The big news last week was that the Federal Reserve plans to raise interest rates next year. There may be three or four rate hikes by the end of 2022.

As Fed Chair Jerome Powell talked about the rate hikes last Wednesday, the yield on 10-year Treasury notes was about 1.47%. Traders in the bond market seemed to believe rates should be lower. By the end of the week, that rate fell to 1.40%.

Looking at the economy, interest rates should head lower.

The Fed Fights Recessions with Interest Rates

The Fed is increasing short-term rates to fight inflation. Higher short-term rates should also slow the pace of economic growth because it will cost more to finance cars, appliances and other consumer products.

As the economy slows, long-term rates should fall. There will be less demand from businesses that won’t expand operations in a contracting economy.

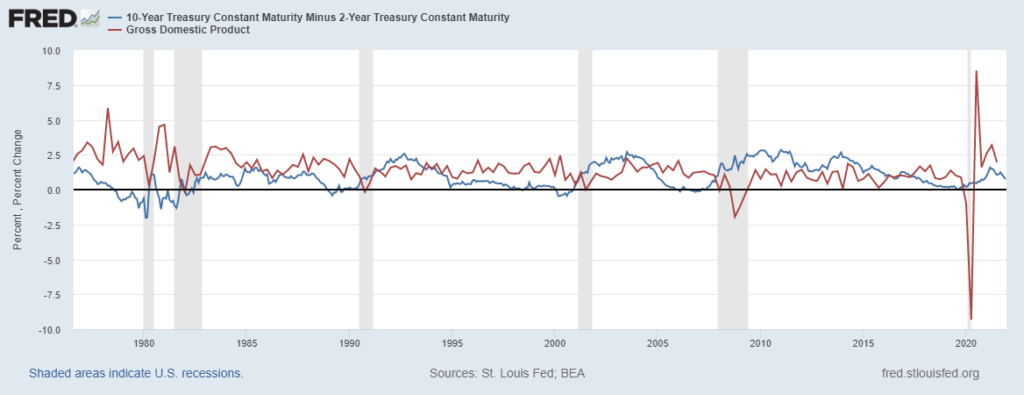

The chart below shows the relationship between short- and long-term rates as the difference between the yields on 10-year and 2-year Treasury notes (blue line). The red line is the change in the gross domestic product (GDP), a measure of economic growth.

Treasury Notes vs. GDP

Source: Federal Reserve.

Most of the time, the two lines move in the same direction. This chart offers an early warning of a recession, which the Fed will seek to avoid.

But former Clinton and Obama administration official Larry Summers recently noted:

There have been few, if any, instances in which inflation has been successfully stabilized without recession. Every U.S. economic expansion between the Korean War and Paul A. Volcker’s slaying of inflation after 1979 ended as the Federal Reserve tried to put the brakes on inflation and the economy skidded into recession. Since Volcker’s victory, there have been no major outbreaks of inflation until this year, and so no need for monetary policy to engineer a soft landing of the kind that the Fed hopes for over the next several years.

It’s unlikely that this time is different. The risk of recession is high and largely being ignored for now. That’s a dangerous environment for investors.

Click here to join True Options Masters.