As the Federal Reserve looks at its first interest rate hike since 2018, officials must ponder how ineffective their policies have been since 2009.

Low interest rates are supposed to encourage borrowers to ask their banks for money.

In the face of a panic in 2008, the Fed began cutting short-term interest rates. For most of the past 13 years, its benchmark rate has been near zero.

This should have led to an increase in loans. Many consumers should have been able to find uses for low-cost money like:

- Home renovations.

- Major purchases like cars and appliances.

- Higher education.

As former Fed Chairman Ben Bernanke noted, “…at a negative (or even zero) interest rate, it would pay to level the Rocky Mountains to save even the small amount of fuel expended by trains and cars that currently must climb steep grades.”

The same is true for consumers. Low rates should have allowed consumers to stretch their finances to buy bigger homes or more expensive cars.

A Rate Hike Shouldn’t Increase Low Loan Demand

The Rocky Mountains are still standing and demand for loans by consumers is actually lower than it was when rates were high.

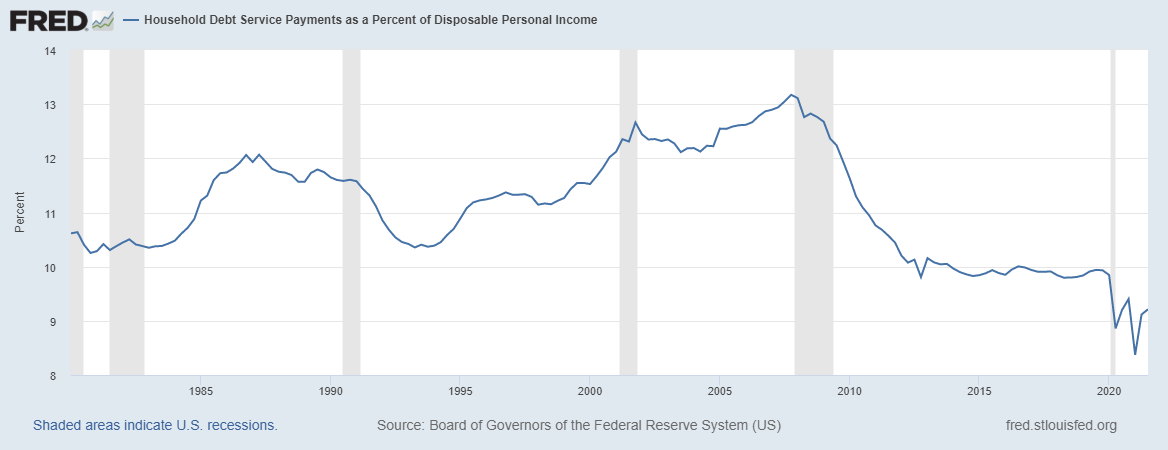

The chart below shows the amount of income dedicated to debt repayment as a percentage of disposable income.

Consumers Aren’t Borrowing

Source: Federal Reserve.

This isn’t the first time low rates failed to entice consumers to borrow. In 1935, during the Great Depression, the Fed chair told Congress:

Under present circumstances, there is very little, if any, that can be done. …One cannot push on a string. We are in the depths of a depression and … beyond creating an easy money situation through reduction of discount rates, there is very little, if anything, that the reserve organization can do to bring about recovery.

Almost 80 years later, that statement summarizes the Fed’s current situation. The central bank can’t do much to stimulate the economy.

But there is some danger to low rates.

Inflation has taken hold as rates hovered near zero. Now the Fed will raise rates to fight higher prices.

Consumers are already buying less because of inflation, and higher rates will discourage borrowing.

Bottom line: The Fed’s been unable to push on a string, but they may be able to pull the economy into recession.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.