Cryptocurrencies have been a top investment of 2021, and you might be wondering how to get into this alternative currency.

So, I brought in someone who knows far more than I do.

Ian King is the resident crypto expert at Banyan Hill Publishing. He sees some great opportunities in crypto, and he’s ready to help you make the most of it through 2021 and beyond.

I brought Ian on for my most recent Ask Adam Anything video segment on our Money & Markets YouTube channel.

You can watch the entirety of our conversation below, or keep scrolling for some highlights.

Ethereum and Crypto Is a Financial Disruptor

Ian: Think of Bitcoin as being a digital store value. It’s the first digital thing that’s like gold, and we know there’s limitations to gold. There’s $9 trillion worth of money stored in gold in the world. There’s $1 trillion in Bitcoin right now. I think, eventually, Bitcoin probably gets to the same value as gold, because you see younger generations that are more favorable towards investing in Bitcoin than gold as a store of value.

And then, you also have that macroeconomic factor, where you’ve got countries all over the world spending way more than they take in tax revenue. So people worried about their own domestic currencies will move into an alternative currency.

But Ethereum is different in the sense that its value is essentially unlimited.

But Ethereum is different in the sense that its value is essentially unlimited.

Ethereum is called layer one, which is basically a building block like Lego. But there are other layer one protocols [like bitcoin and Litecoin]. And I think we’re going to need them to power these smart contracts, as the physical world moves to the digital.

Now, think of all the services that happen online. And this can be anything from the way you bank online, to the way you get cloud storage, to computational power.

And then think of a future where those services are provided not by a centralized thing like Amazon Web Services, for instance for your cloud, or a telecom company for your internet, but powered by a decentralized network of computers where anyone that has idle resource can contribute to the network.

So, if you think about how Uber just disrupted the entire taxi industry, Uber is basically a decentralized version of taxis.

That’s how you can think about how some of these crypto protocols are going to disrupt some of the businesses that we have today.

One of the reasons why I think that this is an existential threat to the banking system is now we have a technology that keeps track of who owns what in a better way than we have in the past. And now we’re moving to build the same type of financial services on top of it that we use in the real world. They’re all just going to be natively digital.

Adam: Interesting. It sounds like a very bright future for Ethereum.

It’s Still the Early Game for Crypto

Adam: What inning are we in? I mean, I play baseball. It sounds like you’re into baseball cards, are we in the first inning [for crypto]? Are we in the seventh inning? Just before you answer that, I mean, you’ve had some monster crypto gains already.

I’m looking at gains of over 9,000%, 8,000%, 2,000%. So I see gains like that, and it makes me nervous that I’ve already missed the boat. Why should I believe that the best days are still to come? And what inning are we in?

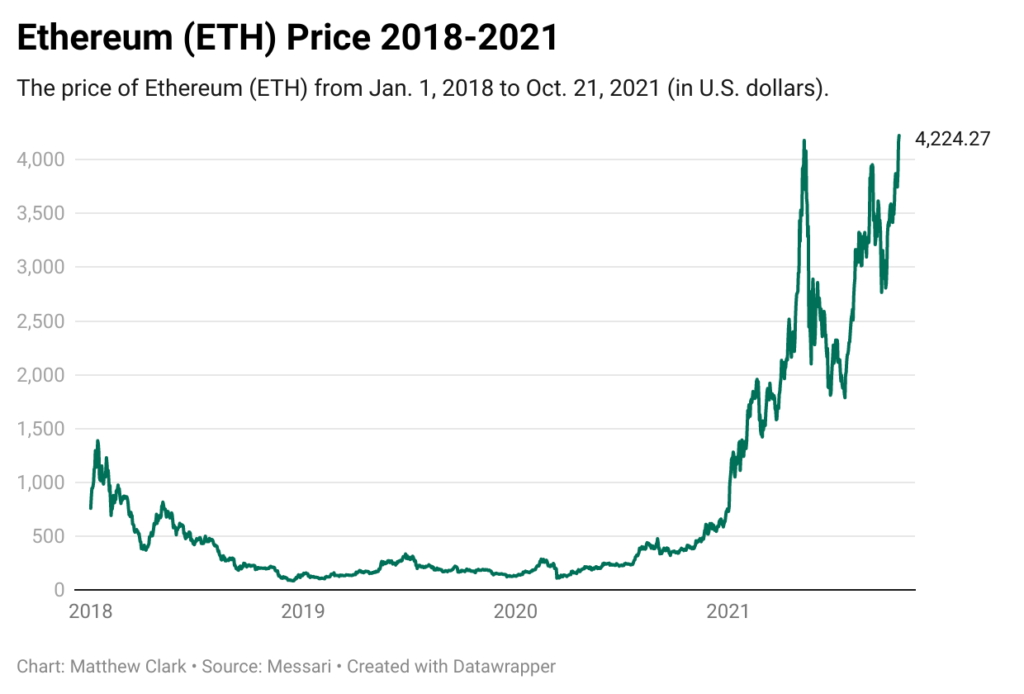

Ian: That’s a great question. So rather than looking at innings, think about bull and bear markets, and take a look at the chart of Ethereum.

Ethereum peaked in early 2018, and then we had basically a three-year bear market. And then we finally entered a new bull market in January of this year.

So we’re nine months into this new bull market, and I hate the term: “This time, it’s different,” but with Ethereum, there are so many other layers on top of it that are being built that just weren’t there in 2018. We didn’t have the capability — we didn’t have the functionality.

On top of that, Ethereum, in its current form, is very expensive to use. If you go buy or list something on the NFT marketplace OpenSea, it’s going to cost you $50. If you want to trade something on a decentralized exchange using Ethereum, it’s going to cost you $75, $100, depending on how congested the network is.

But the solutions are coming.

Within the next six months, there’s going to be a big upgrade that’s going to make everything faster and cheaper.

So, in this bull market, I’d say maybe we’re in the second or third inning. I think Ethereum can climb higher. I think $10,000 is within reach. And you know how these markets trade. Ethereum above $4,000 is basically just price discovery time. So it got to a new breakout point, and everyone who owns it doesn’t want to sell anymore because they know that the price is going higher.

When you have all the owners start to believe that, and on top of that, you have more people seeing it and having complete FOMO (fear of missing out), you can get these incredible price spikes.

Now, it works on the opposite side as well. You can have incredible drawdowns. Ethereum, in a month in the summertime, was down 60% from its high. So I think from an investment perspective, you just have to understand how to position yourself accordingly.

How to Invest in Ethereum and Other Cryptos

I always say dollar cost average.

Let’s say every year you want to contribute $5,000 to crypto. You break that up month by month. If you have a month where Ethereum has dropped, or let’s say, you were going to contribute $500 a month to it, and it’s down 10% or 20% that month, you contribute $1,000. If it goes up 30% one month, you cut that $500 investment in half.

So as long as you’re dollar-cost averaging, and you’re okay with the amount that you’re risking, you’re not going to freak out. A lot of people that go into this market, and they say: “I want to invest $10,000.” They put $10,000 in, it goes down 30% in a week.

And they’re like: “Oh my God, what did I do?”

That’s the worst thing you can do.

The crypto markets always give you an opportunity to get back in. And they always give you an opportunity to get back out or trim some as they move higher. It’s a very volatile asset class.

I’d say we are in the third inning in this bull market. I think that at the end of this year, the returns are going to be incredible. I know that you pointed out that we have a couple of gains of close to 100X in some of it. We just happen to be very early.

And also, this is one of these markets that is different from stocks, where you actually can get in on the ground floor before things launch or actually are used, because they sell the tokens to the public, not just VCs, like the equity markets work.

Adam: So this to me really looks like an opportunity, like you said, to get in on the ground floor for people who are willing to roll up their sleeves and do a little bit of research, or at least follow somebody who’s in the know, like you.

If you want to know the ins and outs of this massive crypto market, Ian King is your guy.

His track record shows top gains of 3,900% in three months (on half a position) and 1,900% in four months (again, selling half a position)…

And the other half of that one is up over 9,700% over 10 months (nearly 100 times your money).

But enough from me. Why not hear it from Ian himself?

To check out his “Crypto’s Third Wave” presentation, click here.

To good profits,

Adam O’Dell

Chief Investment Strategist