Editor’s Note: It’s your last chance to watch Adam’s Emergency Tech Bubble Briefing before today’s expected interest rate cut. If you’re looking for stocks that are set to thrive after the Fed’s decision, click here to watch now.

The eyes of investors, analysts and economists are turned sharply to an office located in Foggy Bottoms near Washington, D.C.

That is where the Federal Open Markets Committee (FOMC) will conclude two days of policy meetings later today, culminating with what is widely predicted to be the first interest rate cut since March 2020.

But it’s important to understand that the FOMC isn’t the only office making important monetary decisions this week.

In fact, this is setting up to be one of the biggest weeks for global markets in recent memory.

Today, I’ll talk about what central banks around the world have in store and what it means for investors.

The U.S. Isn’t Leading the Way…

The FOMC is expected to cut its rates, but as Adam pointed out yesterday in Money & Markets Daily, the biggest question is by how much?

I’ll get into that in a second, but whatever the rate cut decision is, it won’t be the first.

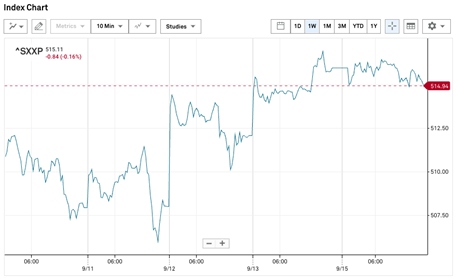

Last week, the European Central Bank trimmed back its interest rate by 25 basis points to 3.5%. The rate cut bumped stocks higher but didn’t spur a longer rally:

STOXX Europe 600 Jumps, Then Flattens

The STOXX Europe 600 index — an index covering 600 large-, mid- and small-cap companies across 17 countries in Europe — rose the day of the rate cut decision.

Aside from another slight increase on Friday, the impact on the broader market in Europe has been muted.

It’s nearly a foregone conclusion that the FOMC will cut rates this week. Conventional wisdom suggested that the cut would be 25 basis points, but there’s growing confidence in a 50-basis-point cut due to a recent rise in unemployment (one of the Federal Reserve’s two mandates is to promote maximum employment).

And if we look at how markets have performed in the past, things are looking good for stocks this time around.

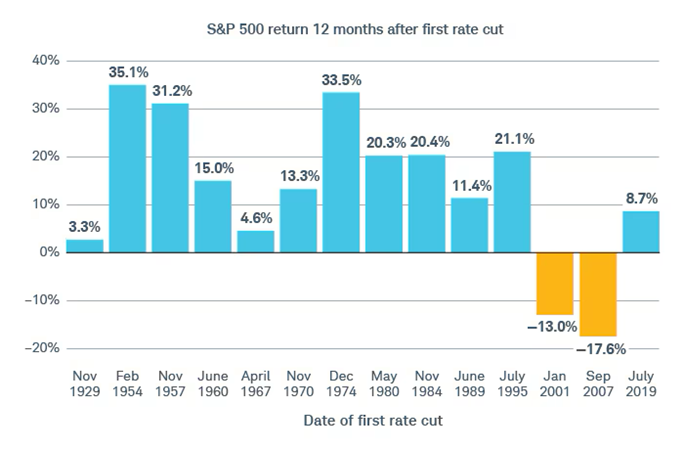

Historical data tells us the market makes solid gains a year after the Fed cuts rates:

Of the last 14 rate cycles (when rates are lowered), 12 of those periods saw positive returns in the S&P 500 in the 12 months following the cut.

Logic suggests we will see a similar trend no matter how much the Fed decides to trim. (If you’re worried about the drops in 2001 and 2007 occurring again, remember that the country faced vastly different economic conditions during those years.)

Other Central Bank Decisions Could Impact Markets

The ECB and FOMC aren’t the only central banks mulling rate decisions.

Brazil’s Banco Centro is meeting at the same time as the FOMC and is contemplating a rate hike following several cuts since July 2023.

Banco Centro’s decision is buoyed by strong second-quarter economic data, showing that the gross domestic product of Latin America’s largest economy surpassed expectations with a 1.4% expansion.

The stronger economic data, coupled with no change in the exchange rate between the Brazilian real and the U.S. dollar, set the stage for a 25-basis-point rate hike in each of the central bank’s next three meetings.

The Bank of England — the U.K.’s central bank — reduced its interest rates in August, but it is widely expected to hold rates firm following its meeting on Thursday.

Central banks in South Africa and Norway will meet on Thursday to discuss rate policy.

South Africa’s Reserve Bank is expected to cut rates for the first time since 2020, while Norges Bank in Norway has already stated its 4.5% rate will remain “for some time ahead.”

The Bank of Japan went from negative rates to a 0.1% rate in March. Then, in July, the bank added another increase to 0.25%. Economists believe the Japanese central bank will hold rates steady this week with an eye to potential increases toward the end of the year.

Finally, the People’s Bank of China will meet on Friday to discuss whether to move from its current fund rate of 3.35%. The bank has steadily cut rates since 2019, and it’s expected they will hold at the current rate this week.

Talk about a busy week!

What It All Means: American investors will be interested in the FOMC decision this week.

A 25-basis-point cut is expected, but a 50-point cut is not out of the realm of possibility.

The market wants a 50-point reduction, which could lead to a strong stock market run. A 25-basis-point cut could lead to a more muted reaction.

One thing is sure…

We’ll soon know what the Fed is thinking about the economy and rate policy.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets