On Monday, my life was not changed, ruined or left in a panic.

I was not one of the millions worldwide who cried out in terror because I could not post my every life moment on Facebook.

At 12 p.m. Eastern time Monday, Facebook and its compatriot social media platforms — Messenger, WhatsApp and Instagram — suffered a six-hour outage that created social media pandemonium.

While Facebook is not my social media outlet of choice — I tend to stay on Twitter — I did pay attention to the outage’s impact on Facebook’s stock price.

And there’s a bigger story here…

In this episode of The Bull & The Bear, I explain how the outage pushed Facebook’s stock down further and how its continued decline can be traced to something that happened a month ago.

Bigger Tech Stock Decline Hurts Facebook

Technology stocks have benefited from strong market sentiment and this long-running bull market.

The Technology Select Sector SPDR Fund (NYSE: XLK), an exchange-traded fund (ETF) that invests in U.S. tech stocks, hit a high of nearly $160 per share in late August. However, since then, the ETF has dropped nearly 7%.

The tech stock sell-off is much deeper within specific segments:

BVP Emerging Cloud Index Hammered Last Month

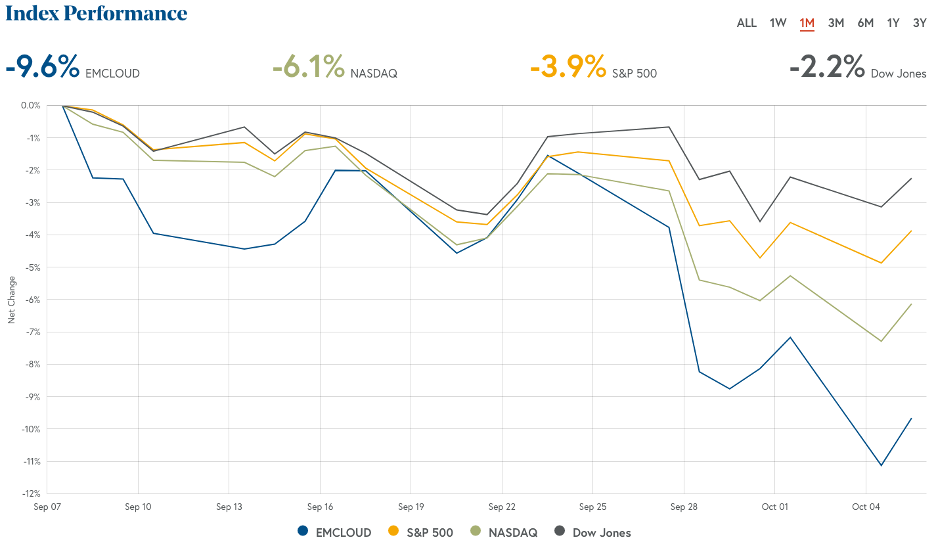

In the last month, EMCLOUD, which tracks cloud-based tech stocks, has declined 9.6% in value, while the tech-laden Nasdaq is down 6.1%. Conversely, the S&P 500 has only lost 3.9% and the Dow Jones Industrial Average is only down 2.2%.

Facebook is in worse shape — dropping nearly 12% in the last month.

The Bull & The Bear

Led by Adam O’Dell and a team of finance journalists, traders and experts, Money & Markets gives you the information you need to protect your nest egg, grow your wealth and safeguard your financial well-being.

You can listen to The Bull & The Bear on Apple Podcasts, Spotify, Amazon and Google Podcasts. Make sure to subscribe and leave us a review.

Be sure to also subscribe to our YouTube channel for more videos like my weekly Marijuana Market Update. You can find more investing insights from Adam and Green Zone Fortunes co-editor Charles Sizemore in our Ask Adam Anything and revamped Investing With Charles videos, respectively.

Have something you want us to talk about? Email thebullandthebear@moneyandmarkets.com and give us your thoughts.

Check out moneyandmarkets.com, and sign up for our free newsletters that deliver you the most important and unbiased financial news, commentary, and actionable advice.

Also, follow us on:

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.