Millions of investors are making a fatal mistake, and I hope you’re not among them.

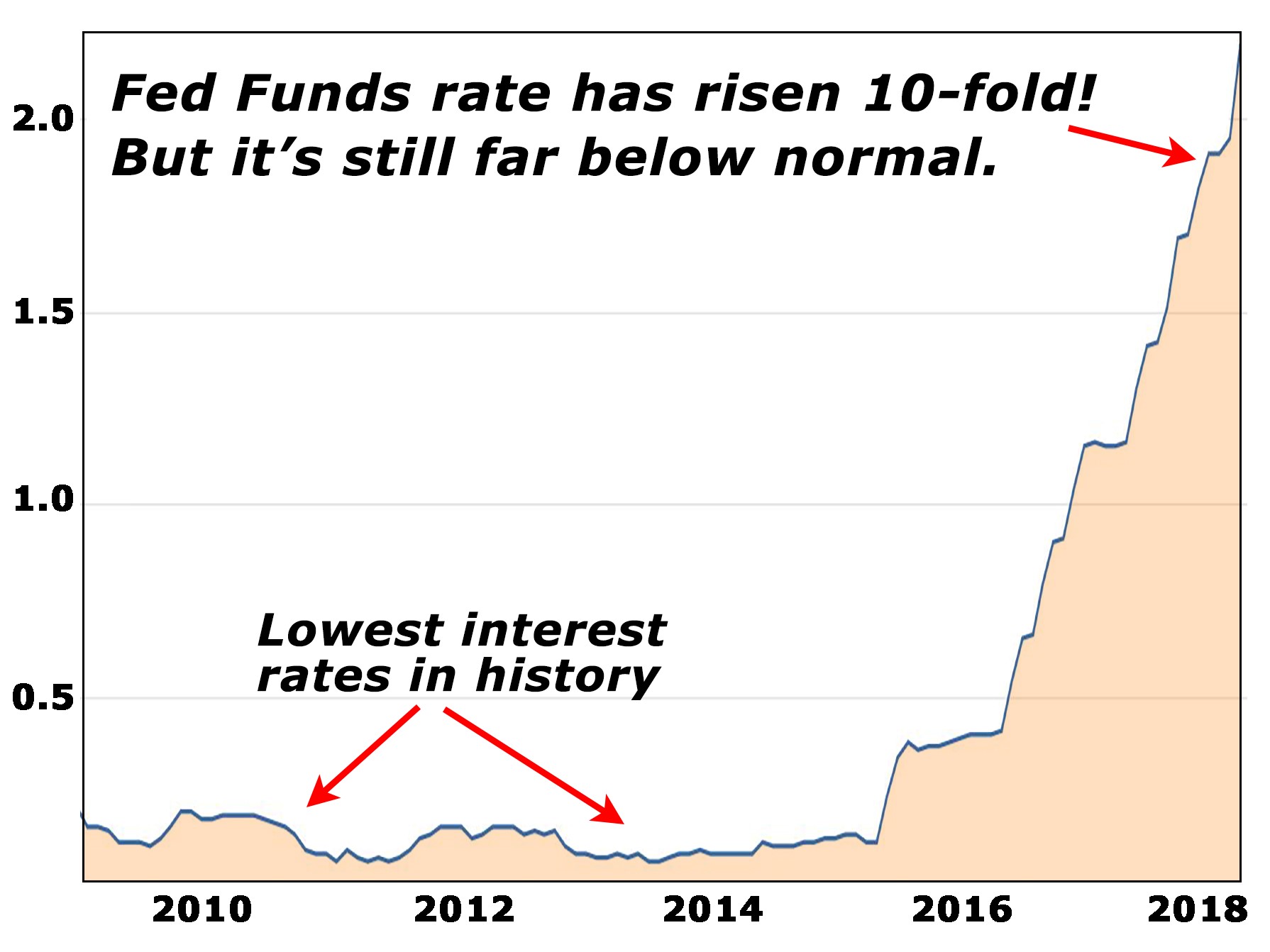

They know the Federal Reserve shoved its official interest rate down to the lowest level in history and kept it there for seven long years. But they haven’t thought much about what happens next.

They’re aware that governments can’t artificially hold down market prices without a subsequent price explosion. But they don’t realize the same is true for the price of money — interest rates.

They know that the Fed has now raised the Fed Funds rate tenfold — from 0.25 percent to 2.5 percent. But they still don’t believe the Fed’s promise to continue raising them.

Quite a few investors also recognize that ridiculously low interest rates have helped fuel massive speculative bubbles in corporate lending, high-flying stocks and commercial real estate.

But they don’t connect the dots. They don’t worry much about the likelihood that higher interest rates could help precipitate equally massive busts.

On Dec. 19, Fed Chairman Jerome Powell decided to hike the Fed Funds rate again despite stern warnings from economists that it could sink the financial markets.

And this is just the beginning! History shows us exactly what happens when the Fed raises rates in the wake of speculative bubbles:

- When the Fed began raising rates in 1999, it triggered the Dot-Com Bust that wiped out a staggering $5 trillion in invested wealth.

- When the Fed started raising rates in the mid-2000s, it triggered the most devastating housing bust, debt crisis and recession since the Great Depression.

Now, the Fed’s doing it again, and the timing couldn’t be worse because of three hidden time bombs that virtually no one is talking about.

Hidden Time Bomb #No. 1

Banks and corporations have thrown caution to the wind.

Many large commercial banks have taken huge risks again by lending money for corporate takeovers at the fastest pace since late 2006-2007, right before everything collapsed.

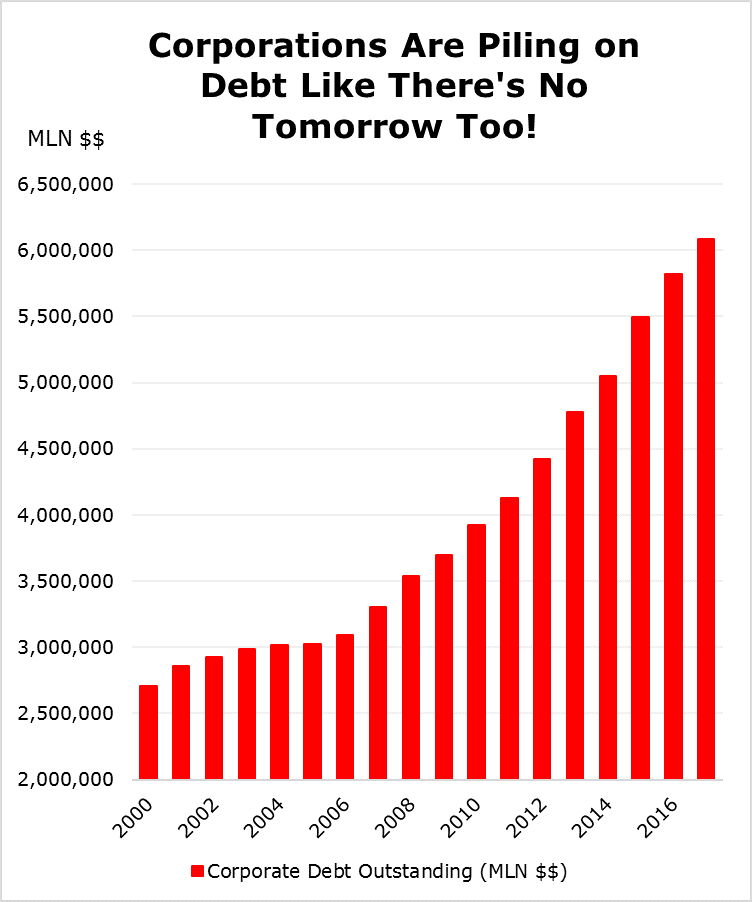

Most of America’s corporations are also taking on huge risks again. We know because their debt has suddenly ballooned like crazy.

A decade ago, they had $3.3 trillion in debt. Now, they have $6.1 trillion, a stunning 84 percent surge!

Measured against the economy, corporate debt is off the charts. These corporations now have 45 cents in debt per $1 of gross domestic product.

That’s a higher percentage of the U.S. economy than at any point in history, including at the peak of the Dot-Com Bubble.

Bond investors have also taken huge risks, piling into junk bonds like never before.

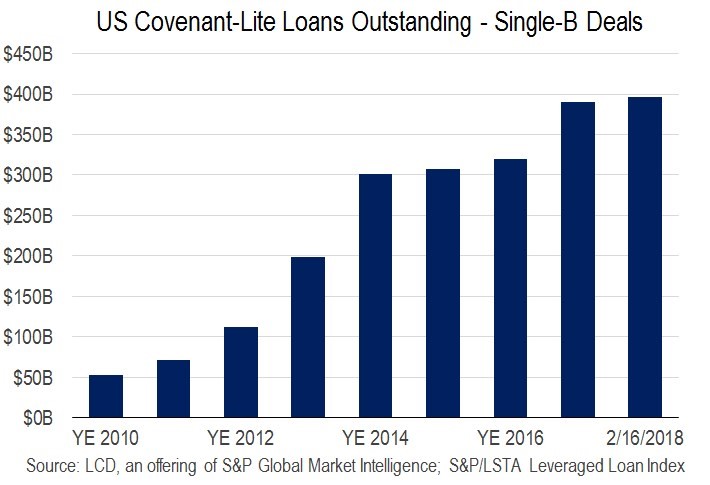

Not only have we seen a surge in corporate debt, we’ve also seen a gigantic surge in the absolute riskiest kind of debt.

In fact, we see more debt going to the highest-risk category of borrowers than at any time in history: These types of debts, called “Covenant-Lite Loans,” are the riskiest of all because they don’t include strict rules on how much debt borrowers can take on or how much cash they need to keep on hand.

They get a rating of single B, which is a low category of “junk.”

We call it “garbage debt.” And it has surged roughly eight times over since 2010 — to an all-time record of $396 billion.

It now represents a whopping 75 percent of all leveraged loans — the highest market share of all time.

This is the same kind of high-risk behavior that preceded nearly every other major economic catastrophe.

Hidden Time Bomb No. 2

The U.S. economy is very vulnerable to higher rates.

Last time around — before the Great Recession in 2008-2009 — the U.S. economy was booming for nearly everyone. It was far better equipped to absorb a shock.

Not so, today!

Sure, the top 1 percent have made out like bandits, raking in millions and even billions on Wall Street with the Fed’s newly printed money. But the other 99 percent are not so lucky.

Average workers are earning less, not more: Disposable income for all income levels has fallen dramatically over the past 15 years.

The inflation-adjusted net worth for the typical household was $142,416 in 2007. Ten years later, it was only $55,876, a whopping 61 percent decline.

Meanwhile, the U.S. has become a welfare nation. A record 46.7 million Americans are receiving food stamps. Another 12.8 million are on welfare. And still another 5.6 million are on unemployment insurance.

The cost is horrendous: In the last five years the federal government has transferred $3.7 trillion from taxpayers to welfare recipients.

Back in 1960, only 10 percent of the money Americans received from regular checks came from welfare payments. Today, it’s 35 percent. That’s right. The portion of income from welfare benefits has more than tripled.

Hidden Time Bomb No. 3

Washington is paralyzed.

Last time around — when the economy collapsed in 2008 — the U.S. government was mostly united and financially strong.

Treasury Secretary Henry Paulson literally dropped to his knees and begged House Speaker Nancy Pelosi not to “blow it all up” by refusing to bail out the nation’s bankrupt banks. She agreed. So did most Democrats and Republicans in Congress.

And that memorable scene marked the beginning of the biggest government bailouts of all time. This time, the safety net is full of holes.

Congress is so deadlocked, even the simplest new laws are stalled for months or even years at a time.

The national debt has more than doubled since 2008.

And the Fed has neither the will nor the means to embark on still another money-printing binge.

That’s why bond prices have already begun to plunge. That’s why interest rates have already started to rise. And that’s why the economy — which was kept alive on cheap money for seven long years — is already starting to sag.

Our Recommendations …

First, sell all the most vulnerable stocks in your portfolio. To find out which ones, look them up on our website. If they have a Weiss Rating of D+ or lower, that means “sell.”

Second, use stock market rallies to buy investments that go up when stocks go down, starting with inverse ETFs. For example, ProShares Short S&P500 is designed to rise 10 percent for every 10 percent decline in the S&P 500. It’s a solid hedge.

Third, buy gold. It’s the world’s oldest and most reliable safe haven. While stocks have been making new lows, gold has risen to a 5-month high, and there’s more to come.

Fourth, consider putting a small portion of your money in the only asset class in the world that was invented precisely for times like these.

It’s completely isolated from all the stock markets of the world. Indeed, even as the stock market was in the midst of a 20 percent plunge, investors in this asset class saw gains of 23 percent, 45 percent, even 85 percent.

We’re talking about cryptocurrencies, especially those with our highest Weiss ratings. The last four times they hit a launch point like today’s they rose by an average of 63-fold.

And just since 2017, if you could have used my strategy based on our Weiss crypto ratings, you could have turned $10,000 into more than $439,000.*

Now, with interest rates threatening nearly every other market and cryptos recovering from a major bottom, I’m so confident this is the right time to start following my strategy, I will give you $1,000 in the free crypto of your choice.

Follow the first three steps to protect yourself from a further decline in stocks. Then click here to get your $1,000 in free crypto and position yourself to start multiplying your wealth no matter what happens in the stock market

Warning: This offer ends permanently at midnight tonight, December 31, 2018.

Best wishes,

Martin Weiss and Mike Larson

* When you visit our website, be sure to read about the risks and how we calculate these numbers.