The Federal Reserve is raising interest rates at a rapid pace. Short-term rates are expected to reach almost 5% by the end of next year. That’s up from 0% just eight months ago.

Higher rates slow the economy. Consumers make fewer large purchases using credit due to higher rates. Businesses respond by spending less on new factories and reducing other investments that require borrowing money.

Investors are worried about how higher rates will affect their stock portfolios. They should also be concerned with how the Fed is withdrawing money from the economy.

Stocks React to the Fed’s Shrinking Balance Sheet

Beginning in 2008, the Fed created trillions of dollars to support the economy after the financial crisis. By 2013, it was clear that this money was needed to support bond and stock markets.

The Fed tried to wean the markets from the supply of easy money. Then the economy shut down for a pandemic and the Fed opened the floodgates. This fueled what many believe was a stock market bubble.

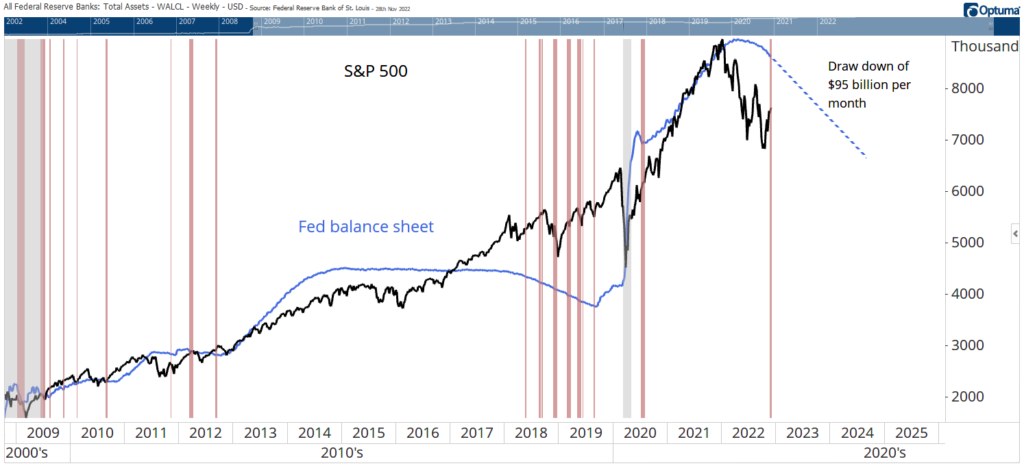

The chart below shows the relationship between the Fed’s balance sheet and the SPDR S&P 500 ETF (NYSE: SPY). The balance sheet is in blue — SPY is the black line. Red bars highlight times when the balance sheet declined at least 1% in a month. SPY generally sold off after these 1% declines.

Investors React to the Fed’s Money Action

SPY peaked as the Fed prepared significant reductions to its balance sheet. Since September, the Fed has sold $95 billion worth of Treasurys and mortgage-backed securities every month. That’s expected to continue for at least the next year.

Bottom line: Stocks have struggled when the Fed sells securities. This is a strong headwind that makes the next year treacherous for investors. Volatility like we saw this year is likely to continue in 2023, and volatility almost always includes periods where prices fall sharply.

Michael Carr is the editor of True Options Masters, One Trade, Precision Profits and Market Leaders. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.