As I write, the world’s superpowers are waging an all-out war for control of a key strategic asset: energy.

Like all wars, we’ve been dragged into this Energy War whether we like it or not. But, unlike any war, it presents nothing but positive outcomes for those who can see it for what it is.

I’m talking about the Energy War – which is quickly shaping up to be the biggest profit opportunity I’ve seen in my life.

On one side stands the old guard, fossil fuels. Titans of the global supply chain and an indispensable part of our daily life.

On the other stands the small, but growing and newly emboldened renewable energy. While its solutions so far account for a small fraction of the world’s energy output, it is growing and now has a major tailwind at its back in the form of government funding.

Who will win? Trick question. At least for the next several decades… the answer is both.

Anyone picking sides and choosing to invest in just one side of this war is missing the big picture. Untold billions of dollars are pouring into both industries simultaneously. At the same time, the demand for any energy, no matter its source, is accelerating.

I believe by 2030, we’ll look back on buying the best companies in both industries as like buying the best tech companies in March 2009.

Today I’ll share why I’m not picking sides in this war, and am instead going “war-profiteering” by investing in both the best fossil fuel AND renewable energy stocks at once.

And finally, I’ll show you a dead-simple way you can position yourself today.

Understanding the Divide

The first step to profiting from the Energy War is an honest look at the global energy picture.

The prevailing narrative is that the world is quickly transitioning from fossil fuels to renewable energy. Solar panels, windmills, geothermal, and hydroelectric power are the future, and the future is now.

I won’t deny that’s an admirable goal. Who doesn’t want a world without all the environmental damage that comes with fossil fuels?

But that’s exactly the thing. Right now, this is a goal that’s being discussed as if we’ve already achieved it. The reality is, we’re quite far off.

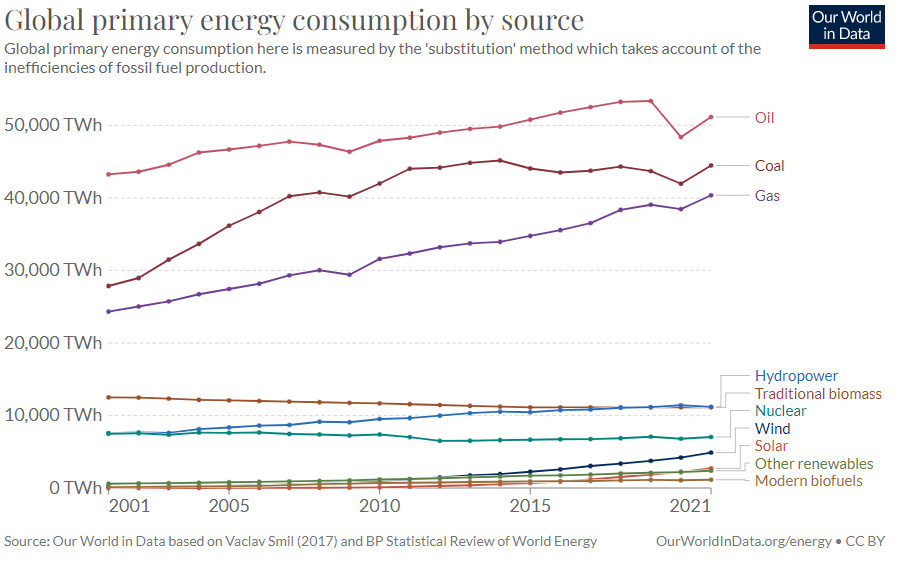

Just take this chart from Our World in Data, which shows that from 2000 to 2021, the energy consumption of oil, coal, and natural gas have been on a steady rise.

Meanwhile, hydropower, wind, solar, and other renewables haven’t even come close to catching up.

That’s despite trillions of dollars spent on renewable energy technologies over the same timeframe.

This tells me it will take MUCH longer to unwind our dependence on fossil fuel than most anticipate.

The current stated goal of the United States is to be carbon neutral by 2050. That’s 27 years from now. Looking at the meager progress renewables have made since 2001, something doesn’t quite add up here.

However, that hasn’t stopped the U.S. from making a strong commitment to renewable energy.

Last year, Joe Biden invoked the Defense Production Act to devote hundreds of billions of dollars to “accelerate domestic production of clean energy technologies, including solar panel parts.”

The government is getting behind renewable energy in such a big way, Biden used a presidential power typically reserved for emergencies.

Renewable energy stocks got a big boost from this, breaking away from the bear market and managing to hold onto their post-pandemic gains.

Renewables have a long, uphill battle to fight in the Energy War if they’re going to unseat the entrenched king that is fossil fuels.

The fact that fossil fuels power a vast majority of the global economy is already a strong position to be in.

But if we take a step back even further, and just look at how intertwined with fossil fuels humanity has become, it becomes clear just how exaggerated the death of this energy source really is.

Let’s think about infrastructure. Right now, the world is built around fossil fuels, full stop. Pipelines cross the continents and oceans, gas stations are on every corner, and the vast majority of all vehicles – land, sea, and air – all require fossil fuels to operate. Electric cars are poised to change that, but again, not anytime soon.

A rapid displacement of this infrastructure alone would be a reckoning not just for fossil fuel companies, but everyone that participates in modern civilization.

Even assuming we move to a fully renewable energy economy, we’ll still need oil for things like plastics, solvents, polyurethane, and yes, even to build solar panels and wind turbines.

That means, even in a fully renewable future, fossil fuels and oil in particular will be a part of the world economy.

Regardless, I don’t assume we’ll see that day anytime in the next several decades.

Instead, I’m following the money. And the money right now is pointing to the best-in-class fossil fuel AND renewable energy stocks in the market.

This dynamic is where we need to focus our attention. It doesn’t matter if we’re in a genuine rapid renewable energy transition or not. What matters is the sector is growing and attracting capital at a rapid pace. And so long as that continues, there will be bountiful opportunities in that sector.

And at the same time, as fossil fuels continue to play a big part in the global energy picture, we can invest in that space too and benefit from their dominant position.

Fossil Fuels Are Still King of the Hill

Renewables have a long, uphill battle to fight in the Energy War if they’re going to unseat the entrenched king that is fossil fuels.

The fact that fossil fuels power a vast majority of the global economy is already a strong position to be in.

But if we take a step back even further, and just look at how intertwined with fossil fuels humanity has become, it becomes clear just how exaggerated the death of this energy source really is.

Let’s think about infrastructure. Right now, the world is built around fossil fuels, full stop. Pipelines cross the continents and oceans, gas stations are on every corner, and the vast majority of all vehicles – land, sea, and air – all require fossil fuels to operate. Electric cars are poised to change that, but again, not anytime soon.

A rapid displacement of this infrastructure alone would be a reckoning not just for fossil fuel companies, but everyone that participates in modern civilization.

Even assuming we move to a fully renewable energy economy, we’ll still need oil for things like plastics, solvents, polyurethane, and yes, even to build solar panels and wind turbines.

That means, even in a fully renewable future, fossil fuels and oil in particular will be a part of the world economy.

Regardless, I don’t assume we’ll see that day anytime in the next several decades.

Instead, I’m following the money. And the money right now is pointing to the best-in-class fossil fuel AND renewable energy stocks in the market.

The Stock Power Ratings System on This Mega Trend

Regular readers of Stock Power Daily know how valuable it is to follow the Stock Power Ratings system.

Companies that rank 80 or above on this rating system have traditionally outperformed the stock market for the next 6 months.

So, how do fossil fuel and renewable energy stocks stack up?

Let’s take a look through the two largest indexes in the market that represent each — the SPDR S&P Oil & Gas Exploration & Production ETF (NYSE: XOP) and the iShares Global Clean Energy ETF (Nasdaq: ICLN).

Of the 60 holdings in XOP, 36 of them rate a 70 and above — putting them in the Bullish or Strong Bullish category. These stocks are in a good position to outperform the broader market over the coming six months.

On the flipside, only 6 of the stocks in XOP rate 39 or below — which puts them in the Bearish camp. 16 are rated Neutral (between 40 and 69). And the average of all the stock in the exchange-traded fund is a Bullish 71.

Overall, this is a very strong position for the oil & gas sector to be in. Now, let’s look at ICLN.

ICLN contains a lot of foreign holdings — which our Stock Power Ratings system filters out. Once we do, what remains are 29 total names that pass our requirements.

Of those names, just three are in the Bullish category. Seven are rated Neutral, and 19 of them are rated Bearish.

This disparity doesn’t really surprise me. Renewable energy stocks — like those in ICLN — are relatively new, volatile, and hold loftier valuations than the proven fossil fuel energy stocks in XOP.

This is where the Stock Power Ratings system comes into play, however. I have found and will continue to find great renewable energy plays at attractive valuations for my readers.

What I’ve found most of all, though, is that the stocks directly playing both sides of the Energy Wars stand to gain the most.

One such stock, which I just recommended to my Green Zone Fortunes subscribers, fits this bill perfectly. It’s already a thriving natural gas provider. But it’s smartly building out solar operations simultaneously.

These stocks are difficult to find, but I believe these companies will command the highest growth as the Energy Wars continue.

If you’re interested in playing this trend and want to do it safely, I would recommend looking first at the oil companies. As I showed earlier, oil companies are incredibly entrenched in the global energy picture and will be for some time to come.

Any oil stock that ranks highly on the Stock Power Ratings system, which you can use for free at MoneyandMarkets.com, is one worth considering.

And if you’d like even more info on the strong trend in fossil fuel stocks, check out my recent research presentation right here.

It details what I’m calling the Super Oil Bull — a long-term bull market in energy stocks that’s just getting started, and few investors are prepared for.

That presentation shares the opportunity to sign on with my small-cap research advisory, 10X Stocks, which targets stocks across multiple industries with the real potential to multiply your investment by 10 times or more.

My recent report, Energy Fortunes Uncovered, details four stocks best positioned to profit as the Energy War plays out this decade. (One of which is up over 15% today alone… and not just because of the OPEC news.)

You can learn all about that report right here.

Regards,

Adam O’Dell

Chief Investment Strategist, Money & Markets