Before the internet, companies used to advertise products to consumers in three main ways: television, radio and newspapers.

In today’s digital world, companies have so many more options.

Businesses need experts to help them navigate the complex new world of advertising.

And because this landscape continues to grow, so have the revenues of those companies who specialize in advertising and marketing tools.

As you can see in the chart below, advertising media owners raked in $248.1 billion in 2020.

By 2027, that revenue is projected to grow 71% to $424.3 billion, according to media investment company GroupM.

Today's Power Stock capitalizes on this trend of more spending on ads.

It’s a company that helps businesses get their message out to the masses. I’m talking about Entravision Communications Corp. (NYSE: EVC).

It rates a “Strong Bullish” 93 out of 100 within our proprietary Stock Power Ratings system!

Not only does EVC provide advertising solutions, but it also owns television and radio stations in multiple states across the U.S.

But this stock stands out for other reasons. Let’s get into why we expect it to beat the broader market by 3X in the next 12 months…

Entravision Stock: Strong Growth + “Strong Bullish” Quality

Entravision Communications had an outstanding third quarter of 2022:

- It reported net revenues of $241 million — a 21% bump from the same period a year ago — and a company record for revenue!

- Its net revenue for the first nine months of 2022 was $659.9 million — up 25% from the same time in 2021!

Those are strong figures.

Toss in a one-year annual sales growth rate of 121% and an earnings-per-share growth rate of 818.1% … it’s easy to see why EVC earns an 87 on our growth factor.

This tells us the company is increasing its profitability from its core operations, which is great for investors.

Now, let’s dive into its stock price movement.

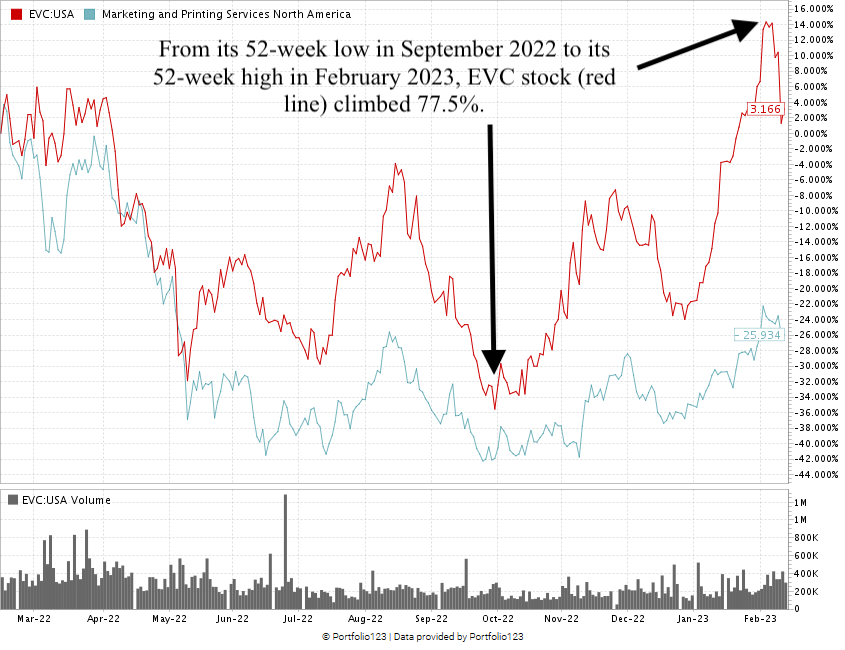

From its recent low in September 2022 to its February 2023 high, EVC raked in a 77.5% gain. You see that jump in the following chart:

Created in February 2023.

Over the last 12 months, Entravision stock has jumped 3.2%. Its marketing industry peers are averaging a 26% decline over the same time.

Entravision Communication stock scores 93 overall on our proprietary Stock Power Ratings system.

That means we're “Strong Bullish” and expect it to beat the broader market by at least 3X in the next 12 months.

Bonus: EVC’s 2.87% forward dividend yield nets investors $0.20 per share per year for every share they own.

There’s a lot of money on the table for companies specializing in advertising services.

Toss in its national reach with television and radio as well as its massive growth and EVC is certainly a marketing stock to consider for your portfolio.

Stay Tuned: A Mid-Cap Aerospace Stock With Promise

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned tomorrow, where I’ll show you details on a “Strong Bullish” stock that works with some of the most in-demand materials for the aerospace industry.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets