When it comes to metals, financial headlines focus more on gold and silver, overlooking one of the most widely used metals in the world: copper.

We need copper for computers, lights and televisions.

It’s also critical to solar panels, wind turbines, and electric vehicle engines and batteries.

And with the world forging out of an oil-dominated energy market to more green energy, the demand for copper will grow.

Check out this chart:

From 2010 to 2020, global copper usage jumped by 31%.

The transition to more green energy solutions will continue to push this trend.

Companies with solid foundations in copper mining stand to see increased profits from this increase in demand … and investors who capitalize on the trend will benefit with strong portfolio gains.

Today’s Power Stock is Ero Copper Corp. (NYSE: ERO).

Canada-based Ero explores and develops base metal mines, primarily in Brazil. It produces and sells copper in a region that produces 41% of the world’s supply: Latin America.

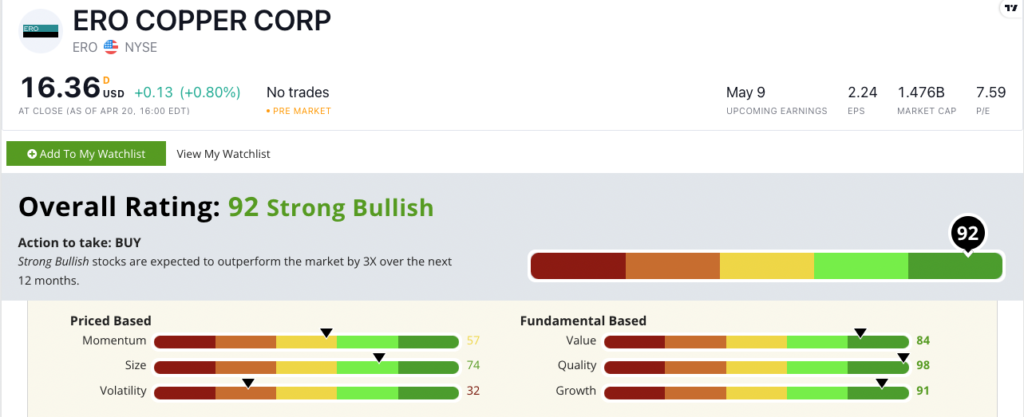

ERO scores a “Strong Bullish” 92 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

ERO Stock: Enormous Growth and Quality Potential in Copper

A couple of things stood out about ERO when I was looking deeper:

- In 2021, the company generated a record $489.9 million in revenues from its mining operation — an increase of 51% from the year before!

- That jump was due to the company surpassing copper mining expectations by 3,511 tons at just one of its facilities.

ERO owns and operates two copper facilities and a gold mine in central Brazil — a country with $41 billion in mining production in 2020.

In 2020, Ero’s R22W mine — in the Brazilian state of Bahia — was the fourth-largest copper mine in the entire country.

Its second mine, also in Bahia, was the fifth-largest copper mine. ERO is one of the largest copper miners in Latin America.

The chart above shows that ERO faced headwinds in 2021.

But in 2022, it’s climbed 39.1% from its 52-week low and is starting to show strong upward momentum.

A solid 2021 annual report renewed investors’ confidence in the stock.

The growing need for copper in the EV and battery markets will push this stock even higher.

Ero Copper stock scores a 92 overall.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

The stock tops all but 2% of the stocks we rate in quality. Its ability to increase copper production year after year and return a gross margin of 74.6% drives its quality score of 98.

Bonus: ERO has enormous growth potential. Its one-year annual earnings-per-share growth rate is an impressive 279.7%, and its one-year annual sales growth rate is 51.2%.

Stay Tuned: Top-Performing Bank

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a bank stock that offers exposure to cryptocurrency!

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets