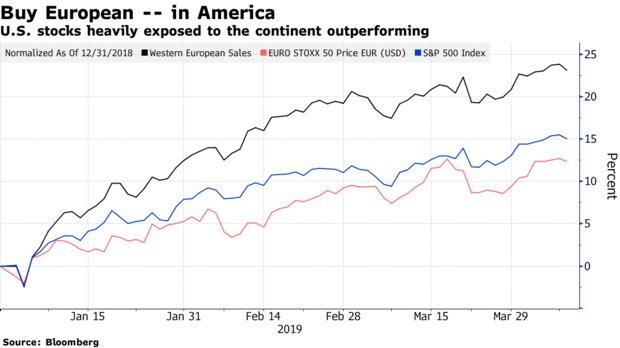

While the global economy continues to sag, it is a source of strength for the U.S. stock market, according to a recent Bloomberg report that shows a segment of American companies with major exposure to Europe is up about 23% on the year.

If the European softness hasn’t been adequately priced, it represents a future reckoning for U.S. investors.

The S&P 500 is up about 15% in 2019 while European equities have seen about a 12% gain in dollar terms.

Per Bloomberg:

The situation is a transatlantic conundrum: the International Monetary Fund blames the continent for its softest global growth outlook since the financial crisis, while the Trump administration is readying tariffs on $11 billion in imports from the European Union. If the European softness hasn’t been adequately priced, it represents a future reckoning for U.S. investors.

During the fourth-quarter risk rout, euro-tilted U.S. stocks lagged behind the S&P 500 by about 4.5 percentage points. The median stock in this Goldman Sachs Group Inc.’s list of 50 companies from the Russell 1000 generates roughly one-third of its revenues from the continent and 60 percent from outside the U.S.

Midway through Tuesday’s session, this basket is modestly trailing the S&P 500.

Heading into the year, Bloomberg Intelligence chief equity strategist Gina Martin Adams warned that Europe, not China, posed the bigger threat to S&P 500 earnings. Disclosed sales to Europe among index constituents dwarf those of China, she noted. The torrid run of form year-to-date reinforces the risk that meager activity in Europe — should green shoots fail to bloom — and heightened trade tensions are under-priced in American stocks.

“The U.S. equity market is generally failing to price in the extent of the global slowdown,’’ said Peter Cecchini, global chief market strategist at Cantor Fitzgerald. “We can see this divergence when looking at global rates versus the U.S. equity market.’’

Certainly, the German bond market does not suggest a high degree of underlying domestic vigor.

An escalation of U.S. tariffs to the automobile industry “would add insult to injury for a struggling euro zone economy that is just barely showing signs of stabilization,’’ Mazen Issa, a senior currency strategist at TD Securities, wrote. “Not only would this derail the prospects of a euro zone recovery, but it would be likely to feed back into U.S. asset prices as well.’’