Because they are shunned in polite company (pension funds and other institutional investors), they tend to be cheap. Investors that are willing to buck the trend can enjoy solid returns.

I see a similar dynamic today in energy stocks — pipeline stocks in particular. If there were a proverbial boogieman to rival Big Tobacco, it would have to be Big Pipeline. As climate change becomes more of a political issue, there needs to be a villain in the narrative. And all too often a pipeline operator is that villain.

Big Pipeline Companies Are Necessary for Now

Now, let me be clear: I’m wildly bullish on clean energy. This is a theme that Adam O’Dell and I cover on a regular basis in Green Zone Fortunes. It’s the future.

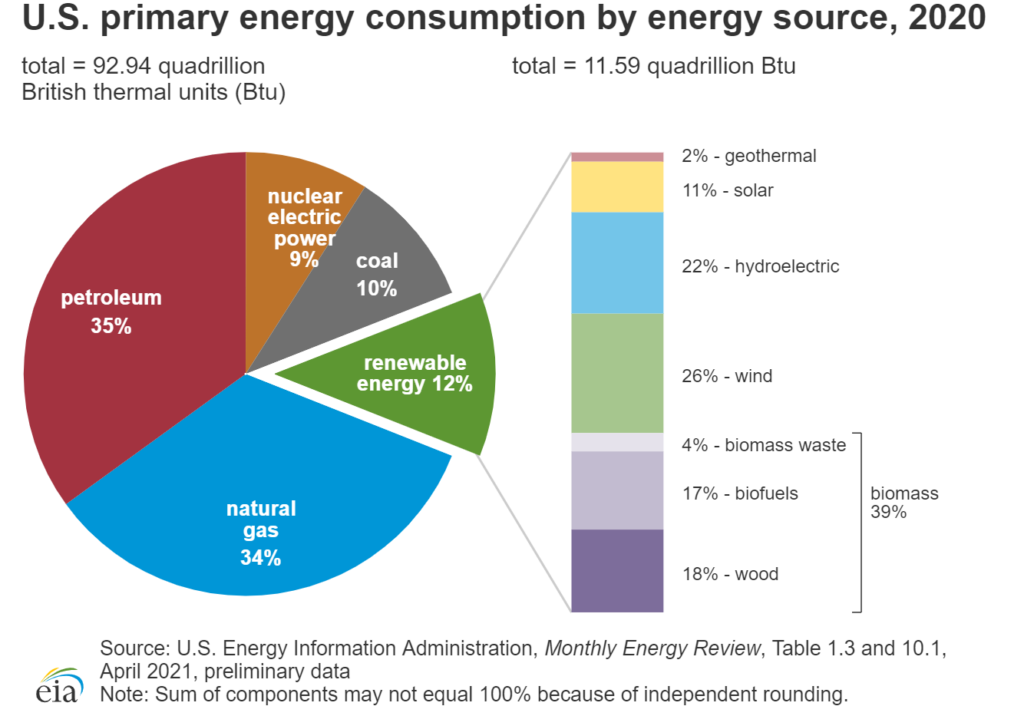

But the reality of the big, bad pipeline operator is far different than the narrative. Pipelines are the safest and most environmentally-friendly way to transport oil and gas … energy sources our economy still needs. You can see that petroleum and natural gas still accounted for more than two-thirds of energy consumption last year, according the U.S. Energy Information Administration.

So, while a greener future of solar and wind energy is on the horizon (and coming a lot sooner than most people realize), we still need fossil fuels to bridge the gap. And we need pipelines to move those resources.

This brings me to Energy Transfer LP (NYSE: ET), one of the largest pipeline operators in the world with more than 90,000 miles of pipelines spread across North America. Approximately 30% of all American crude oil and natural gas passes through Energy Transfer pipelines, a figure that grows almost every year.

The shares yield a fat 6.2%, and I expect the payout to rise over time.

Energy Transfer isn’t without its controversies. (Its Dakota Access pipeline has become something of a cause célèbre for environmental groups and is a site of regular protests.) But the company has survived countless legal challenges and continues to deliver the goods.

Energy Transfer’s Stock Rating

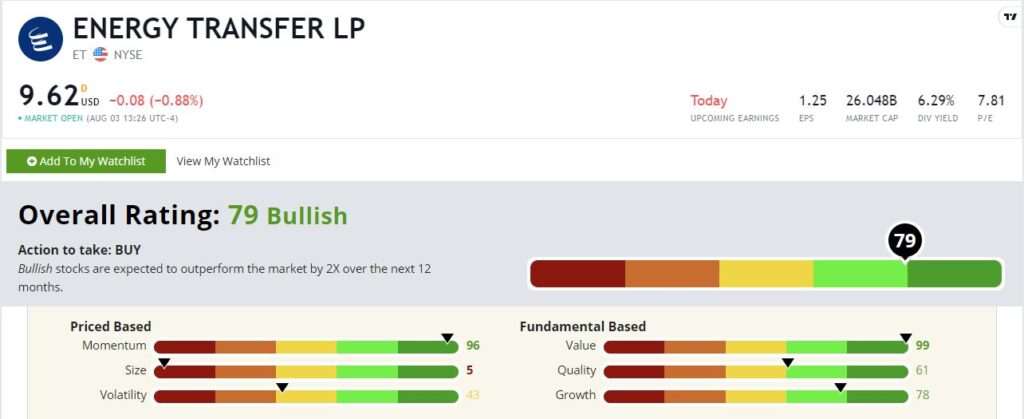

Energy Transfer scores a 79 out of 100 on our Green Zone Ratings system, putting it at the high end of our “Bullish” territory. Anything 61 or higher is rated Bullish on our scale.

Energy Transfer LP’s Green Zone Rating on August 3, 2021.

Let’s dig deeper.

Value — Energy Transfer rates highest on value, scoring a 99. This should come as no surprise given the energy sector’s struggles. Energy prices have been under pressure since 2014, which has sapped investor enthusiasm and kept a lid on prices. These stocks trade a bargain prices today.

Momentum — I’ll admit I was a little surprised to see this, but Energy Transfer also rates in the top 5% on momentum with a rating of 96. ET has struggled to gain traction for almost a decade, but it’s been a different story in 2021. Though down from its highs, the shares are still up by well over 50% this year.

Growth — Here is where it gets fun. Even though ET’s share price has struggled for years, the underlying business was always healthy and growing like a weed. The growth rating is a very robust 78.

Quality — Energy Transfer’s 61 quality rating is nothing to scoff at.. Pipeline operators rely on leverage and have low reported earnings due to high non-cash expenses like depreciation. A rating in the top half of all stocks we track isn’t bad!

Volatility — Energy Transfer rate a little lower on volatility at 43. (A lower score means higher volatility.) That’s not too far below average, and it isn’t a deal-breaker. But ET is a volatile stock with a beta of 2.5.

Size — This is a large stock with a $26 billion market cap. So, it comes as no surprise that it rates low on our size factor with a rating of 5.

Bottom line: Energy Transfer is a little more volatile than many of the income stocks I recommend. But that higher volatility comes with the potential to enjoy fat returns in the years ahead.

Clean energy is making headway, but traditional energy sources will still hold the majority of the market share for years to come. That gives Energy Transfer’s stock plenty of time to grow and pay its investors through dividends.

To safe profits,

Charles Sizemore

Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.