Love central banks or hate them, the Fed’s job isn’t particularly easy.

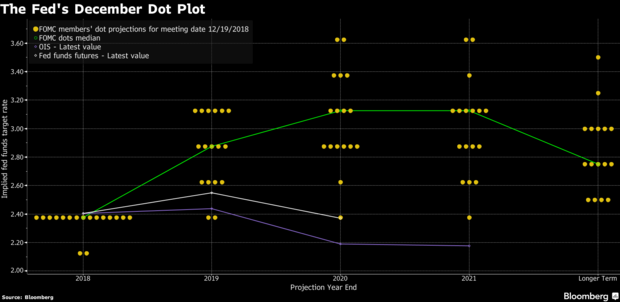

When the Fed laid out its dot plot policy plans for 2019 in December, which included two projected interest rate hikes, the stock market plunged 3.5 percent in an hour. It was the worst December for the market since 1931 and the S&P 500 briefly dipped into bear market territory during Christmas Eve’s massive sell-off.

At the time, investors only got a small piece of the message without any nuance. They heard two rate increases, not that the Fed’s confidence in two increases was waning significantly.

Six weeks later the projections were scrapped and the Fed signaled it would enter a holding pattern on rate hikes for the foreseeable future.

So how do you give your best guess for where the economy is heading without upsetting the market apple cart?

Per Bloomberg:

The Fed would like to avoid that outcome again. There’s no easy fix, though, in their potential options for systematically conveying forecast certainty. Powell has entrusted Vice Chairman Richard Clarida to come up with a solution, and the central bank has tested some tools privately before.

“The problem with the dot plot is that it shows the quarterly rate forecasts but doesn’t communicate anything about the likelihood of that path,’’ said Andrew Levin, a Dartmouth College professor who previously advised the Fed Board on monetary policy strategy and communications.

Without a reliable mechanism for communicating forecast certainty, or uncertainty, the burden will fall more on Powell to work that message into his press conferences and get it just right.

Here’s a rundown of some possibilities discussed by former Fed officials and advisers:

More Forecasts

Now that Powell is holding press conferences eight times a year, instead of four, he could ask the Federal Open Market Committee to provide forecasts at every meeting.

A changing forecast every six weeks would show more agility in response to recent data, giving a sense of how officials’ views are evolving. Still, that wouldn’t communicate how they would respond to unforeseen outcomes further down the road, or how much weight they put on the probability of those outcomes.

Such a change probably wouldn’t alter the thrust of Fed communications which is focused on rationales for why they did what they did, rather than what they might do.

Different Scenarios

William English, an economist at Yale University who also served as a senior adviser to officials on communication, said it might be helpful if officials explained how policy should adjust to hypothetical scenarios that fall outside their baseline forecasts, and present those alongside their quarterly outlooks.

“It seems to me the public often wants to hear not just about the modal outlook, but what it would take for the committee to do something different,” he said.

The idea is intriguing because it would quantify how the Fed would react to, say, a weakening expansion or surging inflation. It also carries risks, such as the chance that mentioning a downside scenario — such as a continuous plunge in stocks — could spook investors.

“I don’t think they would want to feed that beast,” said Michael Feroli, chief U.S. economist at JPMorgan Chase & Co. in New York.

It might also create more confusion than clarity. The Fed experimented with the idea in 2012, asking all 17 policy makers to provide a policy path responding to four alternate forecast scenarios — a “maze of 68 possibilities,” as St. Louis Fed President James Bullard put it at the time.

“I don’t think that kind of information overload is very conducive to improving transparency,” Bullard said in an FOMC meeting transcript.

Consensus Forecasts

Overcoming such divergence — through consensus forecasts — would require a giant leap toward agreement among all governors and regional Fed presidents on how rates should respond in each scenario.

Right now, officials don’t even have a single forecast for their baseline outlook. The projections are a compilation of each individual’s outlook based on “optimal” monetary policy. The median estimate is simply the midpoint and doesn’t represent something the committee, as a group, agrees on.

The Fed also explored the idea of a consensus baseline forecast in 2012.

“In the end, people thought it just wasn’t going to be that helpful, in part because there would be people standing outside the consensus.” said English, a top staff official at the time.

Formulaic Approach

Another option could be to publish scenarios with policy paths based on a model — essentially, a set of economic formulas. Fed officials would still have to agree that the interest-rate rule within the model was in line with theirs, again a difficult challenge given the diversity of views on the committee.