It’s long been said that one key to the American dream is homeownership.

I’m not sure I subscribe to that, as I have never owned a home.

My previous career as a journalist kept me moving around, making buying a home somewhat unnecessary.

Since transitioning out of journalism, mortgage rates kept me from pulling the trigger.

And I’m OK with that.

However, millions of Americans go on the hunt for a new home every year … whether they are moving to a new city or upgrading.

Since 2020, when the Federal Reserve started its aggressive round of interest rate hikes, mortgage rates have prevented many Americans from realizing their dream.

More and more people are living paycheck to paycheck, unable to save for the 10% downpayment needed to buy a home.

But things are starting to look up for those still eyeing that dream…

New Home Sales Start to Perk Up

If you are searching for a new home, you have options.

You can buy an existing home that someone else is selling, or you can build a brand-new home with all the custom amenities you’re looking for.

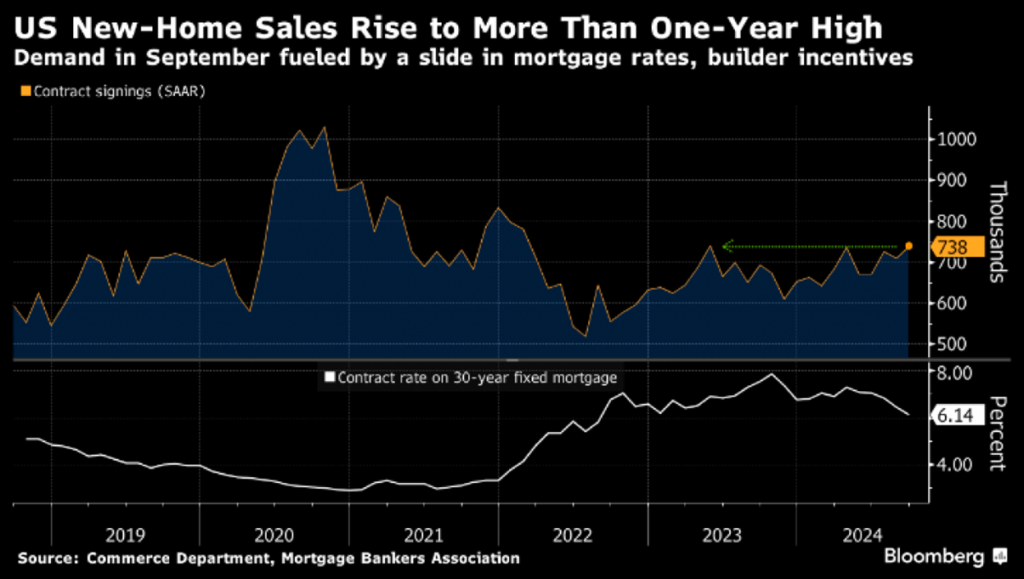

When the Federal Reserve cut back its benchmark lending rate by 50 basis points in September, mortgage and lending rates started to follow suit, making it more attractive for prospective homebuyers to build what they wanted.

According to the U.S. Census Bureau, in September, new home sales increased to 738,000 on an annualized basis… well above consensus expectations of 720,000. That’s the highest it’s been since March 2024.

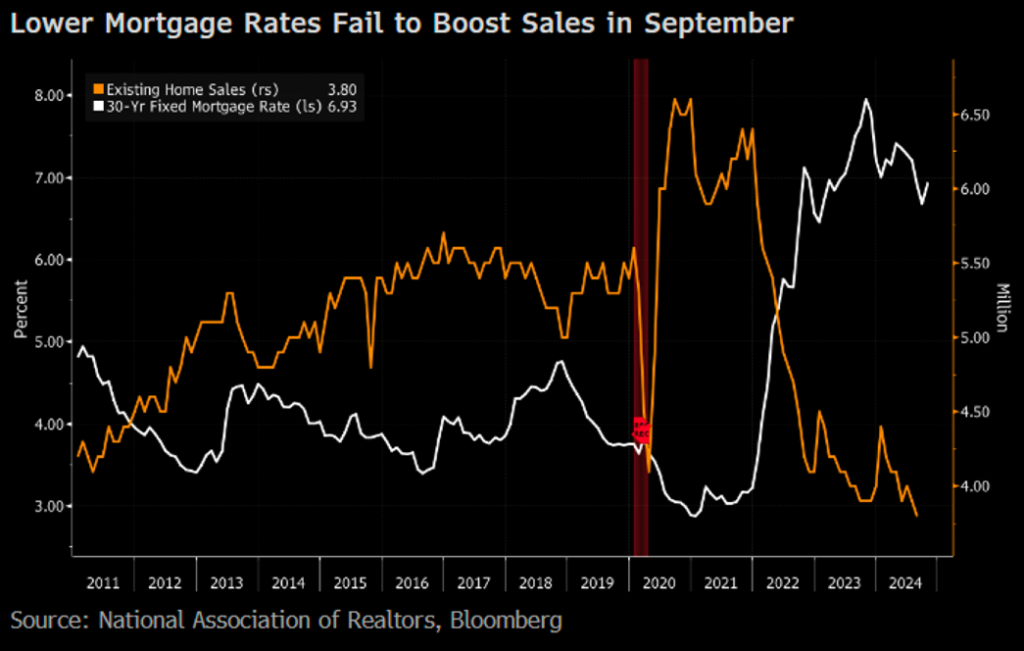

At the same time, existing home sales failed to improve — falling 1% in September to 3.84 million on an annualized rate.

This suggests a few things:

- Right now, new homebuyers are more apt to spend their money building what they want rather than finding something already on the market.

- Current homeowners are still hesitant to sell and exchange their current low-rate mortgage for a higher one on a new loan.

