If you’re an investor looking for a great opportunity to get involved with clean energy, then you might have looked at Enphase Energy Inc. (Nasdaq: ENPH). But how can you know if Enphase stock is one to buy?

This innovative, up-and-coming company has made waves ever since it first debuted in 2006. Let’s take a look at its history and see how it’s set to perform from here.

The History of Enphase Energy

Enphase Energy began as a small startup in 2006 with the goal of making solar energy more accessible for home use.

It rose to prominence by developing its own microinverter system. This allowed Enphase to create complete solar systems that were easy to install and maintain. Its innovative tech was revolutionary at the time and made Enphase one of the leading companies in the renewable energy industry.

In 2011, it released its first generation of “smart grid” technology. Homeowners could now monitor their electricity usage and make real-time adjustments accordingly.

Since then, Enphase has continued to innovate and expand its product offerings, creating everything from solar panels to batteries and other energy storage devices.

Enphase Energy’s Stock

Enphase Energy has made waves in the clean energy industry for over a decade. It’s known for innovative and environmentally-friendly products that have continued to grow in popularity in recent years.

Enphase stock has done well in 2022. It’s up 44% at the time of this report. But there is potential for it to go even higher in the future as it continues expanding into new markets.

If you’re looking for a way to invest om clean energy, then Enphase Energy stock could be a wise decision.

The Outlook for 2023

As we enter 2023, Enphase Energy is still going strong.

It recently announced plans to expand into new markets such as Europe, Asia, South America and Australia as part of an ambitious global expansion plan. Additionally, it’s developing new technologies that will create high-quality products at competitive prices while still being environmentally conscious.

With all these positive developments on the horizon, Enphase stock could be a great way for investors to get involved with clean energy solutions before they become mainstream.

Enphase Stock Power Ratings

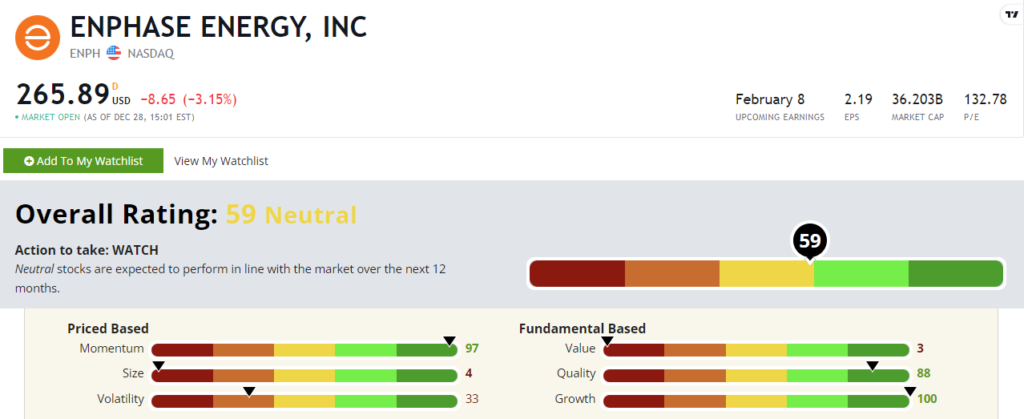

To see how Enphase Energy stock is set to perform over the next 12 months, let’s look at its Stock Power Ratings.

ENPH rates a “Neutral” 59 in our proprietary system. That means its set to perform in line with the rest of the market over the next 12 months.

It has fantastic growth (100) and quality (88) factor ratings. That means its growing its pool of available cash and spending it well.

Investors have caught on to ENPH and are bidding its price up in a big way. Its 97 momentum rating is fantastic after it gained more than 40% over the past year.

But now it rates a 3 out of 100 on value after its recent gains. That means that the stock is overvalued compared to stocks that rate similarly on other factors.

Would you buy Enphase stock right now? Let us know in the comments below!

And if you’re looking for recommendations within the renewable energy mega trend, Adam O’Dell’s “Infinite Energy” presentation highlights the largest untapped energy source in the world.

This source is worth trillions of dollars and makes massive oil fields look tiny in comparison.

We’re still in the early stages, but this breakthrough is set to turn the global energy market on its head.

Make sure to watch his presentation for more information about this revolutionary new renewable tech (and the one company behind it all).