I never thought I’d live to see a central banker give Bitcoin the time of day. But Federal Reserve chair Jerome Powell did just that during his Humphrey-Hawkins testimony this week.

Powell notes that people “use (Bitcoin) as an alternative to gold, really. It’s a store of value, a speculative store of value, like gold. But we haven’t seen it.”

See what? Use Bitcoin and cryptocurrencies in general as a form of payment, threatening the dollar system.

This is all the policy wonks and House members care about, the ability of the dollar to continue buying them power and privilege.

What’s more interesting is then Powell says that it’s possible that Bitcoin could evolve and we could see a return, hypothetically, to the national banking era of multiple, competing currencies within the United States.

Now that happened when we were on a hard money standard. So, Powell is telling us that he is worried about this very thing happening.

That Powell spoke about this calmly and without rancor is interesting. Because, unlike one of his predecessors, Ben Bernanke, he understands the tendencies of people toward demanding hard money. Bernanke, famously, when responding to Ron Paul about why gold was still held within the banking system, said, almost flippantly, that it was tradition.

Bernanke knew better than that, but in his passive-aggressive way tried to tweak Dr. Paul, who he knew was right.

Both men, like Powell, know that confidence in the government’s ability to safeguard the value of its currency is the main thing ultimately propping it up in relation to hard assets.

It’s true we live in a world still addicted to dollars (and, by extension, other national currencies of dubious quality) but this is because of the current liabilities denominated in them.

Once the need for servicing those liabilities recedes, however, the mass exodus out of them toward something different begins in earnest, c.f. Venezuela and soon to be other major economies.

Gold has been in a bull market in every currency except the dollar for a while now, throwing shade on the coordinated central bank policies of the past decade. Bitcoin has only been around since 2009.

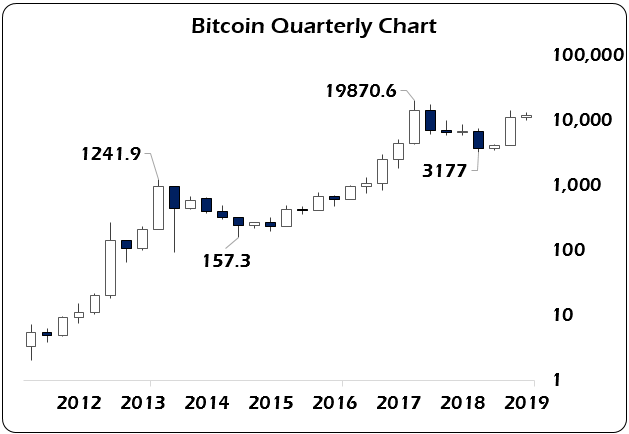

When plotted on a logarithmic scale, Bitcoin doesn’t seem so scary does it?

In fact, it should make you salivate, but there’s no accounting for taste in this world.

Powell is right in calling Bitcoin a ‘store of value’ at this point. It is now openly competing with gold for investor dollars, euros, yen, etc. as part of the traditional, to recall Bernanke, safe haven trade as economic conditions deteriorate.

It’s good to know that some people working in the Marriner-Eccles building still understands Gresham’s Law:

Over-valued money circulates while under-valued money is hoarded.

That’s why neither gold nor Bitcoin are used as payment layers and, frankly, I don’t recommend anyone at this point use them that way for small, everyday purchases. Men like Powell and European Central Bank President Mario Draghi have worked hard to maintain this situation. Because the minute they begin to function beyond the ‘store of value’ level and begin move into ‘unit of account’ and ‘medium of exchange’ functions is the beginning of the end of the current financial system.

In the crypto-space there are coins under development that care about those functions more than the Bitcoin developers do. And it’s likely they will be more successful in the long run at carving out those spaces in the evolution of cryptocurrencies while Bitcoin retains its reserve asset status. I think DASH is the most obvious at this point, but this point is certainly debatable.

But with Bitcoin still under-valued in the minds of HODL’ers a lot of that sentiment is transferred to the alt-coins so they, too, do not circulate as freely as they should. Powell and the people he was speaking to will do everything in their power to keep the world from leaking away into the nether regions of the crypto-ecosystem.

That includes hijacking President Trump’s Twitter feed and saying the most obvious nonsense about Bitcoin.

I am not a fan of Bitcoin and other Cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air. Unregulated Crypto Assets can facilitate unlawful behavior, including drug trade and other illegal activity….

— Donald J. Trump (@realDonaldTrump) July 12, 2019

I don’t believe for a second that Trump wrote that tweet anymore than I think pigs fly.

Bitcoin and gold breaking into new price ranges, $11,000 to $13,000 for Bitcoin and $1,400-plus for gold, is not evidence of a speculative bubble emerging in these assets. Rather, it is that portion of the safe harbor capital flows that aren’t bound by law or prospectus force funneled back into government securities.

Most everything we see in markets today can be explained by spooked capital rushing into anything with a positive yield spread. When you see Austria floating a 100-year bond at just over a 1% yield or basket case Italy issue a 50-year bond at just under 3%, both at massive over-subscription rates, you can’t just chalk that up to irrational behavior.

It’s fear.

And the movements at the long end of yield curves are as much a function of institutional inertia as anything else. Because it certainly isn’t investor confidence in a positive real return over the term of the bond. If anyone buying 50-year Italian debt believes Italy will still be around by 2069, no less pay back the note at par in euros, needs therapy.

No, these bond auctions should only be interpreted as scared capital flowing to the only allowed place it can go to, where the valuations aren’t even more ludicrous.

This also explains the equity markets continuing to make all-time highs while 80% of S&P 500 companies in Q2 so far have issued negative forward guidance warnings.

Source: ZeroHedge

Powell knows he has a real problem. He’s signaling cutting rates into what is supposedly a strong labor market, 3-plus % GDP growth and better than expected inflation. If anything, he should be considering raising rates if the econometric mumbo jumbo is to be believed.

The world is synthetically short dollars at a massive level. The ECB is blackmailing the Fed into lowering rates as spreads between U.S. and Euro-zone debt widen, threatening a massive breakout of the dollar to the upside, which no one wants.

Italian 10-years are trading at a -0.6% spread to that of the U.S. And people tell me Bitcoin is a bubble?!

And therein lies the rub — a rising dollar.

At some point, people look up and no longer see philosopher kings running the world but people just as clueless about the future as they are. And that’s when the stampede begins. First into the dollar to deal with the liabilities and then, later, after it gets too expensive and everything else has crashed, out again. But the next time that happens the dollar will not survive in its current form.

That’s where we are now, and Powell acknowledged it this week during his testimony. He knows he’s trapped, and the dollar is headed higher, much higher. No matter what he says. He can forestall it for a month or two longer, but he can’t hold it back forever.

• Money & Markets contributor Tom Luongo is the publisher of the Gold Goats ‘n Guns Newsletter. His work also is published at Strategic Culture Foundation, LewRockwell.com, Zerohedge and Russia Insider. A Libertarian adherent to Austrian economics, he applies those lessons to geopolitics, gold and central bank policy.