Laurel and Hardy … Abbott and Costello … Aykroyd and Belushi. You know these names. And you’ve probably seen all three comedy teams in action.

Maybe you’ve even seen solo performances. Stan Laurel without Oliver Hardy just isn’t as funny. Neither is Bud Abbott without Lou Costello. While John Belushi is funny no matter what, Dan Aykroyd benefits from their partnership.

These are examples of times when 1 + 1 = 3. Laurel, by himself, for example, is funny. The same applies to Hardy. But it’s when they work together that they create classic comedy.

Researchers have found that this principle applies to finance as well.

Factor investors target specific attributes of stocks that have historically outperformed the market. Factors like value and momentum are especially popular.

Of course, there are more factors than those two. Harvey, Liu and Zhu’s (2016) paper titled …and the Cross-Section of Expected Returns identified 316 different factors. The authors noted this “likely under-represents the factor population.”

While there could be more than 316 factors, far less than that total stand up to scrutiny.

Applying the standard used by medical researchers, the paper found that 158 (50%) are false discoveries. Less than a third of the remaining 158 deliver meaningful improvements in results.

This means that investors need to drill down into the research to understand what really works.

Adam O’Dell has done that. He’s identified six factors that actually work in the long run. Then, he went one step further…

The Synergistic Power of Combined Factors

Adam understands that no one factor is likely to beat the market all the time. Like other researchers, he combines factors to outperform.

That’s the idea behind his proprietary Green Zone Power Ratings system.

As a simple example, consider value and momentum investing. Value stocks are cheap based on their fundamentals. Momentum stocks show strong recent price performance.

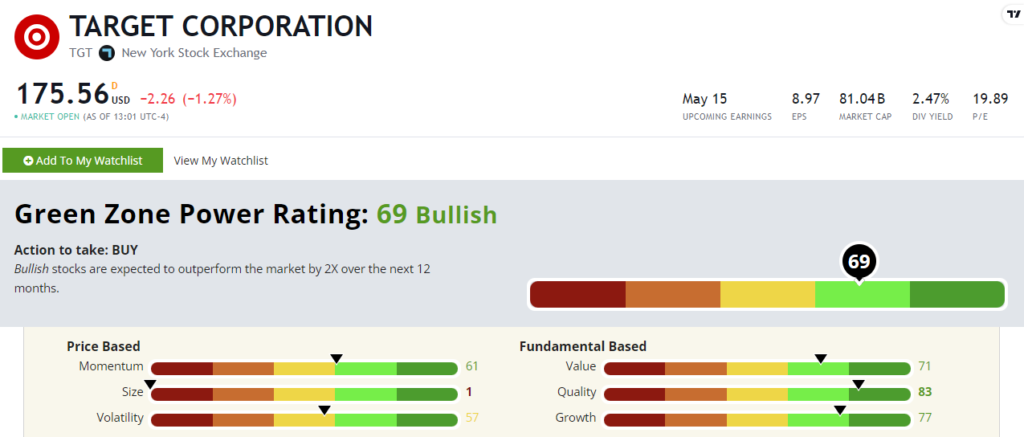

By combining these two factors, investors can capture the potential upside of undervalued stocks. That’s the Value factor in Green Zone Power Ratings. They also benefit from the wave of positive market sentiment about the stock (the Momentum factor). As an example, check out how Target Corp. (NYSE: TGT) rates:

TGT scores well on Momentum (61) and Value (71), and overall, it has a 69 out of 100 rating. Investors have pushed shares of this high-value stock up almost 65% over the last six months.

His Green Zone Power Ratings blend six factors to identify some of the most promising and lucrative trades in the market. And you can try it for free at any time on our site. Just use the search function to look up a stock ticker now.

In some ways, it’s like having Laurel, Hardy, Abbott, Costello, Aykroyd and Belushi all in the same room!

Recently, Adam has been focusing on tech stocks as the AI mega trend solidifies — and with the help of his ratings system, he’s discovered a revolutionary company that deserves every investor’s attention right now.

Its overall ratings aren’t top of the charts, but its scores on individual factors like Quality, Growth and Momentum show this is a stock with massive potential for its early investors.

Some of the most successful tech investors in history have already bought in … dubbing this stock “The Next Google.”

Watch Adam’s special presentation on the stock here — and see why he’s confident this is a stock you need to own as the next stage of AI takes off.

Until next time,

Mike Carr

Chief Market Technician