So mortgage rates have come down, and existing home sales aren’t following suit … but new home sales are.

This is providing a boom for homebuilding stocks.

Homebuilding Stocks Turning Up

The SPDR S&P Homebuilders ETF (NYSE: XHB) holds a basket of some of the biggest stocks in the homebuilding industry.

XHB Up 68% In the Last 12 Months

In the last 12 months, XHB has jumped 68%, compared to the S&P 500 return of just 22% over the same time.

That led me to some additional analysis using Adam’s Green Zone Power Ratings system.

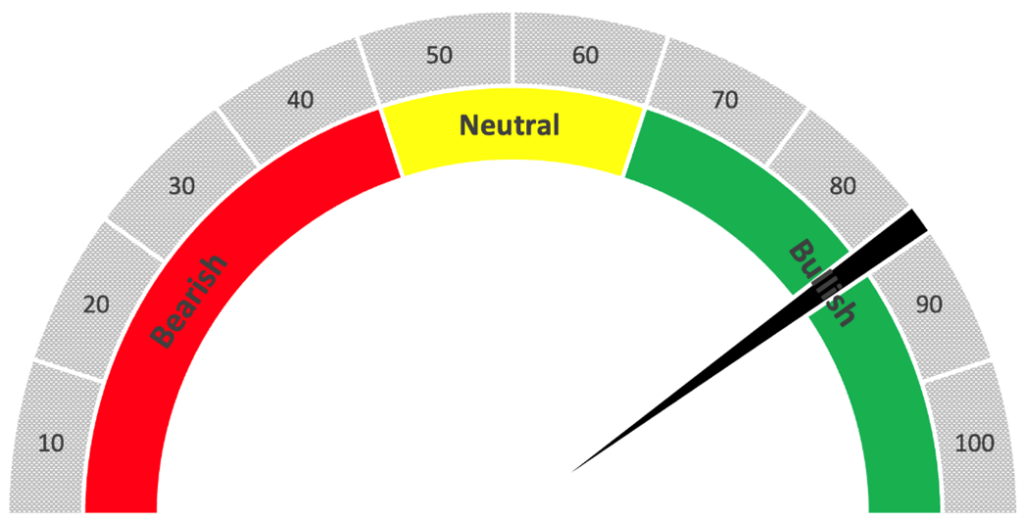

I ran XHB through what we call an ETF X-ray, examining all of the holdings and obtaining an average overall rating according to Adam’s system.

XHB Rates “Bullish”

There are 34 holdings in XHB — 25 of which rate 72 or higher overall. That gives XHB an X-ray average of a “Bullish” 79 out of 100 on Green Zone Power Ratings.

Highlights of the X-ray: All but one stock in XHB rates above 70 on quality, while 28 rate above 70 on Growth and 22 rate above 70 on Momentum.

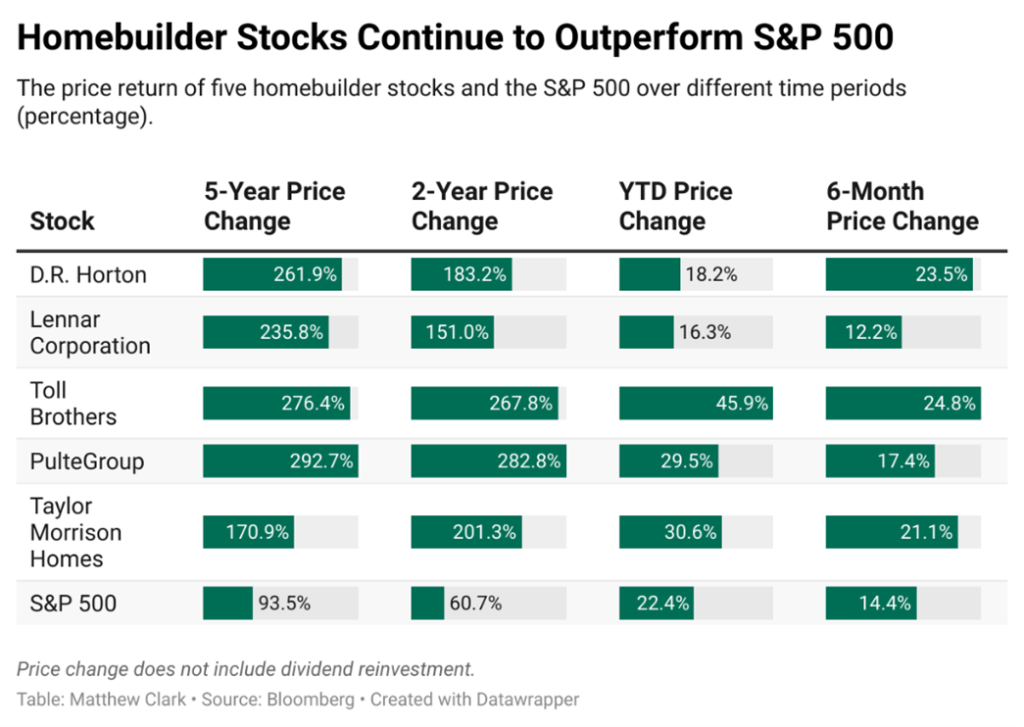

We can dive into historical price change to further illustrate the strength of homebuilders over time:

As you can see, over varying timeframes, homebuilding stocks continue to consistently outperform the S&P 500.

What It Means: Buying a home has been out of reach for many Americans because of high mortgage rates and a lack of existing supply.

However, since the Fed trimmed back its benchmark lending rate, homebuying activity is starting to pick up … especially in new home construction.

Existing supply will still lag demand, and with the Fed poised to potentially cut rates further in the future, things look bright for homebuilder stocks.

That’s all from me today.

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets