FAANG stocks — or Facebook, Apple, Amazon, Netflix and Google — have been the darlings of the stock market over the past several years during the record bull market run.

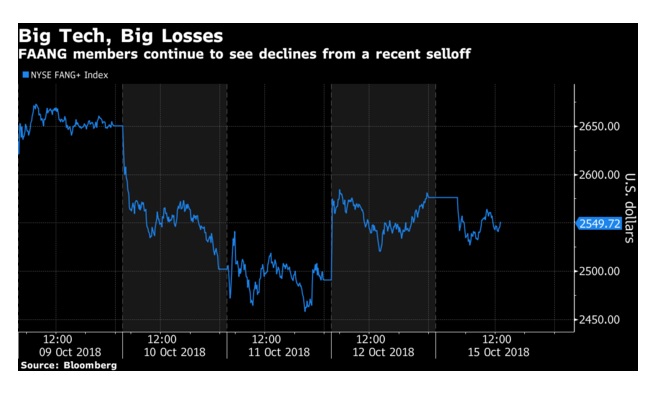

But times are changing, according to a recent article by Bloomberg that says the companies are poised to lose $40 billion dollars in market value.

A big reason?

Market share losses in China as the trade war with President Donald Trump and the United States wages on.

Per Bloomberg:

Apple Inc.’s decline, following a selloff last week, continues as Goldman Sachs cited fresh concerns “of rapidly slowing consumer demand in China,” the firm told clients in a note Monday. And Netflix Inc. was earlier jockeying with the iPhone maker as the family’s worst decliner ahead of an opportunity to mute concerns over its subscriber growth in Tuesday’s scheduled earnings report. Analysts from Raymond James and Goldman Sachs trimmed their price targets on the video streaming service’s stock ahead of the market open.

Facebook, along with a broader sector of technology stocks, has pared some of its losses from the selloff, but other FAANG giants have yet to find their way higher. Amazon.com Inc. and Google-parent Alphabet Inc. fell as much as 3 percent and 2 percent intraday, respectively. Chinese components of the NY FANG index, Alibaba Group Holding Ltd. and Baidu Inc., are also in the red.

Yahoo Finance took a deeper look at Apple in an article published Monday, noting that consumer demand is “rapidly slowing, which we believe could easily affect Apple’s demand there this fall,” said Rod Hall, a Goldman Sachs analyst.

Per Yahoo:

Recent data from China points to substantial economic weakening, with the country’s purchasing managers’ index dropping to 50.8 in September from 51.3 in August and 51.6 in June. Sales for automobiles plummeted to negative 12% year-over-year in September, following 4% year-over-year declines in August and July.

“We also believe that smartphone unit volume deteriorated by ~15%Y/Y in Q3 which is unheard of in a typically seasonally strong Q3,” Hall said. “Though most of the smartphone weakness was in the mid and lower range we find it hard to believe that this general environment is going to be helpful to Apple unless things improve late in the year.”