After years of stubborn resistance, my wife and I are facing the music…

We’re going to need a new car soon.

We’ve managed to keep both of our mid-2000s Hondas in decent running order for going on 15 years now.

But the warning signs (and dashboard indicators) are flashing. Baking in the Florida sun for 10+ years and two cross-country treks have taken their toll.

We’re still stubborn. We’ll do whatever is reasonable to keep the Hondas going for a while longer.

If you’ve had to shop for a car since the pandemic, you know why.

Inflated prices combined with high interest rates on loans make this a rough market to participate in.

But we’re committed to saving now and have moved on to answering the next big question:

Do we stick to a regular gas guzzler, make the leap to an electric vehicle (EV) or pick the middle lane with a hybrid?

The State of EVs and the Energy Transition

If you’ve been following the EV market recently, you may be wondering what the heck is going on?

These are supposed to be the cars of our net-zero future.

But automakers across the board are slashing prices. Tesla cut the price of its flagship Model S by almost 25% last year in an effort to drum up demand. General Motors has also walked back its own short-term EV goals by delaying production of its EV truck and ending a partnership on an EV project with Honda.

Big Auto is facing an “early adoption” problem. While there are a handful of buyers eager to get into an EV, the majority of the market hasn’t bought in yet. Cox Automotive reports a record 1,189,051 new EVs were sold in 2023. That amounts to 7.6% of total automotive sales.

EV technology has incredible potential. We all dream of the day that we won’t have to wait in the gas line at Costco. Or even better, when our autonomous vehicles will shuttle us home while we take a nap.

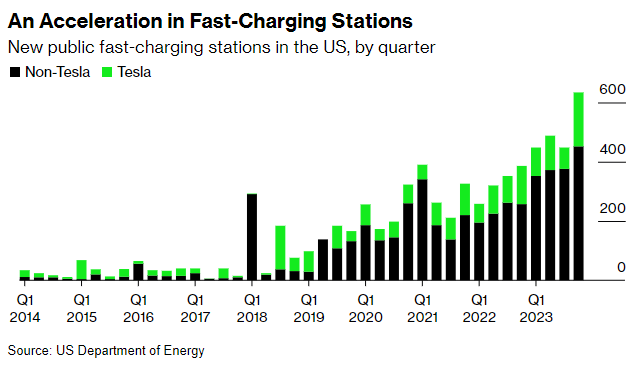

We’re not there yet. The fast-charging infrastructure is growing at a rapid pace, with close to 1,100 public stations added across the U.S. in the second half of 2023:

That’s great progress, but there’s still a lot of work to do. For comparison, there are roughly 168,000 gas stations across the country. That’s not even considering individual pumps per station.

It’s why the energy transition is a constant theme for our team here at Money & Markets.

Chief Investment Strategist Adam O’Dell knows there is massive potential in the green energy space. But he’s also bullish on traditional energy like oil and gas. He understands the move from old to new is going to take time. That’s why he’s investing in “both sides” of the argument in his services Green Zone Fortunes, Max Profit Alert and 10X Stocks.

Using his proprietary Green Zone Power Ratings system, I landed on an auto stock that’s following the same track.

Toyota Stock: A Hybrid State of Mind

My wife is dead set on the Swedish-based Volvo crossover for our upcoming car purchase. I, on the other hand, want to stick to Japanese-produced vehicles, like Honda or a Toyota…

We do at least agree on one thing: We want a hybrid engine.

And that brings me around to Toyota Motor Co. (NYSE: TM). While other automakers have hemmed and hawed over their EV plans, Toyota has stuck to its guns, pushing hybrid-powered cars for years.

Everyone laughed when the Prius hit the market in 2000. Two decades later, hybrid-engine cars accounted for 29% of Toyota’s sales in 2023, and the company expects that number to hit 45% this year.

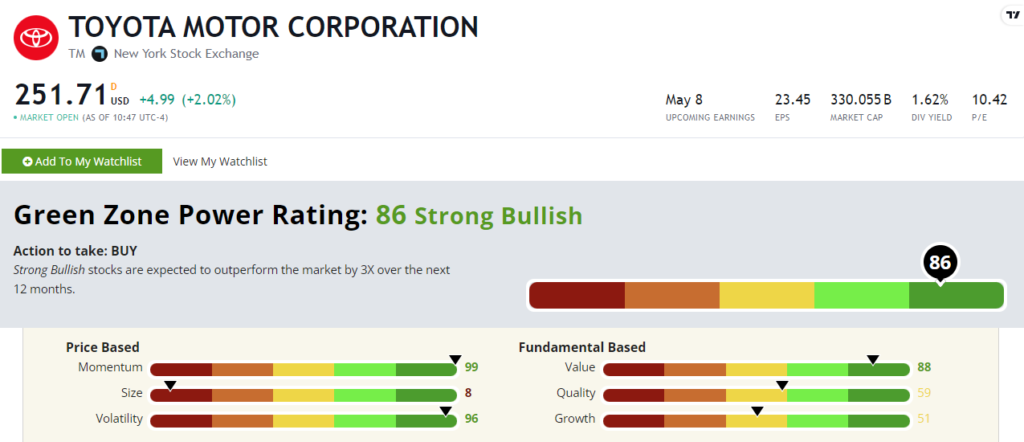

And that’s boosting its stock price. TM stock has gained 85% over the last year and rates a “Strong Bullish” 86 out of 100 on Adam’s Green Zone Power Ratings system.

Stocks in this category are expected to outperform the broader market by 3X over the next 12 months.

That massive (and steady) rise in its stock price is why it rates a 99 on Momentum and a 96 on Volatility.

And with an 88 on Value, the stock is still trading at a fair price compared to its peers.

TM trades with a price-to-earnings ratio of 10.5. This is more favorable than the consumer vehicles industry average of 19.

It’s the same story on price to sales. TM trades at 1.07, while the industry average is nearly double at 1.98.

Comparing just overall ratings, General Motors stock (GM) rates a “Neutral” 47, Tesla (TSLA) rates a “Bearish” 25 and Ford (F) lags them all with a “High-Risk” 19 out of 100 rating.

Toyota’s hybrid strategy is paying off. While EVs and green energy is the future, it looks like the road to mass adoption is longer than many expected.

And if you’re following Green Zone Power Ratings, TM stock is already miles ahead.

Until next time,

Chad Stone

Managing Editor, Money & Markets

P.S. I mentioned Adam’s bullish mindset for both sides of the energy sector. If you want access to his top energy stock recommendations, his flagship Green Zone Fortunes stock research service is a great place to start.

Looking to take it to the next level? Check out 10X Stocks here…