In yesterday’s issue of What My System Says Today, I mentioned how the varied performance of U.S. sectors this week would be more important than they were last week, given Sunday’s announcement of substantial progress in the tariff negotiations between the U.S. and China.

It’s only been one day…

But so far, the consumer discretionary sector seems to be most relieved about the thaw. The SPDR Consumer Discretionary Sector ETF (XLY) gained a full 5% between last Friday’s close and yesterday’s — the best showing of all 11 sectors we track.

Today, we’ll revisit the consumer discretionary sector to see where things stand according to my Green Zone Power Rating system following the big news.

Let’s dig in…

Consumer Discretionary Sector X-Ray

The first step in assessing the strength of any sector is to examine its trend to see if it’s up or down over the medium term.

In my option-trading Max Profit Alert service, I use a six-month lookback to size up a sector’s medium-term trend. Currently, thanks in large part to yesterday’s rally, 7 of the 11 major sectors have reclaimed their uptrend status, including the consumer discretionary sector.

That’s a meaningful improvement over just one week ago, when 8 of 11 sectors were in downtrends.

Step number two in assessing a sector’s strength involves judging the individual stocks within the sector, which is generally called “breadth” analysis. Most of the time, if a majority of individual stocks within a sector are sending a “bullish” message, a bullish trend in the sector’s market prices can be trusted.

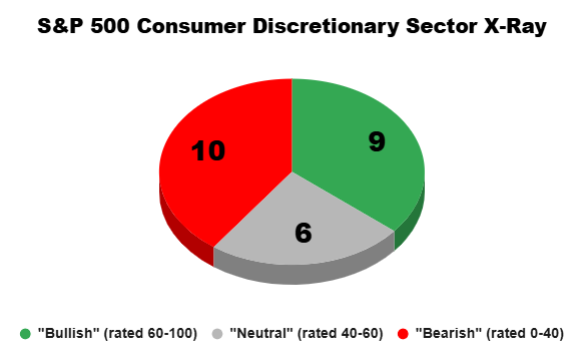

We’ll see if that’s the case currently with the consumer discretionary sector. Let’s have a look at the sector’s breakdown of bullish, bearish and neutral ratings, according to my Green Zone Power Rating system.

My system’s Overall rating can be categorized into one of three buckets:

- Bullish (stocks rated 60 to 100).

- Neutral (stocks rated 40 to 60).

- Bearish (stocks rated 0 to 40).

Here’s how my system is rating the sector currently:

As you can see, 9 of 25 (36%) of consumer discretionary stocks in the S&P 500 currently rate “bullish” or better. That’s a larger share of bullish stocks than the S&P 500 as a whole, where 148 of its 500 stocks (29%) earn the same coveted rating.

This shows the sector is generally a good place to invest.

Next, let’s examine the characteristics of the sector that make it rate more bullish than the broader market…

Factor Breakdown of the Consumer Discretionary Stocks

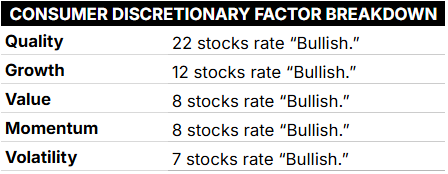

Beyond looking at the overall Green Zone Power Rating of each stock in the sector, we can also see the positive aspects of these stocks by checking to see how many rate bullish or better on individual factors.

Here, I’ve listed in descending order the factors with the most “bullish” stocks. Here’s how the consumer discretionary sector shapes up:

This breakdown shows that there are many quality companies (22) in the sector, and even companies still showing strong growth (12).

In short, the companies in this sector look to be in good shape.

Though much like we saw with the industrials sector last week, it’s their stock prices that pose a challenge … as a minority of them have positive momentum (8), and an equal number are a good value (8).

Of course, finding a single stock where all or most of these positive characteristics line up together is rare.

My system is designed that way … we aren’t necessarily looking for just one or two “needles in a haystack,” but the system is highly selective and we can use it to identify well-rounded companies whose stock prices are also behaving “nicely.”

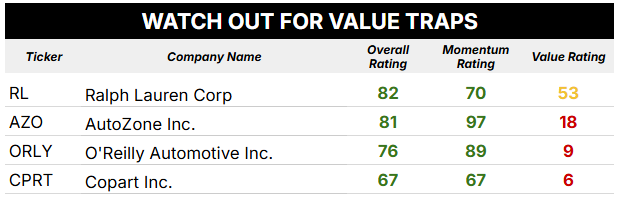

Presented below is a list of just four stocks that meet all of the following criteria:

- “Bullish” (60 or greater) rating overall.

- “Bullish” rating on momentum.

- “Bullish” rating on quality.

- “Bullish” rating on growth.

Have a look…

As you can see, the overall Green Zone Power Ratings on these four stocks range from just barely “bullish” in the case of Copart Inc. (CPRT) … to “Strong Bullish,” in the case of AutoZone (AZO) and Ralph Lauren Corp. (RL).

Each of these discretionary stocks are backed by healthy companies that are growing revenue and earnings at a favorable rate. But you may notice that only one of them appears to be a good value…

Whereas my system’s value factor rating is quite poor for AutoZone (18), O’Reilly Automotive (9) and Copart (6) … Ralph Lauren (RL) is rated a respectable 53 out of 100 on this factor.

This means it isn’t exactly “cheap,” but it’s also not expensive — it’s more or less in line with the broader market’s current valuation.

As a premium but not ultra-premium brand, Ralph Lauren manages profit margins of 68% (gross) and 10% (net) … which is strong for an apparel company.

It also pays a dividend yielding 1.3% annually…

Though my Max Profit Alert readers have been one to do one better on Ralph Lauren, with a simple transaction that so far has netted them an annualized yield of 34% over just the last two weeks.

Shoot my team a quick email (MaxProfitAlert@MoneyandMarkets.com) if you’re interested in learning how to do that. Put in the subject line “interested in 34% yield!”

To good profits,

Editor, What My System Says Today