As I wrote yesterday, the past week has seen investors really stop and consider tech valuations for the first time in a very long while.

The AI revolution is very real and is already massively transforming the economy. But when triple-digit price/earnings ratios start to become the norm, it’s safe to assume that the growth everyone’s salivating over has already been priced in (and then some).

When the 1990s tech bubble finally burst early in 2000, investors rotated out of hypergrowth tech stocks and into “boring” old-economy stocks. As tech suffered a lost decade, energy stocks did particularly well, returning about 240% (including dividends) between March 2000 and their eventual top in 2008.

Could a similar rotation be just around the corner?

Given investors’ newfound sobriety regarding tech valuations, energy stocks are worth a deeper dive.

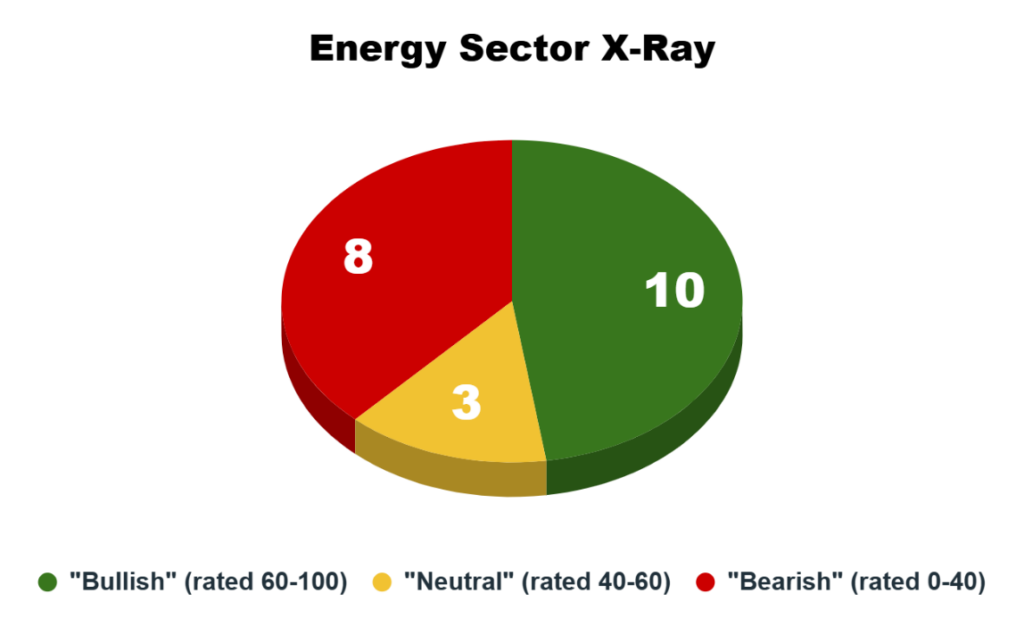

Immediately, we can see that the energy sector is a mixed bag. Of the 21 energy stocks in the S&P 500, 10 rate as “Bullish” on my Green Zone Power Ratings system and another three rate as “Neutral.” Eight rate as “Bearish.” It’s roughly evenly balanced between Bullish stocks we’d consider for further research and “meh” stocks we’d avoid.

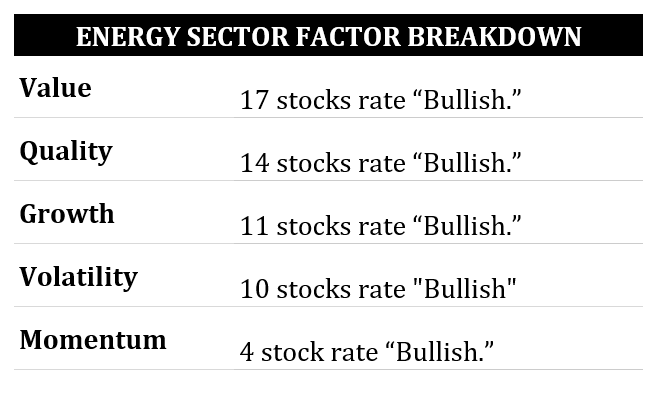

Digging a little deeper, it’s clear where energy stocks “win points” on my Green Zone Power Ratings system. Fully 17 rate as “Bullish” on the value factor rating, with a score over 60, and a respectable 14 rate as “Bullish” on their quality score. Energy can be a brutally cyclical business, so having a strong balance sheet is critically important to weathering the troughs.

Not surprisingly, though, energy stocks tend to really score poorly on their momentum factor. Only four out of 21 rated a “Bullish” 60 or higher. Investors have been chasing tech stocks for years. There simply hasn’t been demand for energy stocks.

That can change quickly, of course, as it did back in 2000. But for now, the energy sector as a whole remains cheap and mostly unloved.

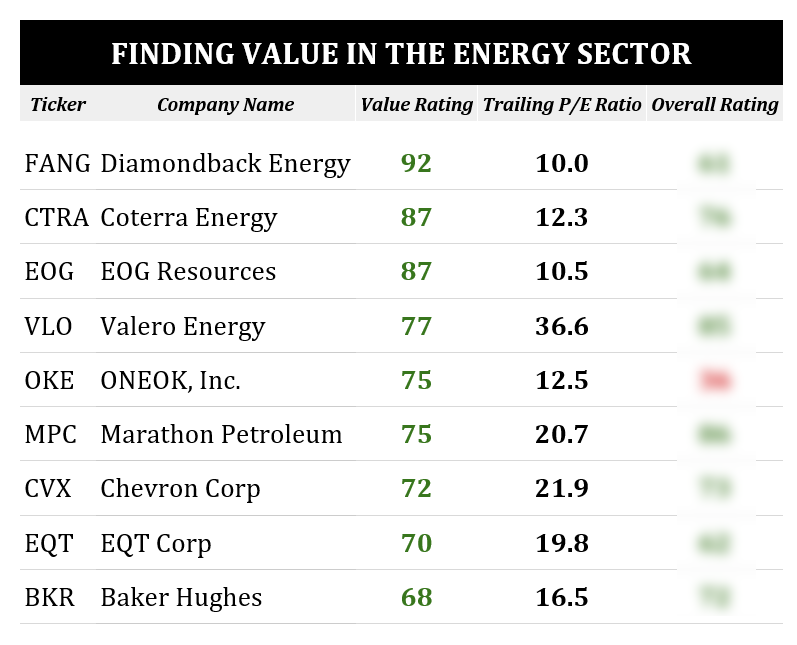

With that in mind, I ran a screen for the energy stocks that rated the highest on value. Let’s see if we can find some good candidates on the “sale rack.”

Diamondback Energy (FANG) is the cheapest by a wide margin, with a value factor rating of 92. Its overall Green Zone rating is also a “Bullish” 61. Exploration and production companies tend to be volatile. Their earnings can fluctuate wildly based on energy prices, and they are sensitive to the ebb and flow of the business cycle.

We see this reflected in Diamondback’s volatility factor rating, where it rates a 35 out of 100. (High volatility means a lower volatility rating.)

As I mentioned yesterday, Valero Energy (VLO) also rates well. It scores a 77 on value and “Strong Bullish” 85 overall. Fellow refiner Marathon Petroleum (MPC) boasts similar numbers, with a 75 on value and an 86 overall Green Zone rating. Both stocks have been trending higher all year, and particularly since August.

If you’re looking for something a little more diversified, supermajor Chevron (CVX) is a solid, balanced option. It’s cheap, with a value factor rating of 72, and boasts a “Bullish” overall rating of 73.

It’s too early to say that a major rotation out of tech and into energy is underway. But with history as a guide, we know this is a likely shift that will reward open-minded investors who anticipate and play it correctly.

If you are looking to diversify your portfolio with some quality “Bullish” rated value stocks, the energy sector is a good place to start.

To good profits,

Editor, What My System Says Today