Our chief investment strategist Adam O’Dell is bullish on clean energy.

Here’s an excerpt from his most recent Ask Adam Anything video where he tackles a reader’s question concerning a popular clean energy stock.

And if you’d like to check out the video in full, go here. Along with his insights on clean energy, he breaks down a smaller financial stock in this week’s episode.

Matt Clark:

This question comes from YouTube, and it says: “I would love to know what you guys think about Enphase Energy long-term.”

Adam O’Dell:

Sure. So Enphase Energy Inc. (Nasdaq: ENPH) — it’s a California-based company that provides rental and commercial solar power. There isn’t much alpha — excess returns earned on an investment above the benchmark return — in crowded trades. I would characterize Enphase Energy as a very looked-at, popular, crowded trade.

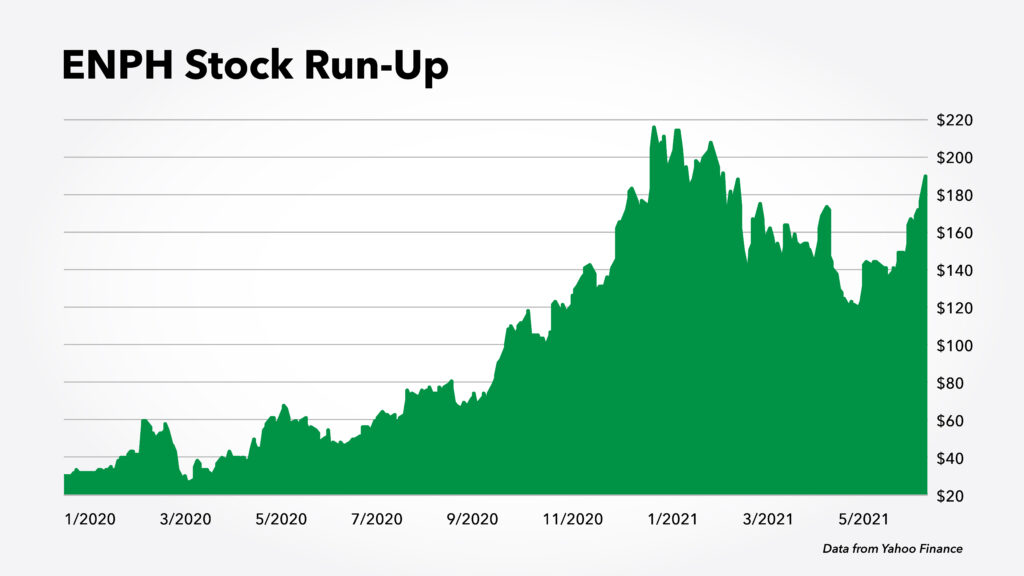

Enphase Energy stock trades at about $170 per share. At the very bottom of the March 2020 crash, it traded for just about $20, maybe $1 or $2 above.

So we’re talking about a 750% gain over the last 15 months or so. The stock is certainly a run-up, and this is the problem with Enphase: its valuations.

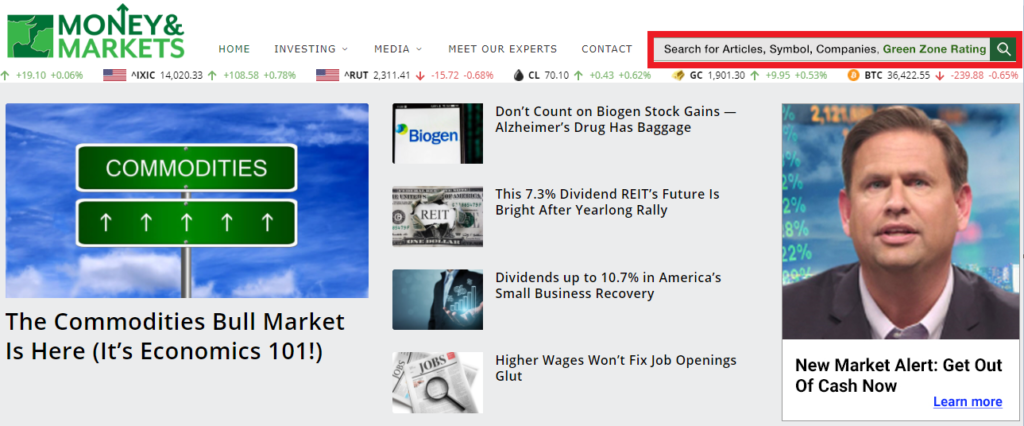

If you head to our homepage and go to the top right-hand corner, you’ll see the Green Zone Ratings dialog box.

Type in “ENPH” and hit “Enter,” and you’ll see the six-factor Green Zone Ratings for Enphase.

