Inflation appears to be rising. In the most recent report, the Consumer Price Index jumped 2.6% compared to a year ago. This is higher than the Federal Reserve’s target of 2%, but the Fed believes inflation is high right now because of the math.

When comparing prices to last year, some argue there should be an increase because the economy was at a standstill last spring. This makes year-over-year comparisons unreliable.

The Fed and consumers do agree that everyone is paying more for goods this year. Consumers are concerned about the impact of higher prices on their finances. And investors are joining them in that concern.

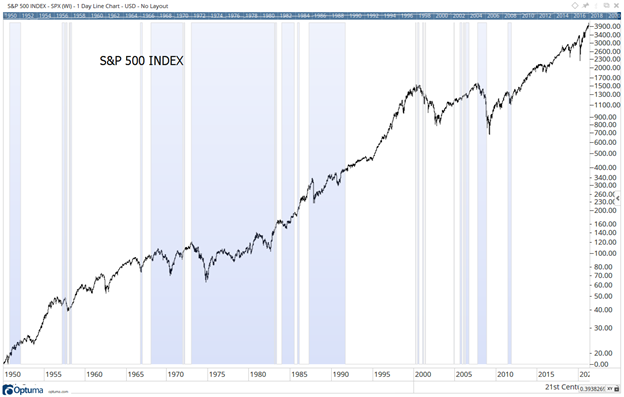

The impact on investors could be significant. The chart below shows the S&P 500 Index. Blue shading indicates times when inflation, measured by the CPI, exceeded 3.5%. This is twice the level of the average inflation experienced over the past 10 years.

S&P 500 Index Performs Worse Under Inflation

Source: Optuma.

The Fed Isn’t Concerned About Inflation, Investors Should Be

Prior to 2000, the S&P 500 showed below-average gains while inflation was above that level, but it did manage to deliver gains. Sine 2000, the Index has often declined during the brief bursts of high inflation.

While the Fed says inflation isn’t a short-term concern, not all investors share that opinion. It’s likely stocks will sell off despite the central bank’s efforts to ignore the data.

Investors can’t be sure the Fed will be able to reverse the trends in prices once they take hold.

In the late 1960s, the Fed believed inflation was temporary. At that time, it seemed that government spending would decline after the Army ended the war in Vietnam and Washington achieved victory in the War on Poverty.

Officials were wrong then. Government spending increased, and it took almost 20 years to bring inflation back under control.

This time, there is no plan to rein in government spending. Policymakers and the Fed insist they will tolerate higher inflation in the short run. These are risks for investors.

Those risks are high, and investors should take them more seriously than policymakers seem to be doing.

I don’t like working more than I have to.

That’s why I found a way to beat the market by making one simple trade per week.

Last year, this trade helped me beat the market eight times over.

It’s a great way to accelerate your gains. Click here, and I’ll show you how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.