Editor’s Note: Adam O’Dell’s Green Zone Power Ratings are at the core of everything we do at Money & Markets. Adam just used his proprietary system to find his next batch of recommendations for Infinite Momentum Alert, his elite stock advisory. He’s releasing his top 10 stocks to hold for the next four weeks today! Click here to see how you can access his recommendations.

Federal Reserve Chair Jerome Powell donned his cap and delivered some early holiday cheer this week…

No one was surprised by the Fed’s decision to hold interest rates steady between 5.25% and 5.5% as inflation continues to cool. But projections for 2024 sent Wall Street into a frenzy!

After the central bank signaled three potential rate cuts next year, investors jumped in. The Dow Jones Industrial Average closed above 37,000 for the first time ever on Wednesday, and the S&P 500 hit a new 52-week high at 4,707.

Inflation and the Fed’s response was the dominant theme of 2023. While meetings didn’t feel as dire as last year (a massive bull market run helps), investors are paying attention to Powell and his team. This short-term rally is proof of that.

With that as a backdrop, I wanted to break out Adam O’Dell’s Green Zone Power Ratings system to find some stocks that could benefit from a more dovish Fed.

Let’s get into it!

A Confident Consumer

Your first inclination when you hear lower interest rates may be to look for a growing tech company to invest in. Borrowing will become cheaper as rates sink, and that means more available capital to fuel growth.

But I want to go a different direction first…

With inflation cooling, consumers will gain more confidence. We’re already seeing that play out.

Economists expected weak retail sales in November, citing inflation concerns. But the Commerce Department reported a 0.3% increase in sales for the month.

That tells me consumers are weathering the storm better than expected, and that’s a great sign for certain retail stocks like Costco Wholesale Corp. (Nasdaq: COST).

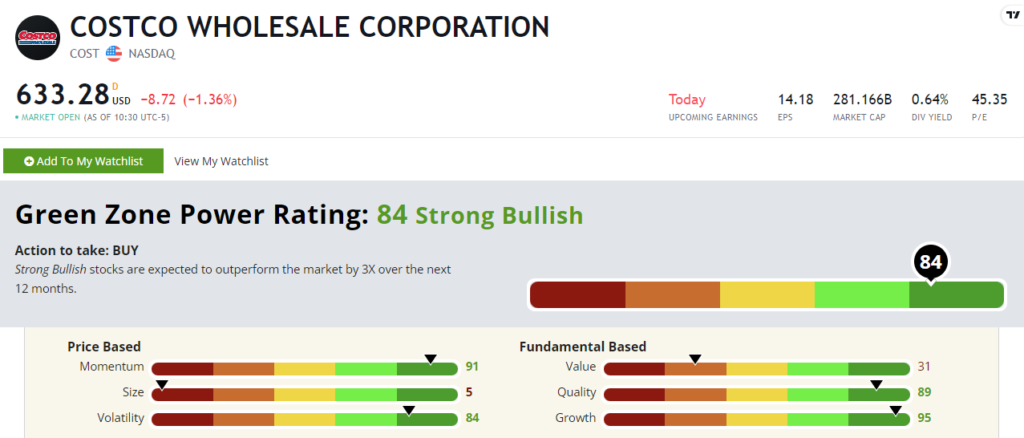

It turns out COST stock already has a “Strong Bullish” rating at 84 out of 100.

Stocks in this highest tier of the ratings system are expected to outperform the broader market by 3X over the next 12 months!

Honestly, COST has all the trappings of a high-growth tech stock. It sports strong ratings on Momentum, Growth and Quality (with low Volatility as a bonus). Low Value and Size ratings are also very tech-like. Just look at stocks like AMZN or META.

This is what happens when you use a system like Green Zone Power Ratings consistently. You start to notice trends and common ground between stocks and industries. And that can uncover unexpected opportunities.

That’s exactly what happened with the second stock I have today.

A Strong Bullish Surprise

This is my first bout with sustained higher inflation in my adult life, and it has changed my spending habits.

Gone are the days of just walking into an unknown restaurant and trying whatever looked good on the menu. Now, I spend more time vetting a spot because there’s nothing worse than spending $25 on a bad meal.

And if Yelp Inc.’s (NYSE: YELP) Green Zone Power Ratings are any indication, I don’t think I’m the only one.

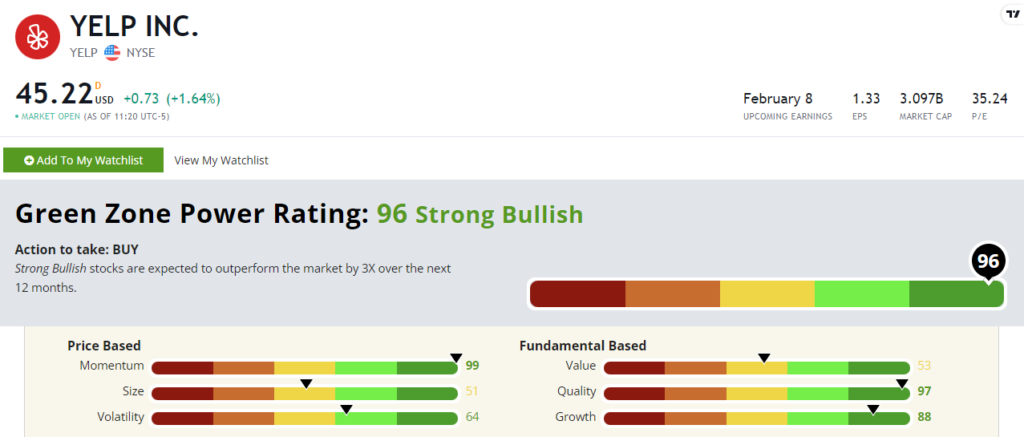

YELP stock rates a “Strong Bullish” 96 out of 100. That puts it in the top 4% of stocks in the system!

Yelp managed to grow its operating income to $41.8 million in the third quarter, according to its latest earnings report. That’s a 470% jump year over year and a big reason why YELP stock rates a 97 on Quality.

What’s more, Yelp rates higher than many tech stocks on Size and Value at 51 and 53, respectively. This is a smaller stock ($3.1 billion market cap) that investors haven’t bid up to exorbitant valuations like some of its tech peers.

I’m not going to lie — I was a little shocked to see how well YELP rates. I thought for sure it’d be a dog on Size and Value, especially.

But that’s why I love using Adam’s Green Zone Power Ratings. It can reveal incredible stock opportunities in moments.

Try it yourself. Click on the search bar here and type in a ticker or company name.

In seconds, you’ll know whether a stock is set for strong outperformance over the next year. Or you’ll find another stock to avoid as you prep for 2024.

Simple as that.

Time to Reflect and Plan

As we zoom toward the end of the year, we’re going to give you everything you need to make next year your best as an investor yet!

Over the next couple of weeks, the Money & Markets team will look back — and look ahead.

We’ll highlight some of our best calls from 2023, dive into some top macroeconomic trends and tell you what’s on our radars in the markets for 2024.

Stay tuned!

Until next time,

Chad Stone

Managing Editor, Money & Markets