The U.S. recently raised tariffs on $200 billion worth of Chinese imports from 10% to 25%, and that will effectively cost the average U.S. family upward of $831 a year, according to a recent study published by Federal Reserve Bank of New York.

The study gets to the $831 figure by looking at the recent experience of the 2018 U.S. tariffs, which the Fed found imposed an annual cost of $419 for the typical household.

The cost is comprised of two components:

- an added tax burden faced by consumers

- a deadweight or efficiency loss

The size of the costs depend on how a tariff affects the prices charged by foreign exporters and the U.S. demand for imported goods. Studies show that tariffs the U.S. imposed in 2018 have had a “complete passthrough into domestic prices of imports, which means that Chinese exporters did not reduce their prices.”

And what that means for you is that domestic prices at the border have risen one-for-one with the tariffs levied — so you are paying more for the goods. The study also found that a 10% tariff reduced import demand by as much as 43%.

So U.S. buyers of Chinese imports must now pay the import tax in addition to the base price. Basically, if an imported unit costs $100, it will cost $110 with a 10% tariff, and $125 with a 25% tariff.

However, this isn’t a true cost for the U.S. economy because that money is transferred from the buyers of imports to the U.S. government, which could then be rebated in principle.

Companies also will start looking elsewhere for cheaper products (ie. the same product that costs $125 per unit from China might cost $120 from Vietnam), which then leads to tariff-induced shifts in supply chains that are called “deadweight or efficiency loss.”

Per the Fed:

Economic theory tells us that deadweight losses tend to rise more than proportionally as tariffs rise because importers are induced to shift to ever more expensive sources of supply as the tariffs rise. Very high tariff rates can thereby cause tariff revenue to fall as buyers of imports stop purchasing imports from a targeted country and seek out imports from (less efficient) producers in other countries.

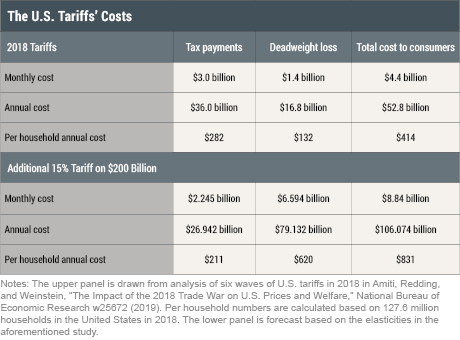

We can see these two forces at work when we compare the estimates of the costs of the 2018 tariffs with those of the recently announced higher tariffs on $200 billion of Chinese products. As one can see in the following table, in November 2018, purchasers of imports were paying $3 billion per month in added tax costs and experiencing another $1.4 billion in deadweight losses. Thus, the total bill for U.S. importers was $4.4 billion per month. If we annualize these numbers, they amount to a cost of $52.8 billion, or $414 per household. Of this cost, $282 per household per year was flowing into government coffers as a tax increase and could theoretically be rebated. For example, U.S. government transfers to farmers to mitigate their losses from foreign retaliatory tariffs can be thought of as households receiving just this type of transfer. However, deadweight losses accounted for an additional $132 to households per annum and represent a net loss to the U.S. economy that is in excess of any tariff revenue collected by the government.

Based on these estimates, we can infer the likely cost of increasing the tariff rate from 10 percent to 25 percent on $200 billion of Chinese imports. From the table, we see that the tax portion of the cost to households actually falls, from $282 to $211 per annum, because the tariff-inclusive price for Chinese imports becomes so high that consumers start to purchase substitute goods from countries like Vietnam instead. As the U.S. economy sources more goods from countries other than China, firms are forced to pay more for similar goods, but there is no tariff revenue collected. Our results are based on estimates where imports from China can be substituted for other foreign suppliers or stopped altogether. In principle, consumers could switch expenditure to domestically produced goods, where domestic firms might be able to benefit from the lack of foreign competition, but in practice, other studies have found that other developing countries often pick up much of the slack when one of them is targeted. Nevertheless, the deadweight efficiency loss arises regardless of whether consumers switch to more expensive foreign sources or to a more expensive domestic source.

As a result of this expenditure switching, we estimate that the annualized deadweight loss increases from $132 to $620 per household, bringing the total annual cost of the new round of tariffs to the typical household to $831. In sum, according to our estimates, these higher tariffs are likely to create large economic distortions and reduce U.S. tariff revenues.