The energy sector has enjoyed a resurgence in 2021, but it’s hard to ignore the past.

Just last year, the price of crude oil went negative. The longer-term picture for energy has been bleak since the end of 2014. Most investors have abandoned the sector.

It’s not hyperbole to call energy stocks the most hated assets in America.

That’s fine by me.

We’re a lot more likely to find better payouts in an unpopular corner of the market, and energy infrastructure boasts some of the highest yields around.

One, in particular, stands out as a fantastic bargain: blue-chip pipeline operator Enterprise Products Partners L.P. (NYSE: EPD).

Huge Energy Yields

Enterprise Products is a master limited partnership (MLP), which means that it’s legally structured as a limited partnership rather than a corporation. This allows it to skip a layer of taxation and frees up more capital for distributions. (MLPs pay “distributions” rather than “dividends.”)

EPD shares yield 8.4% at current prices. On top of that, Enterprise has raised its payout for 23 straight years.

To say Enterprise Products’ footprint is large is an understatement. Moving and storing natural gas and natural gas liquids is the core if its business. It owns and operates 50,000 miles of pipelines and 260 million barrels of storage capacity.. It also operates 19 deep-water docks and an assortment of other energy assets.

Enterprise Products Stock Rates Well

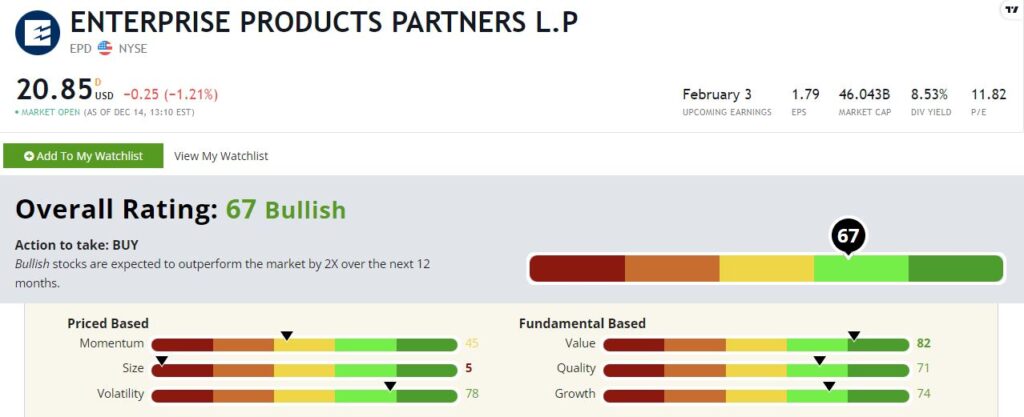

Enterprise Products rates a “Bullish” 67 on Adam O’Dell’s proprietary Green Zone Ratings system. This is despite the unusual accounting that penalizes MLPs. Not too shabby!

Let’s dig into the details.

Value — Enterprise Products rates in the top 20% of 8,000 stocks Adam’s system analyzes on value. Its 82 rating here would be impressive enough by itself. Still, it’s more remarkable when we consider that MLPs like Enterprise tend to report lower earnings due to large non-cash expenses like depreciation.

This is a long way of saying that EPD is actually even cheaper than our score would indicate.

Volatility — It seems like anything involving energy has been volatile in the market over the past eight years. Yet Enterprise Products’ business profile looks more like a bond than a stock. It gets paid under long-term contracts to move natural gas products from point A to point B. That’s it.

Things got a little scary last year when a wave of bankruptcies in the energy patch threatened to blow up the entire midstream energy model. That crisis passed, and Enterprise came out of it stronger than ever. The stock rates a 78 on our volatility factor.

Growth — From looking at Enterprise Products’ stock price over the past decade, you would assume the company was a slow-growth dinosaur. But nothing could be further from the truth. Enterprise Products rates an impressive 74 on our growth factor, as it has quietly built out an energy infrastructure empire over the past quarter-century.

Quality — As with value, MLPs like Enterprise Products are somewhat handicapped on our quality score due to quirky accounting. Larger debt loads are an additional drag. Yet, that hasn’t stopped Enterprise from posting a 71 on our quality factor. EPD scores well across our returns on equity, assets and investment subfactors as well as our cash flow subfactors.

Momentum — I barely remember a time when pipeline stocks had market-beating momentum. It feels like this sector has been under attack since the dawn of time. Yet Enterprise Products sports a momentum score of 45, Which is right around average. Shares have stumbled a little since summer, but they’ve trended higher since the March 2020 crash. That broader uptrend appears to be holding.

Size — Enterprise Products is a large company with a $46 billion market cap. A 5 rating on our size factor isn’t a surprise. That’s OK. In a big, reliable dividend producer, size is an advantage.

Bottom line: The energy sector is enjoying a breath of new life in 2021. After years of disappointing returns, new opportunities within the downtrodden sector are cropping up.

Enterprise Products Partners looks like one of those opportunities.

And to be frank, I don’t know of too many places we can find a safe and growing 8.4% payout.

To safe profits,

Charles Sizemore

Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.