The Super Bowl was fantastic this year. For all the hype surrounding America’s most celebrated annual sporting event, the game isn’t always close. It was refreshing to see a real nail-biter for once!

Even so, as an investor, I had my eye on a more compelling trend.

The Super Bowl isn’t just football. It’s the biggest day of the year for TV commercials. Sometimes the advertisements are the real stars of the show.

And speaking of ads, there were seven commercials for electric vehicles (EVs) during this year’s big game. That’s more than 10% of the total advertising spots.

For perspective, there were only six commercials for beer or other alcoholic beverages… during a football game.

Now, we don’t need to read too much into TV commercials at a sporting event. But there is a major takeaway here.

The auto industry is betting big on EVs.

And an even bigger story is brewing in the renewable energy story space.

EVs Get All the Attention

Automakers see EVs as the future, and they’re jockeying for position. Super Bowl ads are a way of making huge public statements… and take some of the limelight away from EV pioneer Tesla.

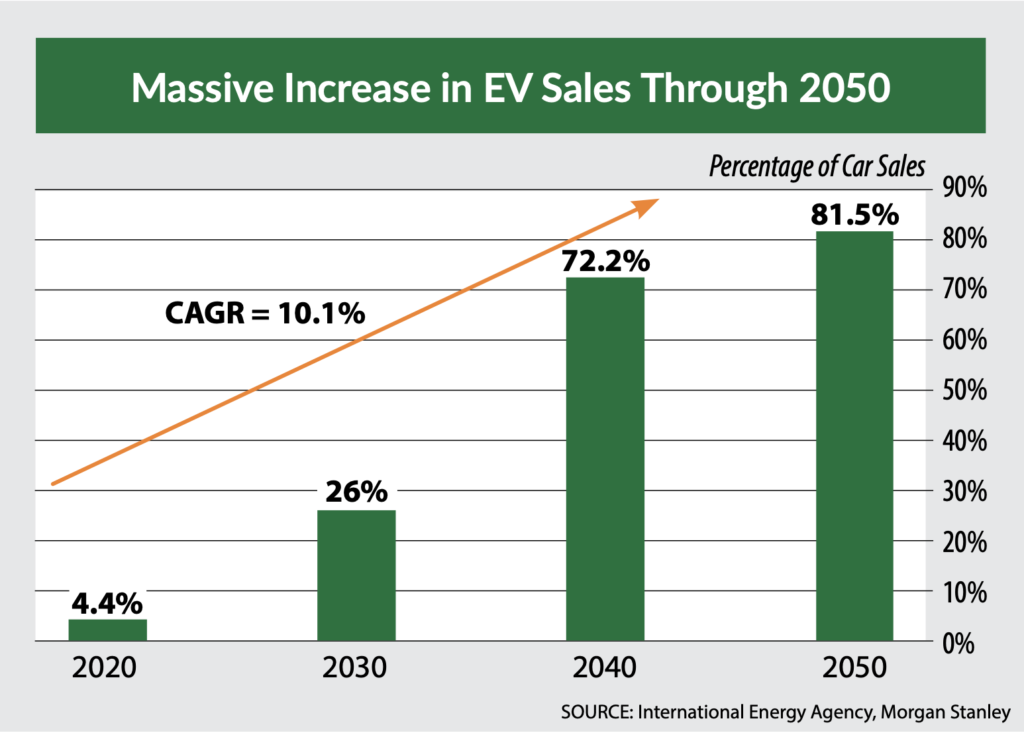

I like the EV play. Over the coming decades, the EV market share will continue to grow.

In 2020, electric vehicles made up about 5% of new car sales. But by 2030, less than a decade from now, EVs are expected to make up 26%. By 2040, the figure is expected to be more than 72%. And those are global figures. In developed economies, the numbers should be much larger.

Electric cars are more expensive today than their gas-powered rivals, but the price difference is falling by the day. On top of that, ongoing maintenance and fuel costs of an EV are lower over the vehicle’s life. In time, basic economics tells you that EVs will win the race.

While I like EVs — and have recommended investments in the EV space to my Green Zone Fortunes subscribers — I see a much larger play within the renewable energy space.

The Real Opportunity Lies in Renewable Energy Storage

There is so much potential in storage. Producing new renewable energy is easy enough. With current tech, it’s easier than ever to throw up a new wind turbine or a new solar panel array. Production costs have plummeted.

The bigger problem is timing. The sun doesn’t shine at night, and the wind doesn’t always blow. This has been the Achilles heel of the renewable space since the construction of the first windmills centuries ago. But this is also why renewable energy storage presents such an incredible opportunity.

Your phone, your laptop and a host of other devices you own are powered by lithium ion batteries. It’s fantastic technology that helped to make the mobile revolution possible. Unfortunately, for utility-grade power, that technology won’t cut it. You need longer-duration storage on a massive scale.

Well, I’ve identified a market leader in this field.

A tiny Silicon Valley company is using its artificial intelligence software — known as the “Infinite Energy” platform — to unleash the largest untapped energy source in the world.

This is a breakthrough that’s set to usher in an era of cheap, abundant electricity the likes of which the world has never seen.

Americans could soon pay almost nothing for electricity as a result, with one Colorado resident paying just $12 a month for electricity!

I’ll reveal the full story later this week, as well as how you can invest in the tiny Silicon Valley company responsible for this incredible breakthrough. Stay tuned!

To good profits,

Adam O’Dell

Chief Investment Strategist