Looking for a way to play the renewable energy mega trend? Let’s see if Equinor ASA stock (NYSE: EQNR) fits the bill using our proprietary Stock Power Ratings system.

Equinor is a Norwegian energy company that is leading the way in the energy transition.

With its sights set on becoming a global leader in renewables, it has made great strides in making this goal a reality. Let’s explore what Equinor does and its outlook for 2023.

What Does Equinor Do?

Equinor stands apart from other energy companies because of its commitment to developing renewable sources, while also bringing in profits from its more typical oil and gas developments.

The company’s strategy focuses on transitioning from oil and gas to renewable sources such as wind and solar power.

This strategy has been successful so far. According to Reuters, the company doubled its investment in renewables in 2022, and it has planned around $23 billion in gross investments within green energy between 2021 and 2026.

Equinor also engages in other activities related to oil and gas production.

It operates offshore oil and gas fields around the world, including Norway’s largest offshore field located off the coast of Angola.

The company also produces natural gas and chemicals, operates refineries, owns pipelines and provides services related to energy management.

2023 Outlook for EQNR

Along with more renewable investing, Equinor also plans to expand its current business operations by investing in new technologies that will help reduce emissions from oil and gas production operations.

The company is also looking into new opportunities for collaboration with other businesses that could help accelerate their transition into renewables even further.

With developments in both old and new types of energy, Equinor stock could be a great buy for 2023.

Let’s see how it looks within Stock Power Ratings.

Equinor Stock Power Ratings

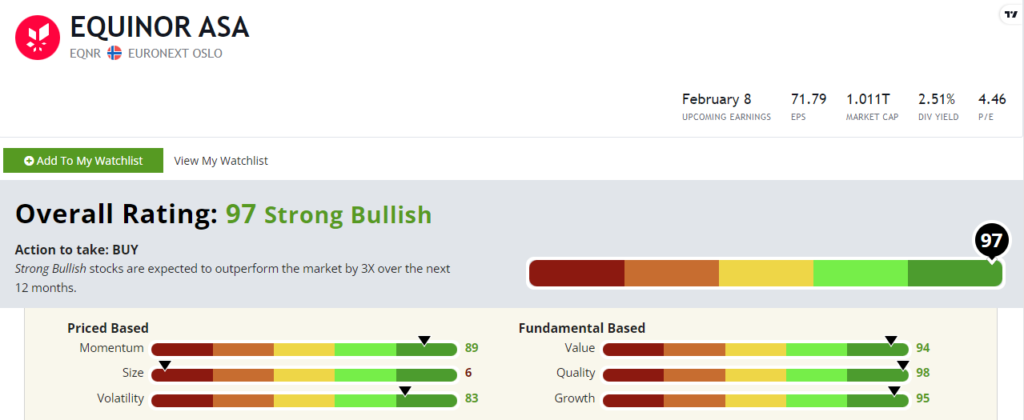

EQNR scores a “Strong Bullish” 97 out of 100 within our proprietary system! That means we expect it to 3X the broader market over the next 12 months.

The only knock against Equinor stock right now is its size. This is a massive company with a market capitalization (current stock price times outstanding shares) of $99.5 billion.

That’s why it scores a 6 out of 100 on the size factor. When looking at two stocks that have similar ratings on the other five factors, a smaller company (i.e. higher size rating) should outperform its larger counterpart since it takes less money to push the stock higher.

But this stock looks great within Stock Power Ratings otherwise. And it’s gained 11% over the last year, while the broader S&P 500 lost 14%.

Bottom line: As one can see from this overview of Equinor’s business and outlook for 2023, the Norwegian-based energy giant is moving full steam ahead toward becoming a global leader in renewables.

We’ll see how 2023 plays out for Equinor stock.

P.S. To see how a tiny Silicon Valley company is using artificial intelligence technology to unleash the largest untapped energy source in the world … and how its early investors could reap the benefits … watch Adam O’Dell’s “Infinite Energy” presentation now.