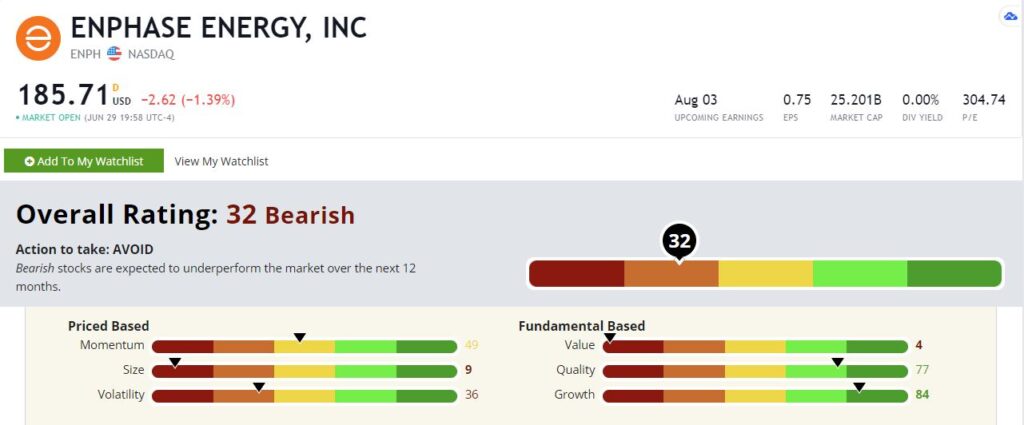

Enphase Energy Stock Rating

You’ll see it rates overall 32 out of 100, which is a bit below average.

We typically look for 80 or above unless there’s a special situation.

Enphase Energy’s Green Zone Rating on June 30, 2021.

Where does Enphase Energy stock rate poorly? It rates poorly on momentum because of a recent pullback.

It rates poorly on volatility because its average range and its beta are very high.

It also rates poorly on size at 9 out of 100. That’s because it has a rather large market cap of $23 billion.

But its worst rating is on value: It gets a value rating of 4 out of 100, which means that out of all the stocks we rate, 96% of them you can buy with a better valuation than Enphase. And that’s really the concern I have with buying Enphase at this price.

The price you pay does matter, specifically over the long run, which is what this user asked about.

I think the company — what they’re doing — is great. Enphase allows commercial companies and residential customers alike to bank solar power, to get off the grid or to have as a hybrid model. I think that the company’s technology and their service model and everything is solid.

There is a difference between a good company and a good stock, and Enphase Energy stock at this price is not good.

Just to give you some of the metrics:

- Its price-to-earnings ratio is 275. It’s like a nosebleed.

- Its price-to-cash flow multiple is 213.

- Its price-to-book is 34.

- Its price-to-sales is 28.

So all of these metrics are many, many multiples higher than the industry average. You have to realize that, yes, the company’s profitable — it has a net margin of 11%, which isn’t all that bad.

But at the same time, the price you’re paying today is really going to hamper the returns you can earn over the next one, three, five or 10 years.

Adam’s Takeaway

So this is one of those stocks that, if you like the company, wait for a much, much sharper pullback or wait for a much, much stronger increase in earnings. You really want to see that P/E ratio come down to much, much more reasonable levels.

We are, in Green Zone Fortunes, very, very bullish on the clean energy space. So that’s why I have a hard time saying: “Don’t go out and buy Enphase.” But it’s just not a good stock, in my opinion, based on valuation.

If you are interested in clean energy, we have a number of plays already in the portfolio that are targeted toward the clean energy, renewable energy and infrastructure space. And we have about three or four recommendations coming down the pike in the next six to eight weeks that we will be rolling out to the newsletter.

So, if you’re interested in good research on clean energy plays, certainly sign up for Green Zone Fortunes. It’s a nominal annual cost ($47), and you get a lot of research from myself, co-editor Charles Sizemore, and behind the scenes, and in front of the video, Matt does a ton of great work for us.

Just to give you an idea: In our monthly newsletter, we just recommended an infrastructure play.

We believe that the power grid is going to be revamped in a demonstrable, lucrative way to bring in all of these renewable sources, like solar and wind.

And we found an established company with a $12.6-billion-dollar market cap that is the industry leader in doing all of the work on these types of utility operations. It rates 89 out of 100 on our Green Zone Ratings model.

It’s a well-rounded stock, whether you look at the stock’s momentum or volatility or whether you look at the company’s fundamentals, like value, quality and growth.

This stock trades with a P/E ratio of just 26, so, maybe one-ninth of the valuation of Enphase, and it trades with a price-to-book of just under three times. So, again, a much, much better valuation. That’s what you want to look for.

Thank you for the analysis, Adam!

Be sure to check out Ask Adam Anything every week for more thoughtful insights from our chief investment strategist. You can catch the rest of this episode below:

Until next time!

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. He is a certified Capital Markets and Securities Analyst with the Corporate Finance Institute. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.